Just-In: Russian Ruble Crashes Against Bitcoin After SWIFT Sanctions Amid Russia-Ukraine Conflict

Russia’s currency lost a third of its value against Bitcoin on Monday, while also tumbling to the dollar after the United States blocked several banks from global financial markets.

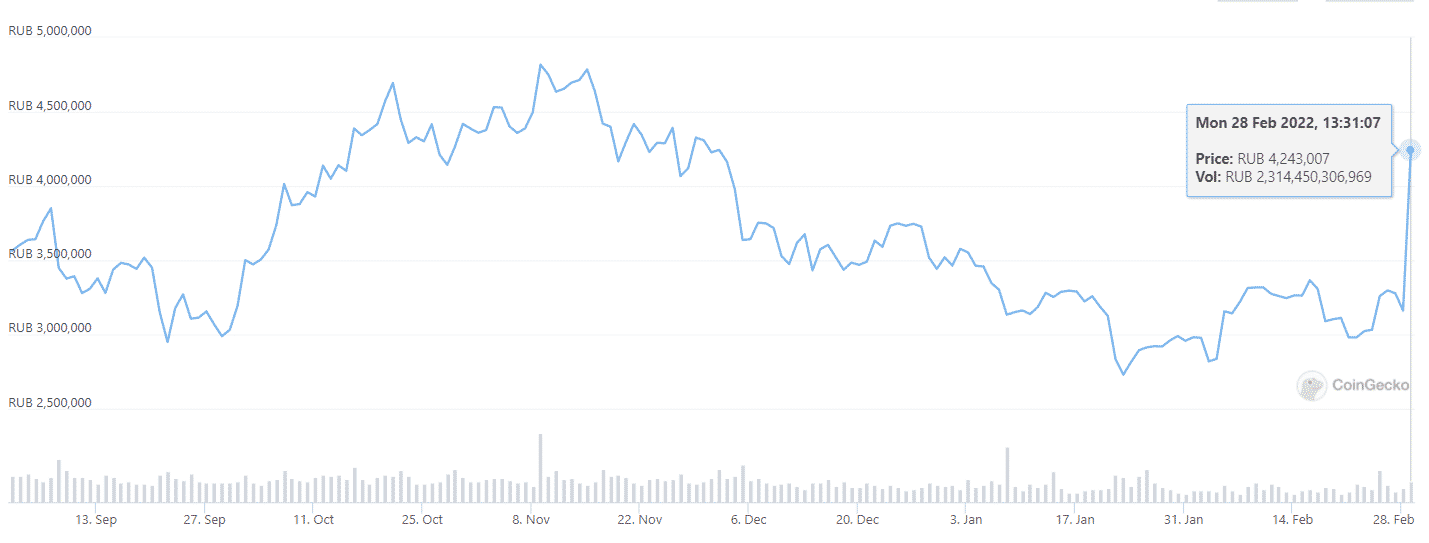

The exchange rate shot up by more than 30% to nearly 4.3 million ruble per bitcoin, data from Coingecko showed. The ruble depreciated in a similar range against most altcoins.

The weakening ruble likely indicates that Russian entities are buying crypto in the face of extreme volatility. Limitations on Russia’s foreign exchange reserves, placed by the West, are likely to ramp up inflation, and stifle economic growth in the country.

The United States over the weekend moved to block several Russian banks from the SWIFT transaction system, over the invasion of Ukraine. Much of Russia’s overseas holdings were also frozen.

In another blow to sentiment, Russian President Vladimir Putin ordered the country’s nuclear deterrent forces to be on high alert.

Most major tokens retreated against the dollar, while stablecoins continued to see high demand.

Russia faces sanctions shock

The sanctions knocked the ruble to a record low against the U.S. dollar, and saw the Russian central bank raise its benchmark interest rate to a record-high 20%, as damage control.

Reports show Russian citizens forming long lines outside ATMs, on fears that banks could limit cash withdrawals. In Ukraine, citizens were seen piling into dollar-pegged stablecoin Tether, after the country’s central bank suspended electronic cash transfers.

Amid increasing economic restrictions, speculation has been rife over whether Moscow will adopt crypto to bypass western sanctions. As it stands, there is no effective method for regulators to block peer-to-peer transactions.

Russians already hold 12% of the world’s crypto. And with mining also set to boom in the country, widespread adoption may not be such a foreign concept.

Still, limitations on technology imports could hurt Russia’s mining industry.

It is also unclear how major crypto exchanges will be able to function in Russia with the recent sanctions. Currently, Binance and Kraken are among the largest operators in the country.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs