Satoshi Nakamoto’s Bitcoin Holdings Back to $100 Billion Club Again

Highlights

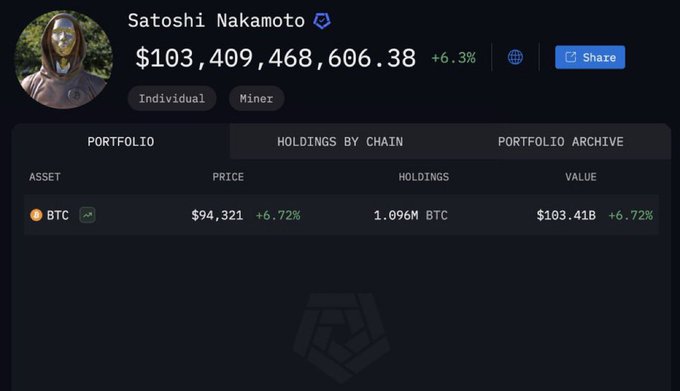

- Satoshi's Bitcoin holdings exceed $103 billion, driven by Bitcoin's surge.

- Nakamoto holds 1.1M BTC, remaining the largest individual Bitcoin holder.

- Institutional investors like BlackRock and MicroStrategy hold significant Bitcoin reserves.

Satoshi Nakamoto, the pseudonymous Bitcoin creator, has once again seen the value of their Bitcoin holdings rise above the $100 billion mark. This increase comes as Bitcoin’s price climbs and recovers from recent lows.

With Bitcoin trading above $94,000, Nakamoto’s holdings, which have remained untouched since their creation, are now worth over $103 billion.

Bitcoin Price Surge Drives Satoshi Nakamoto BTC Holdings To $100B

Over the past several days, the increase in Bitcoin price has seen Satoshi Nakamoto’s Bitcoin reserve gain value, bring back the billionaire status in the $100 billion category. The Bitcoin price broke the $90k level to touch a high of $94500 before consolidating at slightly lower values in other exchanges.

This price increase forms part of a rally that has seen Bitcoin surging by 27% above its five-month low it hit earlier this month, and just 3 weeks after turning 50 years.

Data from Arkham Intelligence reveals that Bitcoin creator Nakamoto holds approximately 1.1 million BTC, making them the largest individual holder of BTC. These holdings, which have been dormant for over a decade, have recently surpassed $103 billion.

Bitcoin Holdings Remain Untouched

Despite the rise in Bitcoin’s price, Satoshi Nakamoto has not moved any of their holdings since mined in the early days of Bitcoin’s existence. The 1.1 million BTC linked to Nakamoto got mined using a unique “Patoshi Pattern.”

This specific set of blocks, mined between 2009 and 2010, had distinct technical features allegedly created by a single entity.

The pattern is also related to the unique Bitcoin transaction associated with Nakamoto. This transaction, which occurred in 2009, is the only activity that can be linked to Nakamoto’s wallets. Since then, Nakamoto has not sold or transferred any of his BTC tokens. Concurrently, no information states that Nakamoto plans to use any of this BTC for selling or transferring purposes.

Satoshi Nakamoto’s Holdings Compared to Institutional Investors

Though the identity of Bitcoin’s creator remains unknown, some institutions now possess a considerable number of BTC. Some companies, such as BlackRock and MicroStrategy, have stacked significant Bitcoin holdings, even as high as Nakamoto.

BlackRock, the largest Bitcoin ETF, currently holds about 573,000 BTC, whereas MicroStrategy owns 538,000 BTC. Together, these institutions own more than 1.1 million Bitcoin, and they are major stakeholders in the Bitcoin market. However, these institutional Bitcoin holdings have legal and regulatory responsibilities to stakeholders and investors, unlike Nakamoto’s unspent and personally owned allocation.

Tesla is among many other firms that have entered the Bitcoin market and possess many BTC. In its Q1 2025 earnings report, Tesla held approximately 11,509 BTC, worth more than $1 billion because of the BTC price increase.

While not as large as BlackRock or MicroStrategy’s investments, Tesla’s BTC investment highlights the increasing trend of companies investing in cryptocurrency. However, unlike Satoshi Nakamoto who has not been active in trading while possessing large amounts of BTC, Tesla has been buying and holding BTC as one of its corporate assets.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Why Is Crypto Market Crashing Today (Feb 28)

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs