Robert Kiyosaki Predicts Biggest Crash Ahead Urging Investors To Buy Bitcoin

Highlights

- Robert Kiyosaki predicts a potential incoming financial market crash.

- Kiyosaki urge investors to buy Bitcoin amid the economic turmoil.

- The Kobeissi Letter report contrasts with Kiyosaki's warning, predicting a major milestone ahead for S&P 500.

Rich Dad Poor Dad author Robert Kiyosaki has once again sparked discussions in the broader financial market with his recent X post. In his social media post, the renowned author predicted a potential financial market crash, which weighed on the traders’ sentiment amid the recent market selloff. Besides, he also urged investors to shift focus from traditional assets like stocks, bonds, etc. to risk-bet assets like Bitcoin, gold, and others.

Robert Kiyosaki Urges Caution For Boomers

In a recent post on X, Kiyosaki expressed his concern about the financial vulnerability of baby “boomers” as market conditions evolve. He argued that past trends like the real estate boom in the 1970s and stock market gains fueled by 401(k) plans have set unrealistic expectations. “When the stock market bursts, boomers will be the biggest losers,” he warned, emphasizing the need for a drastic financial shift.

In addition, Kiyosaki urged younger generations to advise their parents to sell high-value assets, such as real estate and stocks, while prices remain favorable. He predicted these markets would soon face significant downturns. “The biggest crash in history is coming. Please be proactive and get rich before boomers go bust,” he said urging investors to buy Bitcoin, gold, and silver. This comment, amid the recent crypto market crash, highlights his trust in Bitcoin as a hedge against the anticipated collapse.

Meanwhile, this isn’t the first time Kiyosaki has championed alternative investments. He has consistently advocated for Bitcoin, highlighting its potential to weather macroeconomic hurdles. However, his latest advice arrives amid increased volatility, with a $1.7 billion crypto market liquidation wave sparking concerns about broader market fragility.

A Closer Look Into The Stock Market

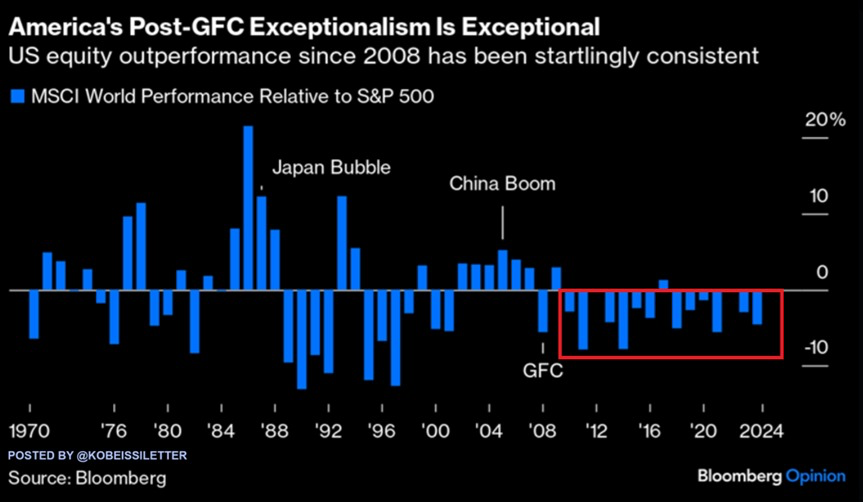

Kiyosaki’s dire forecast contrasts sharply with the current performance of the U.S. stock market. According to The Kobeissi Letter, the S&P 500 is on track for a historic 14th year of outperforming global markets. The index has risen 446% since 2009, far surpassing the 229% gain of the MSCI World Index.

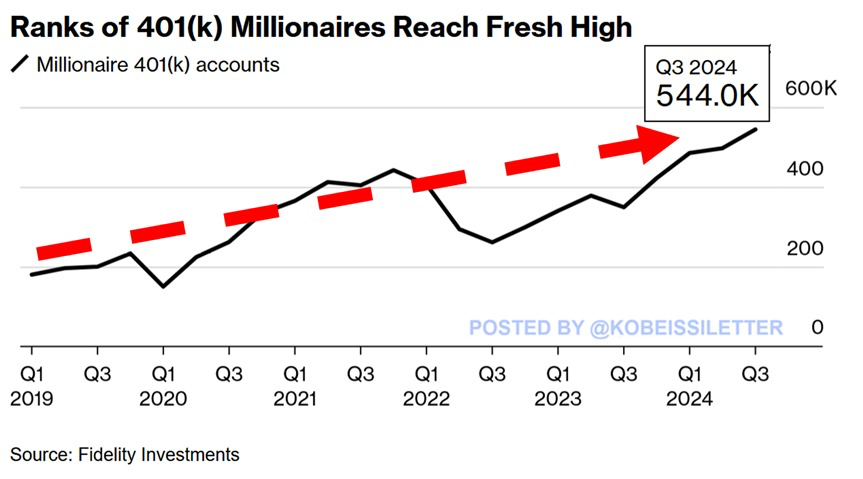

Additionally, U.S. retirement savings accounts have flourished. The number of 401(k) millionaires reached 544,000 in Q3 2024, a 56% increase from the previous year. Despite this, nearly 40% of workers lack access to retirement savings plans, highlighting a growing wealth divide.

However, Kiyosaki’s outlook challenges the optimism surrounding these gains. He believes traditional assets are unsustainable in the long term and warns of devastating consequences if investors fail to diversify. His focus on Bitcoin, along with other hard assets like gold and silver, reflects his belief in their enduring value amid economic turmoil.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs