SEC Chair Gary Gensler Hinted At Spot Bitcoin ETF Approval?

A spot Bitcoin exchange-traded fund (ETF) approval by the U.S. Securities and Exchange Commission (SEC) is most awaited not just by the crypto market, but also traditional financial services industry. While SEC Chair Gary Gensler remained silent on prospects of spot Bitcoin ETF approval, his post on X raised speculation of a Bitcoin ETF approval. A Bloomberg ETF analyst explains the motive behind Gensler’s post and is confident about a forthcoming approval.

Bloomberg ETF Analyst Clears Air On Gary Gensler’s Post

U.S. SEC Chair Gary Gensler’s video post about the SEC’s Division of Trading and Markets, which is in talks with spot Bitcoin ETF issuers, led people to speculate about a forthcoming approval. Surprisingly, the post came amid the SEC-BlackRock meeting and the SEC’s decision on Franklin Templeton and Hashdex spot Bitcoin ETF applications.

Bloomberg senior ETF analyst Eric Balchunas agreed that the timing is perfect and SEC has done this for every division at this point. He said it’s not a big deal as there are other legit signs indicating a forthcoming approval.

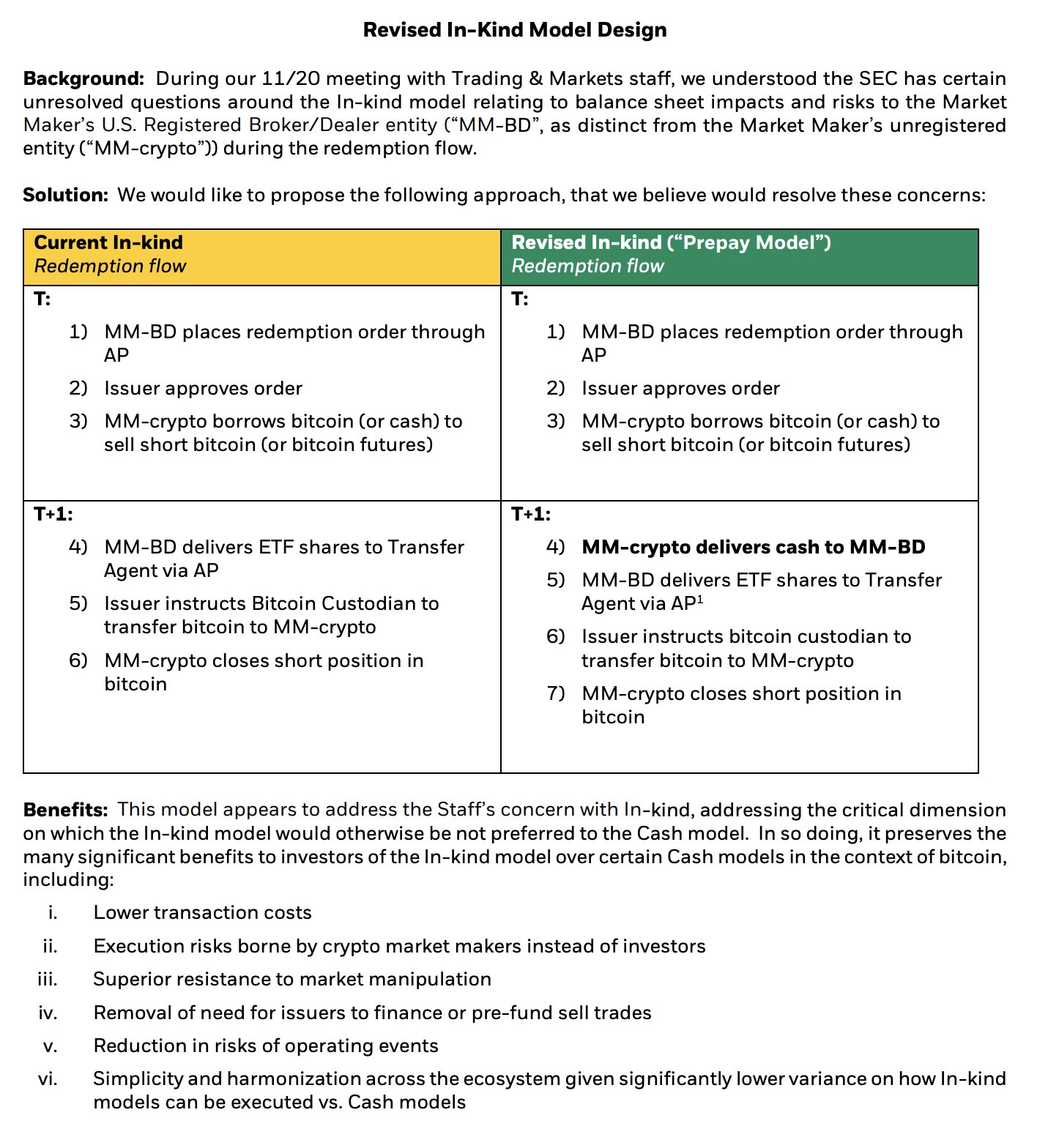

He also said BlackRock met with the SEC’s Trading & Markets division again and presented them with a “revised” in-kind model design based on comments at their earlier meeting last week.

Commenting on the video, VanEck and Tether advisor Gabor Gurbacs said:

“Having to rely on reading tea-leaves and tweet-sequences from a single man does not sound like a free, functioning or optimal capital market supervision structure for the largest market in the world.”

Also Read: Australia Unveils Bold Strategy To Tackle Banking And Crypto Scams

Signs of Forthcoming Spot Bitcoin ETF

At the Healthy Markets Association conference on November 29, Gary Gensler said he would not “pre-judge” the matter, when a reporter asked him about the prospects of spot Bitcoin ETF approval as he had denied multiple spot Bitcoin ETF applications.

Grayscale has made a few amendments to the agreement of its Grayscale Bitcoin Trust (GBTC), for the very first time since 2018, in preparation for a potential transition to a spot Bitcoin ETF.

The SEC gave the update on Franklin Templeton much earlier than its deadline of January 1, 2023. Meanwhile, the odds of approval are still at 90%, Balchunas stated the next update on the odds of spot Bitcoin ETF approval will be on January 10, 2024.

Also Read: Linda Yaccarino Candidly Defends Elon Musk & X’s Free Speech Stand As Advertisers Flee

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs