Ripple’s RLUSD Stablecoin Makes Way To Japan, Mints $24 Million This Week

Highlights

- Ripple emphasizes transparency of RLUSD stablecoin through third-party accounting.

- The enterprise-grade RLUSD is backed by high-quality reserves and maintained by BNY Mellon.

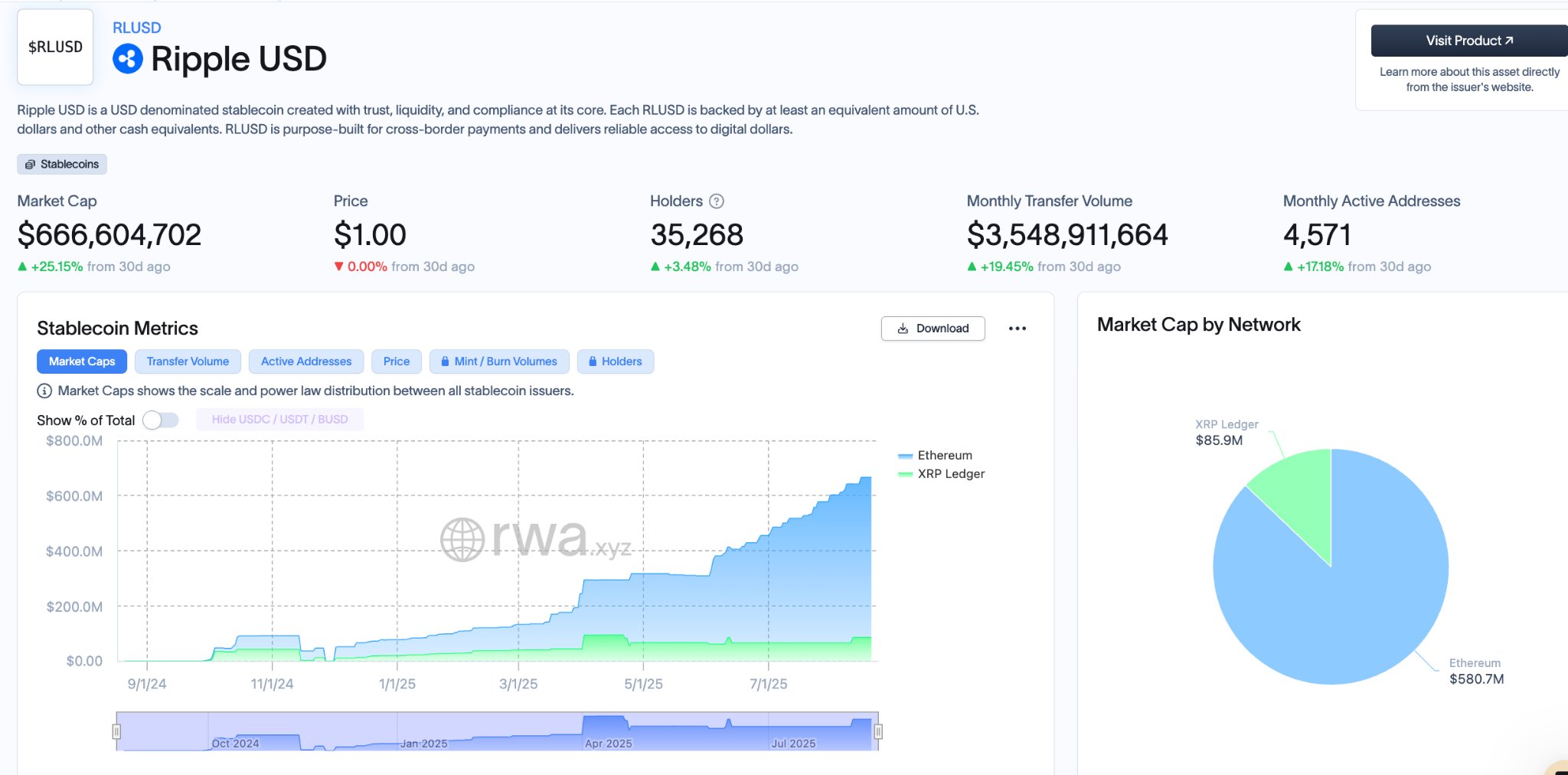

- RLUSD adoption is rising, with $134 million minted in the past month, active addresses up 17%, and transfer volume hitting $3.5 billion.

Leading blockchain firm Ripple announced the launch of its native RLUSD stablecoin in Japan, along with key partner SBI Holdings. The company looks to grab a larger share of the $300 billion stablecoin market, which is likely to grow into trillions, they said. Over the past week, the company has added $24 million worth of stablecoins through fresh minting.

Ripple Pushes RLUSD Stablecoin Into Japanese Market

Earlier today, XRP parent company Ripple made a move by bringing its native RLUSD stablecoin into the Japanese market. The launch comes in partnership with their key ally, SBI Holdings, which announced plans to bring the stablecoin to its platform earlier this month. Speaking on the development, SBI VC Trade CEO Tomohiko Kondo said:

“SBI Group has been leading the development of the cryptocurrency and blockchain field in Japan. The introduction of RLUSD will not just expand the option of stablecoins in the Japanese market, but is a major step forward in the reliability and convenience of stablecoins in the Japanese market. We will continue to work with Ripple to build a safe and transparent financial infrastructure.”

Ripple noted that its enterprise-grade stablecoin RLUSD is built with utmost compliance and transparency. It assures that the stablecoin is backed by high-quality reserves such as short-term U.S. government bonds, USD deposits, and other cash equivalents.

Furthermore, what sets Ripple apart from its competitors is that it allows third-party accounting, unlike its competitors like Tether’s USDT. In order to introduce greater transparency, banking giant BNY Mellon is maintaining Ripple’s RLUSD stablecoin custody.

Stablecoin Active Addresses on the Rise

Over the past week, the market share of the Ripple stablecoin has surged by another $24 million. Similarly, over the past month, the company has minted $134 million in new stablecoins. Data from RWA.xyz shows that the monthly active addresses for RLUSD have surged by 17%, while the monthly transfer volume has soared by 19% to $3.5 billion.

Earlier this month, the U.S. Office of the Comptroller of the Currency (OCC) authorized community banks to collaborate with companies developing stablecoins. This could serve as a major boost for Ripple to push its native stablecoin in the market by bridging the gap with traditional finance.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs