Ripple Vs SEC: Recent Updates on Settlement Date?

Highlights

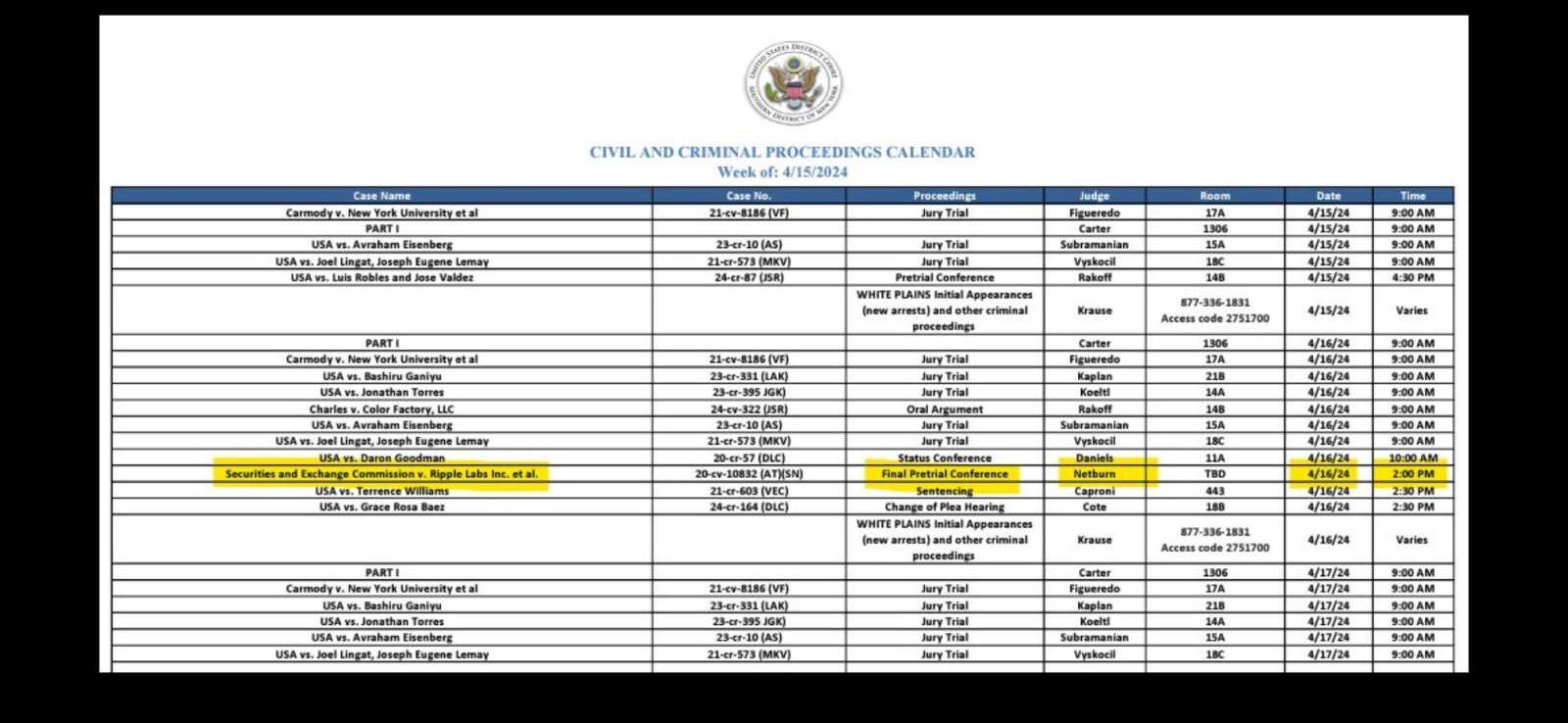

- Ripple Vs SEC settlement date in the court calendar stirred further debate of potential settlement.

- SEC's recent closed-door meeting, XRP unlocks, and reasons by expert Ashley Prosper raised questions among XRP army.

- Coinbase seeks clarity on whether an “investment contract” requires something contractual.

The age-long legal battle between blockchain payments firm Ripple Labs and the United States Securities and Exchange Commission (SEC) had a settlement conference in March end, raising speculation of final settlement talks in the coming days as per an earlier order by Judge Torres.

In addition, Ripple Labs will also file its response to the SEC’s request for a final judgment and nearly $2 billion in penalties on April 22. This month will be crucial for the XRP lawsuit and the army.

Ripple and SEC to Meet Next Week?

The SDNY Court’s proceeding calendar for the week of April 15 displays a “Final Pretrial Conference” between the U.S. SEC and Ripple Labs on April 16. However, the courtroom detail shows as “TBD.” This could either mean the March 29 settlement conference was the final meeting between parties or final settlement talks are still off the table.

While the matters were dismissed after the SEC dropped charges against CEO Brad Garlinghouse and executive chairman Chris Larsen, experts believe Ripple and SEC could settle the XRP institutional sales with lower penalties.

Meanwhile, the SEC seeks a final judgment against Ripple. This includes permanent injunctions, disgorgement and prejudgment interest, and civil penalties of nearly $2 billion. In response, Ripple CEO Brad Garlinghouse and CLO Stuart Alderoty lashed out at the SEC and said to expose the regulator in Ripple’s filing on April 22.

However, the SEC’s recent closed-door meeting on April 11, Ripple’s delayed XRP unlocks from escrow, and reasons by expert Ashley Prosper on the Ripple vs SEC case probably over, stirred further debate of potential settlement.

Also Read: EigenLayer Crypto’s Biggest Project This Year Removes LST Caps, Unpause Restaking Deposits

Clarity on XRP Secondary Sales and “Investment Contract”

Coinbase won an argument in a lawsuit that secondary market transactions of cryptocurrency are not securities, as per an order by the US Court of Appeals for the Second Circuit. This provided further support for Judge Torres on secondary market sales of XRP, ruling that “Programmatic Buyer stood in the same shoes as a secondary market purchaser.”

Coinbase has filed for interlocutory appeal in the SEC case in the same Second Circuit court seeking clarity on whether an “investment contract” requires something contractual. In addition, the Second Circuit Court of Appeals rejected the SEC’s appeal in the Aron Govil case, sparking hope for Ripple’s win against SEC.

“We’re asking to take this up on appeal earlier than normal because it’s critical to our industry. The SEC’s action against us and other digital asset companies goes way beyond the legal authority granted by Congress and puts an unjust cloud over US digital asset innovation, said Coinbase CLO Paul Grewal.

Pro-XRP lawyer Bill Morgan said if Coinbase loses appeal, it could potentially bolster the SEC’s position in the XRP programmatic sales case.

XRP Price Rebounds

XRP price recovered more than 5% amid a market-wide relief rally, with the price currently trading at $0.516. The 24-hour low and high are $0.477 and $0.518, respectively. However, the price climbed during low trading volume as it has decreased by 48% in the last 24 hours. This indicates a decline in interest in spot market.

Derivatives traders are buying with more than 8% increase in XRP futures open interest in the last 24 hours, as per data by CoinGlass. In the last few hours, total XRP futures OI has also rose by 1%.

Also Read: Crypto Market Crash – Here’s Why Bicoin, ETH, SOL, XRP, SHIB Fell Sharply

- White House to Hold CLARITY Act Meeting With Ripple, Coinbase, Banks Today

- Senator Warren Warns Fed Against Bitcoin Crash Rescue Amid Liquidity Pump Claims

- Top 5 Reasons Ethereum Price Is Down Today

- Crypto Market Slides as Hawkish FOMC Minutes Trigger BTC, ETH, XRP Sell-Off

- XRP News: French Banking Giant Launches Euro Stablecoin On XRPL With Ripple Support

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum