SEC Delays Decision on Franklin Templeton’s Solana and XRP ETFs

Highlights

- SEC delays Franklin Solana ETF decision again, sets final November deadline.

- Grayscale deadline in October may shape broader Solana ETF approvals timeline.

- Solana price jumps 3% as analysts predict 95% approval chance.

The U.S. Securities and Exchange Commission has extended its review of the Franklin Solana (SOL) and XRP ETFs, setting a new deadline of November 14, 2025. The Commission had already extended its review once before. In April, it pushed back the deadline to June. By mid-June, the SEC opened formal proceedings to determine whether the ETF should be approved or rejected. That move triggered a 180-day timeline, which was set to expire on September 15.

Delayed Solana and XRP ETF Proposals Set Up Pivotal October Decision

The SEC document says the regulator requires more time to evaluate the filing. Under its rules, the Commission may extend deadlines by up to 60 days if additional review is needed. This means the final date for a decision on the Franklin Solana ETF is now November 14, 2025.

A separate document by the regulator also revealed deadline for the Franklin XRP ETF proposal. At that time, the SEC must either approve or disapprove the ETFs. No further extensions are possible under the law. Both the Franklin Solana ETF and XRP ETF are one of several Solana-and XRP-based products currently before the Commission.

Data from Bloomberg Intelligence shows that multiple issuers, including Grayscale, VanEck, and 21Shares, have filed Solana and XRP ETF applications. Several of these SOL ETF issuers have amended their SEC filings to strengthen their cases for approval. Nearly all of these have also been delayed by the U.S. regulator until their final deadlines, most of which fall in October.

The first final deadline is for Grayscale’s Solana Trust, which is set for October 10, 2025. That date could become pivotal for the broader review of Solana ETFs.

The SEC can approve multiple Solana and XRP ETFs at once, like it did with the spot Bitcoin ETFs in 2024. Those are possible scenarios under which the SEC may decide on the Franklin Solana ETF and XRP ETF along with the other pending applications. However, the November deadline still remains.

Solana and XRP Prices Rise as Analyst Has High Odds of ETF Approval This Year

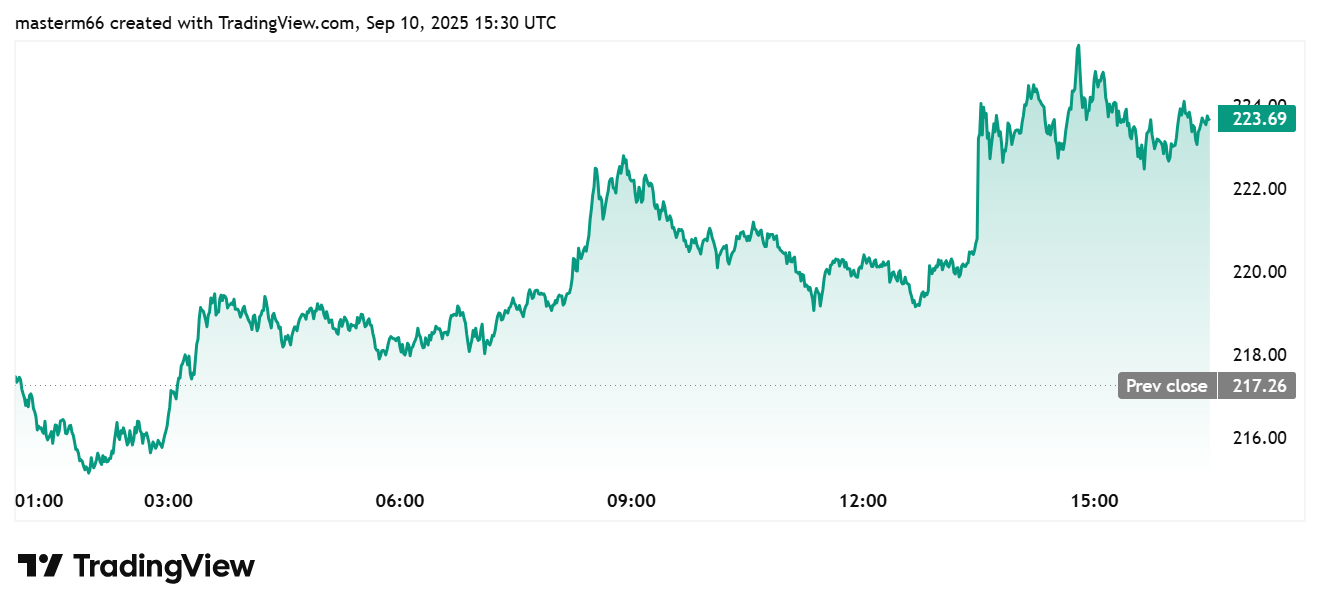

The value of SOL has jumped nearly 3% in the last 24 hours to $223. Weekly gains have reached almost 7% and in the last month, SOL has jumped more than 22%. Its performance over six months is even stronger, with gains above 80%. On a yearly basis, SOL has risen nearly 66%.

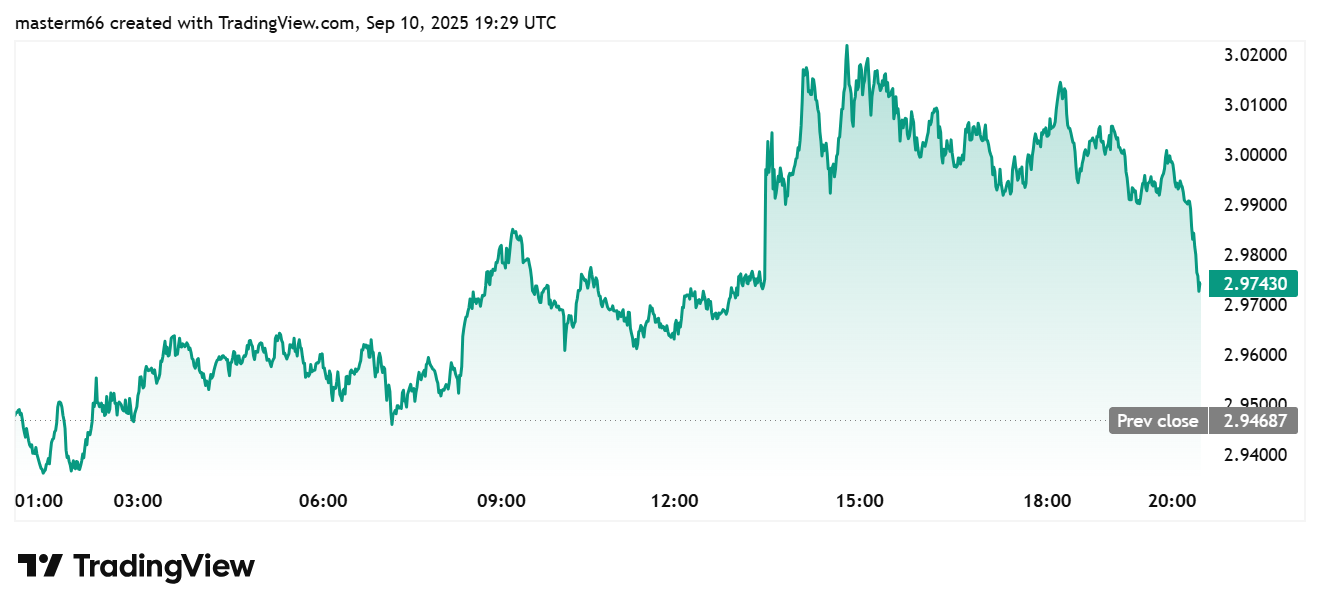

XRP has also attracted attention as the ETF timeline develops. The token rose 1.43% over the past 24 hours to $2.98. On a weekly basis, XRP is up more than 4%, though it has slipped slightly by 6% over the past month. Longer-term performance remains strong, with gains of over 32% in six months, 43% year-to-date, and an eye-catching 454% over the past year.

XRP has also attracted attention as the ETF timeline develops. The token rose 1.43% over the past 24 hours to $2.98. On a weekly basis, XRP price is up more than 4%, though it has slipped slightly by 6% over the past month. Longer-term performance remains strong, with gains of over 32% in six months, 43% year-to-date, and an eye-catching 454% over the past year.

An ETF listed in the United States would speed up the institutional adoption for both tokens and make trading easier in their respective ecosystems. ETF analysts also signal high approval confidence. Blommberg analyst James Seyffart predicts a 95% chance that a SOL and an XRP ETF will be approved by the end of 2025.

Yes! have a full list. here is most recent post about the active 19b-4 filings. Will be updating in coming days/week. Odds haven’t really changed much if at all. https://t.co/DO2gu8Zqi5

— James Seyffart (@JSeyff) August 26, 2025

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs