Russian Ruble Crashes Further Against Bitcoin As Oil Sanctions Loom

Russia’s ruble sank 26% to a record low against Bitcoin on Monday, extending losses as the United States said it was mulling sanctions on Moscow’s oil exports. One Bitcoin is now worth over 5 million ruble, with the currency having slumped nearly 60% against Bitcoin in the past month.

Sanctions pressure Russian economy

Restrictions on Russian oil will be the latest sanctions by the west over the country’s invasion of Ukraine. The United States and its allies had in February blocked several Russian banks from the SWIFT payments network, and also frozen their overseas assets, depriving Russia of its foreign exchange sources.

The move to block oil will further this trend, and is expected to put more pressure on the Russian economy. According to data from the Observatory of Economic Complexity, oil makes up more than 50% of Russia’s total exports. The ruble, which was already trading at record lows to the dollar, crashed further against the greenback on Monday.

The Russian Central Bank has acted quickly to protect the economy, more than doubling interest rates to 20%. But it said that the economic situation remained dire. Recent sanctions have also seen several international firms suspending their Russian operations.

Crypto demand surges in Russia

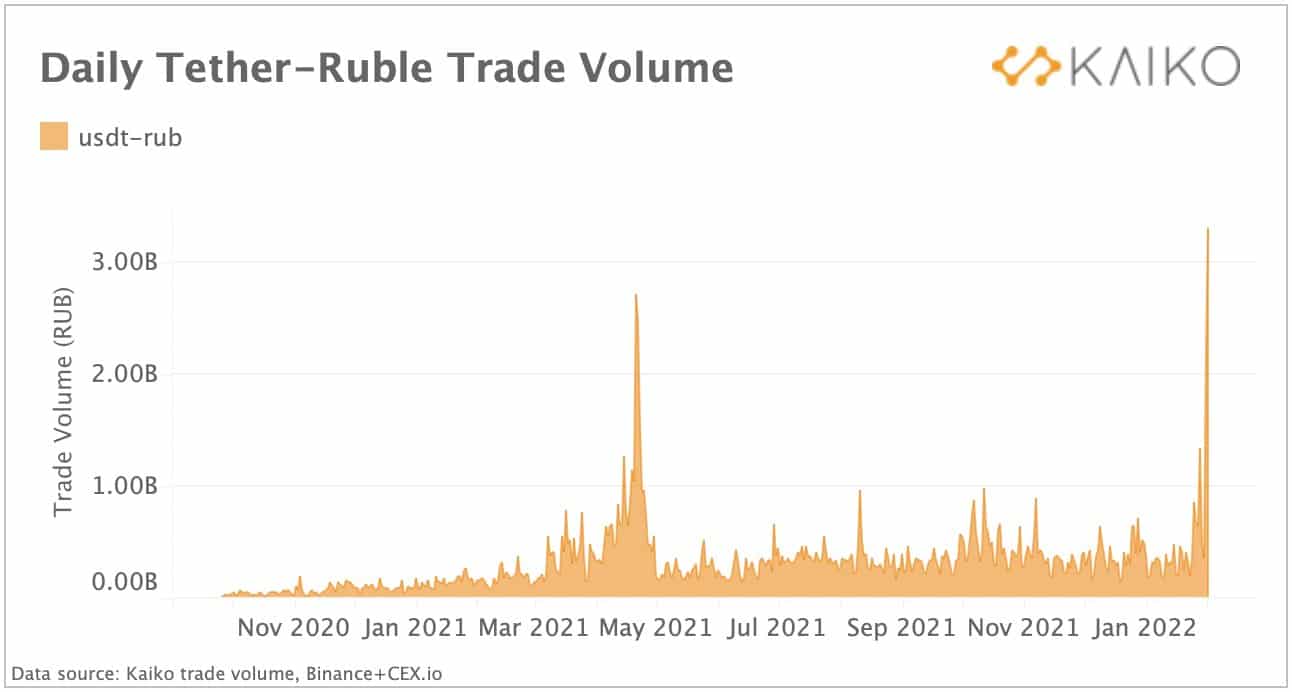

Crypto trading volumes had surged in Russia over the last two weeks of February, specifically after the U.S. sanctions, data from data provider Kaiko shows. This fueled some speculation that Russians were moving into crypto to protect their wealth, especially given the rising popularity of stablecoin tether.

In contrast to sanctions by major payment services Visa and Mastercard, most major crypto exchanges are still active in Russia. Recently, Coinbase CEO Brian Armstrong said many Russians were using crypto as a lifeline due to ruble volatility and restricted access to foreign markets. Armstrong also said there was little risk of Russia using crypto to avoid sanctions, which was a major concern for western lawmakers.

In Ukraine, several citizens were also seen turning to crypto as the hryvnia crashed, with tether being in demand.

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?