Regulators are pushing the crypto industry to get better KYC providers

As investors’ interest in crypto continues to grow, so does regulators’ scrutiny. In July, Securities and Exchange Commission (SEC) Chair Gary Gensler hinted that some stablecoins are securities in a speech before the American Bar Association.

“Make no mistake: It doesn’t matter whether it’s a stock token, a stable value token backed by securities, or any other virtual product that provides synthetic exposure to underlying securities,” he said. “These platforms – whether in the decentralized or centralized finance space – are implicated by the securities laws and must work within our securities regime.”

Days later, as part of its role in monitoring the “evolving regulatory landscape”, Uniswap announced that it would be restricting access to certain tokens through its app. According to Uniswap, this decision was made in order to remain “consistent with actions taken by other DeFi interfaces”.

Even more recently, cryptocurrency exchange company Binance publicly announced that know your customer (KYC) verification would be mandatory for new users. From now on, new users of Binance will be required to upload their IDs to use its services. According to Binance, this decision was made to strengthen its anti money laundering (AML) laws.

Increasing collaboration between crypto companies and regulators seems highly inevitable at this point. But there’s a problem: many crypto companies’ KYC and AML procedures are still lagging behind, and there is a very notable lack of providers in the space.

This is hardly surprising — one of the key benefits of the blockchain is that it doesn’t require users to reveal their identity. But as the regulatory landscape continues to evolve, there is little doubt that we will begin to see more companies in the space — in fact, we’re already starting to see a few.

One of the leaders in the space up to now is KILT, an open-source blockchain protocol. The company is named after the Scottish kilt, a knee-length mens’ dress skirt that represents the wearer’s “clan” without revealing personal information that they’d prefer to keep private.

The KILT Protocol has been specifically designed to issue claim-based, verifiable, revocable and anonymous credentials on the web. Users can leverage the protocol to claim arbitrary attributes about themselves, get them attested by trusted entities, who store these claims as certificates in exchange for payment.

Ingo Rüebe, BOTLabs CEO, and project lead at KILT protocol says,

“Regulation is part of the maturing process of the crypto industry. Many DEXs will follow upcoming KYC requirements and thus attract liquidity from new sources, which can be seen as positive”

“KILT Protocol can help these DEXs to avoid centralisation of customer data, like we see in today’s finance industry”. “Proving your KYC with each transaction would make these transactions even safer for customers”, Rüebe added.

In addition to representing users’ identities, KILT can be used to create identifiers for machines, services, and pretty much anything else that identifiers can be built on. KILT has chosen to build on the Polkadot network, given that it is currently the only technology that combines both low fixed and definable network costs with the tamper-proof “trustless” nature of the blockchain. Ultimately, KILT hopes to cover the entire Polkadot network with this fundamental, highly crucial service.

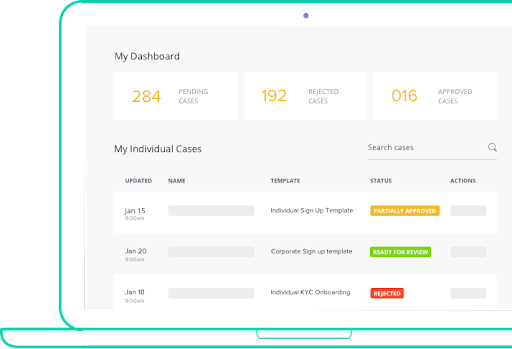

KILT isn’t the only company in this space. KYC-Chain is a KYC and AML blockchain and banking compliance solution. It allows businesses to verify customer identities and streamline the onboarding process.

Companies will be able to screen their corporate, institutional, and individual clients for associated prohibited activities through KYC-Chain’s global sanctions and watchlists, politically exposed persons and adverse media databases. They will also be able to analyze the historical transactions of a crypto wallet and check it against known risk indicators.

Ultimately, KYC-Chain aims to enable automated on-boarding of people and legal entities through leveraging high-tech solutions including robotic process automation, biometric matching neural networks, and blockchain based identity credentials.

We’re still just at the very beginning of KYC and AML in the crypto space. But given how the news has unraveled over the past few months, there is little doubt that things are about to get very interesting very quickly.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs