Up 25% in 7 Days, This Crypto’s Next Move Deserves Your Attention

Among other cryptocurrencies, the price of Ethereum (ETH) in 2023 has continued to demonstrate impressive strength in the broader crypto market. In spite of the fact that some market participants may still be skeptical, there is a chance that ETH may surge significantly based on the technical factors currently favoring the second-largest cryptocurrency by market cap.

Ethereum’s Key Price Levels

The ETH price has delivered nine consecutive days of green daily candles, demonstrating significant market vigor. Since ETH had its most recent halt at around $1,197, the newly discovered uptrend has recovered 25% of the market value that investors had lost. However, according to a well-known crypto analyst Crypto Tony, the price range of $2,250 – $2,500 determines a key level for ETH. Breaching these price levels will validate a price bottom for further uptrend.

He goes on to say that the decline in the price of Ethereum will greatly depend on the state of the stock market and global economics for the remainder of this year. Additionally, the Relative Strength Index (RSI), an indicator that is used to evaluate the underlying power of market participants, demonstrates that the price of ETH is in severely overbought conditions near the level of 90. In January 2021, when Ethereum momentarily marked $1,300 and established a new all-time high, the RSI read 90 for the last time.

Factors Driving ETH Price

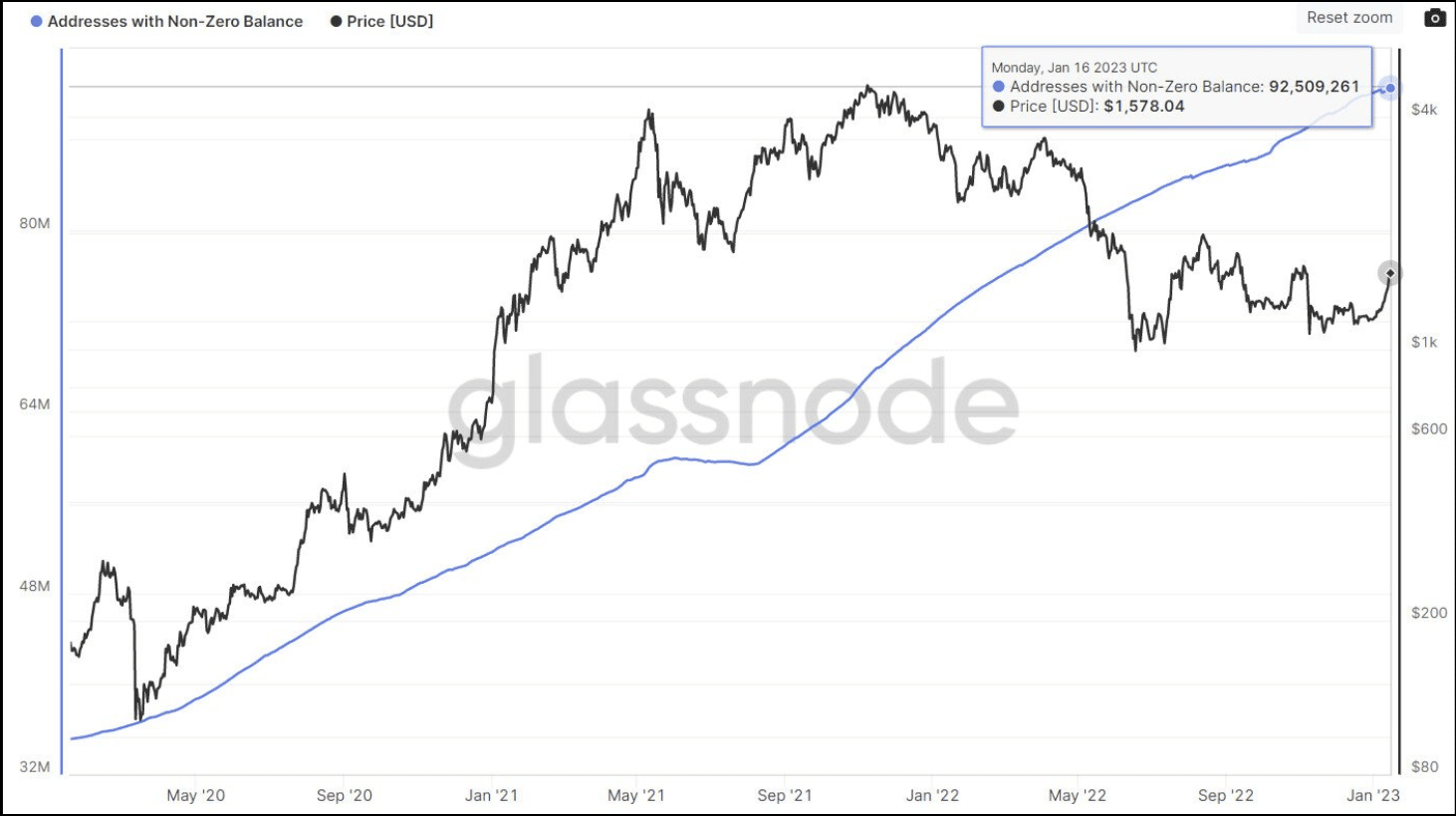

On Monday, the number of Ethereum addresses that have a balance greater than zero reached a new all-time high of 92.5 million, breaking the previous record set on Friday. It does not appear that the bear market of 2022, which ended in the closure of one of the world’s formerly largest cryptocurrency exchanges in November, had any effect on the growth in the number of addresses that have a balance greater than zero.

Read More: Bitcoin Bulls Need to Clear This Key Level For BTC Price To Rally

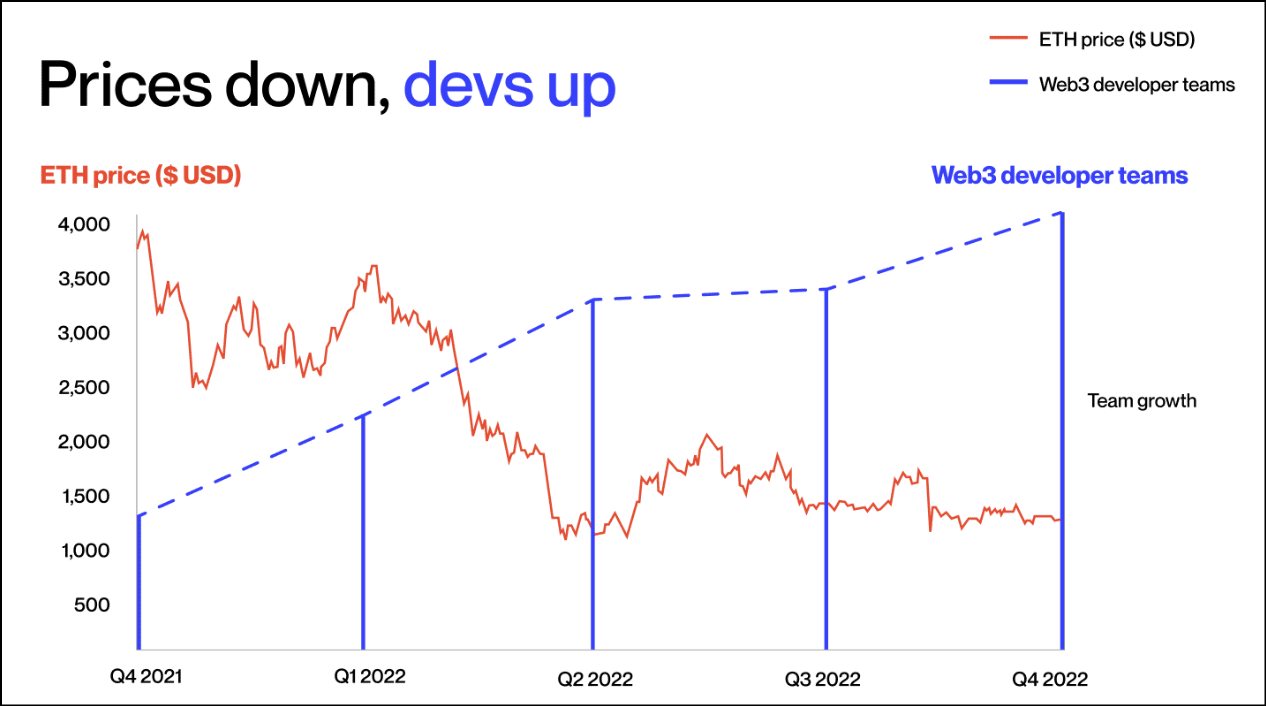

In addition, according to a report recently published by the blockchain software development firm Alchemy, the number of smart contracts implemented on the Ethereum mainnet increased by an astounding 300% in 2022. And, in spite of the bear market of 2022, smart contract deployment growth essentially matched the rate of growth experienced in 2021. At the end of Q4 2022, 4.6 million smart contracts were active on the Ethereum blockchain, according to the research.

As things stand, the price of Ethereum (ETH) is currently being traded at $1,598. This represents an increase of 0.96% in the past 24 hours, in contrast to its 19.76% jump during the last seven days, as per CoinGape’s crypto market tracker.

Also Read: Crypto Fraudster Charged In $4.5 Bn Bitcoin Theft Lands New Marketing Job

- XRP News: Ripple Taps Zand Bank to Boost RLUSD Stablecoin Use in UAE

- BitMine Keeps Buying Ethereum With New $84M Purchase Despite $8B Paper Losses

- Polymarket Sues Massachusetts Amid Prediction Market Crackdown

- CLARITY Act: Bessent Slams Coinbase CEO, Calls for Compromise in White House Meeting Today

- Crypto Traders Reduce Fed Rate Cut Expectations Even as Expert Calls Fed Chair Nominee Kevin Warsh ‘Dovish’

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting