Ripple, Theta Network price Analysis: August 6, 2021

- Ripple price remains pivotal between $0.75 resistance and $0.7 support.

- THETA price posts double-digit gains but stops o brushing shoulders with $7.

The cryptocurrency market flipped slightly bullish Friday, but most assets lacked the muscle to keep the uptrends going. For example, Bitcoin climbed above $40,000 but stalled under $42,000. As reported, the bellwether cryptocurrency trades at $40,200 amid the push by the bulls to resume the price action toward $50,000.

Ethereum completed the London hard fork, whereby it rallied close to $2,800. However, the expected gains past $3,000 are still a pipe dream, with the gigantic smart contract token seeking support above $2,700.

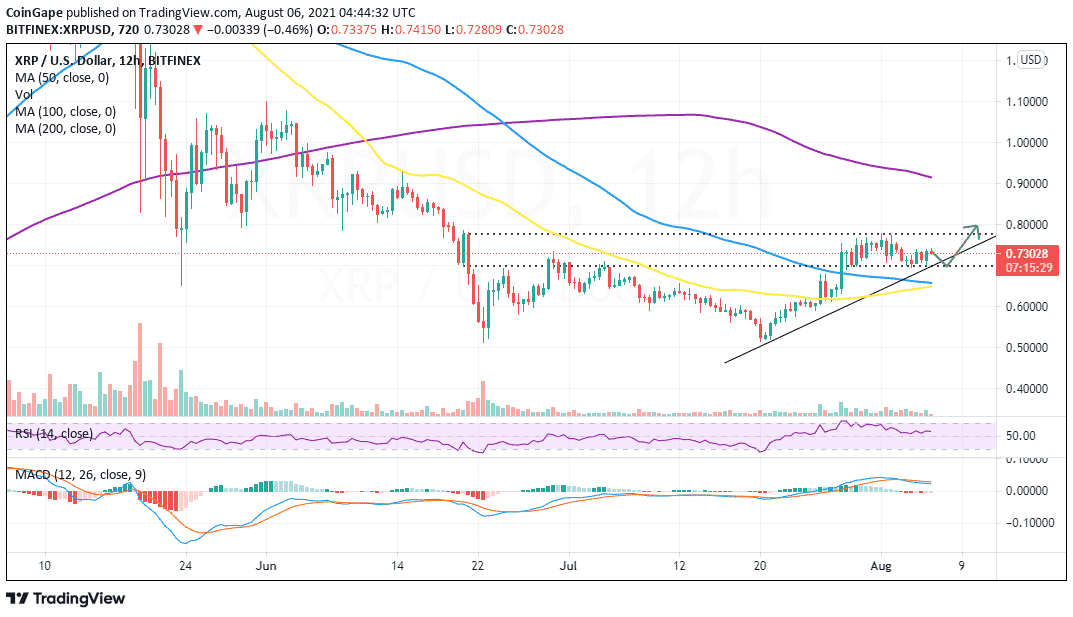

Ripple:-

The international remittance token XRP leaped toward $0.75 but traded an intraday high of $0.744. The barrier at $0.75 seems strong enough to keep bullish advances at bay. At writing, Ripple has retreated to $0.73 amid the hunt for formidable higher support.

According to the 12-hour Moving Average Convergence Divergence (MACD) indicator, sellers are slightly in control. Realize that a sell signal appeared as the 12-day EMA crossed under the 26-day EMA, and if sustained, Ripple will keep struggling with recovery toward $0.8.

The Relative Strength Index (RSI) also has a bearish outlook amid its gradual drop from the overbought area to the midline.

It is worth mentioning that XRP is trading above the 100 SMA and the 50 SMA, which can be considered a bullish picture. Besides, as the 50 SMA crosses above the 100 SMA, buyers are likely to cement their position on the market. Hence, a more substantial bid for gains toward $0.8 will surface.

XRP/USD 12-hour chart

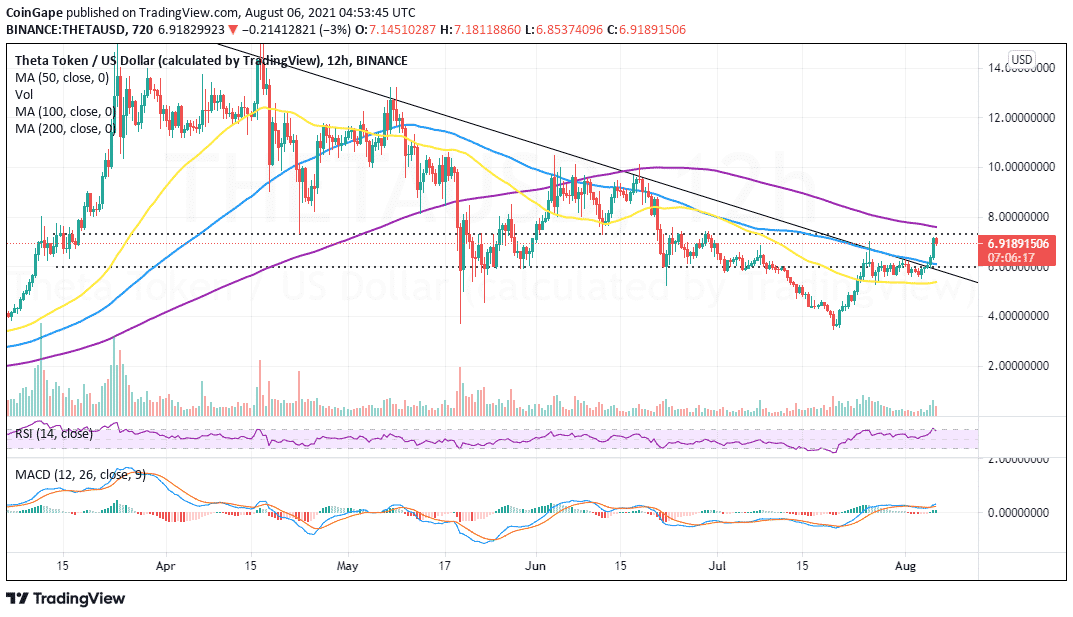

Theta Network:-

Theta Network has outperformed other altcoins to post double-digit gains on Friday. In the last couple of weeks, the token has sustained a bullish outlook while bulls bid for gains above $10. A break above a four-month descending trendline encouraged buyers to flock into the market amid increased confidence in the uptrend.

THETA is exchanging hands at $6.9, moments after suffering rejection at $7. If bulls can throw another jab at this level, there is a higher chance the token will sail through. Note that the MACD has a bullish signal in addition to lifting higher above the mean line.

THETA/USD 12-hour chart

It is imperative that bulls close the day above $7 and perhaps crack the resistance at the 200 SMA. However, if push comes to shove, the 100 SMA is in line to prevent losses from extending below $5.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs