Sam Bankman-Fried Says FTX Was “Never Bankrupt,” Crypto Community Reacts

Highlights

- Sam Bankman-Fried (SBF) team posted "FTX was never bankrupt" and revealed $136 billion in holdings.

- FTX claims it has $8 billion left and all customers will receive 119% to 143% repayment.

- Crypto community blasted the SBF team for spreading misinformation.

- FTT token price jumps despite community believe that SBF must remain in jail and Trump must not pardon him.

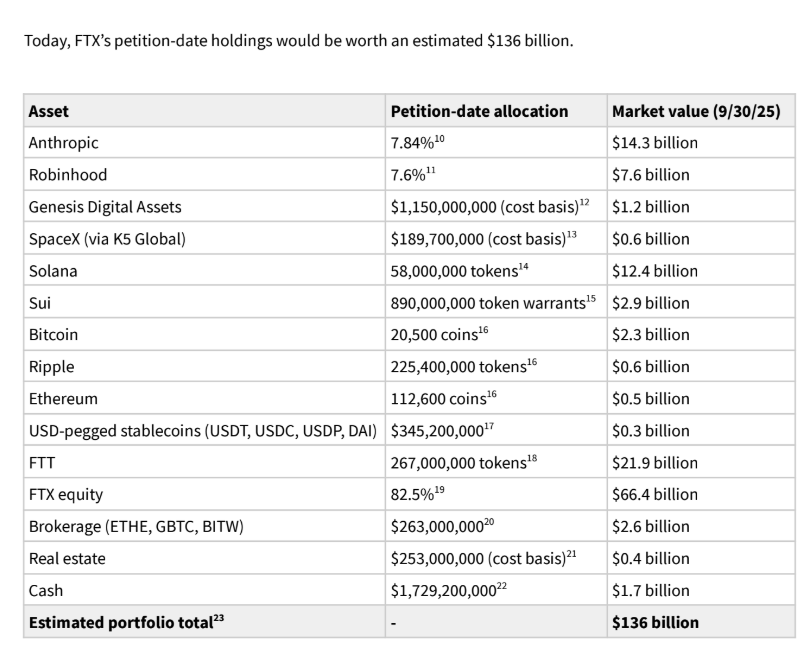

Sam Bankman-Fried (SBF) team on Friday revealed an estimated $136 billion in petition-date holdings of beleaguered crypto exchange FTX. They claim “FTX was never bankrupt, even when its lawyers placed it into bankruptcy.”

The crypto community criticized the SBF team for spreading misinformation, with calls rising not to pardon him. The community still does not trust him.

Sam Bankman-Fried Team Alleges “FTX Was Never Insolvent”

In an X post on October 31, the Sam Bankman-Fried team shared a document revealing where all the money went and said, “FTX was never insolvent.” The team added that $8 billion in customer assets owed never left the exchange when its lawyers filed for bankruptcy protection.

About 98% of creditors have already repaid 120%. They claim that all customers will receive 119% to 143% repayment. After repaying $8 billion in claims and $1 billion in lawyer fees, the estate still owns $8 billion after three years of the November 2022 collapse.

The team alleges that they faced a liquidity crisis due to a sudden shortage of cash. 7 million customers deposited around 20 billion dollars. “It was on track to be resolved by the end of the month – that is, until FTX’s external counsel seized control,” as per Sam Bankman-Fried.

FTX’s Stocks and Crypto Asset Holdings

Today, the crypto exchange’s petition-date holdings are estimated at $136 billion, including $14.3 billion in Anthropic equity, $7.6 billion in Robinhood (HOOD) stock, $1.2 billion in Genesis Digital Assets, $600 million in SpaceX (via K5 Global).

In addition, crypto holdings are 58 million SOL ($12.4B), 890 million SUI ($2.9B), 205K BTC ($2.3B), 225.4 million XRP ($600M), 112.6K ETH ($500M), along with having $1.7 billion in cash and $345.2 million in stablecoins.

Crypto Community’s Reactions to Sam Bankman-Fried

On-chain investigator ZachXBT claims customers have actually taken massive losses as they held assets like SOL or BTC. The creditors were paid from crypto prices at the time of the November 2022 bankruptcy and not at current prices.

“Illiquid investments worth more today are just a coincidence. You clearly have no learned from your time spent in prison thus far and repeat the same misinformation like before,” he added.

Shut the fuck up Sam.

You stole. https://t.co/IMbOpTzTn2

— Adam Cochran (adamscochran.eth) (@adamscochran) October 31, 2025

The crypto community believes Sam Bankman-Fried must remain in jail and President Donald Trump must not pardon him under pressure from Democrats. Recently, Binance founder CZ claimed that all people, such as Gary Gensler, Elizabeth Warren, and Maxine Waters, who are aggressive against him were all SBF supporters.

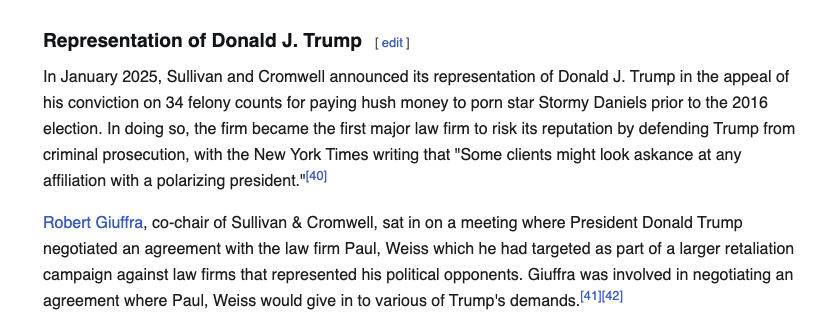

Notably, some shared ties between lawyers from Sullivan & Cromwell LLP who handled Trump’s conviction this year. As Trump pardoned CZ this month, speculation on Sam Bankman-Fried getting a pardon grew immensely.

FTX Token (FTT) climbed more than 3% in the last few hours, with the price currently trading at $0.83. Trading volume jumped over 33% over the last 24 hours.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs