Breaking: SBF Received $1Bn In Personal Loans From Alameda Research

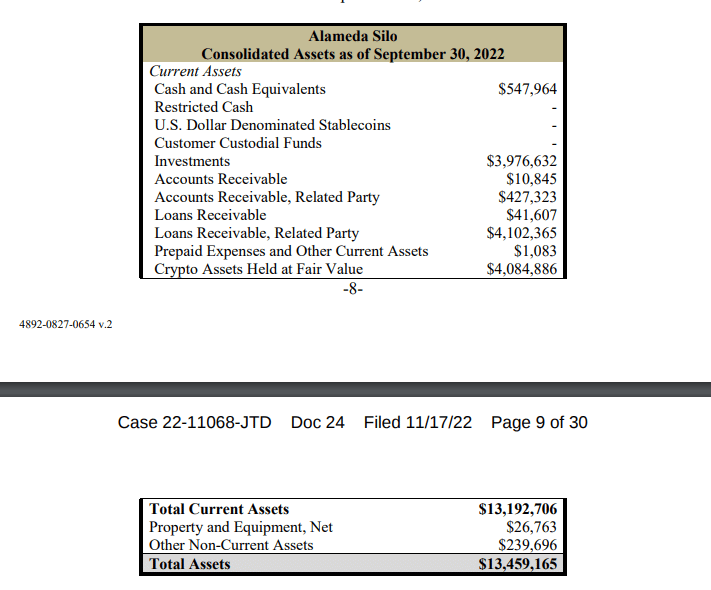

Sam Bankman-Fried a.k.a SBF, the former CEO of FTX, acquired a $1 billion personal loan from Alameda Research, one of the four silo firms that played a significant role in the demise of the FTX crypto exchange.

New FTX CEO Spits Facts In Latest Court Filing

John Ray III, the new CEO of FTX, made a formal declaration in the continuing Chapter 11 bankruptcy papers that showed additional financial embezzlement by Bankman Fried. According to the filing, Nishad Singh, Director of Engineering of FTX, also received a $543 million loan from Alameda Research.

Read More: SBF Resigns, John Ray III Joins As New FTX CEO

In his initial submission to the Bankruptcy court for the district of Delaware, John Ray III, the man in charge of putting the facts back together after the iconic fall of Enron, was quite abrasive. He even went on to say that it was the worst thing he had ever seen in his professional career.

Read More: New FTX CEO Blasts SBF In Latest Court Filing

U.S. House Committee To Hold Hearing

As per reports, a hearing on the demise of the cryptocurrency exchange FTX is scheduled to take place in December by the U.S. House Financial Services Committee.

The committee’s chair and ranking member, Reps. Maxine Waters (D-Calif.) and Patrick McHenry (R-N.C.), said in a joint statement that the lawmakers would be interested in learning more about the demise of FTX and its broader ramifications for the cryptocurrency ecosystem.

The FTX Fiasco

As reported earlier on CoinGape, FTX financed Alameda Research, its affiliated trading firm, billions of dollars worth of customer assets to finance risky trades, paving the way for its sudden collapse. With only $1 Billion in liquid assets, it failed to bridge the gap and eventually had to file for bankruptcy.

However, as per recent news, SBF is still not ready to give up as he’s planning to raise alternate sources of funding in a dire attempt to resurrect his debt-ridden FTX crypto exchange.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise