“Sell Bitcoin Now,” Peter Schiff Projects Further BTC Price Crash to $20k

Highlights

- Peter Schiff warned that Bitcoin could face a much deeper crash if the price breaks below the $50,000 level.

- He argued that this downturn could be more severe than past cycles.

- Bitcoin spot ETFs recorded $165.76 million in net outflows, continuing its negative streak.

Well-known Bitcoin critic Peter Schiff has now issued a new warning to cryptocurrency investors. He said that the price of BTC could crash if this important price level fails.

BTC Price Crash Could be Worse, Peter Schiff Says

In a post on X, Schiff shared that a fall below $50,000 would likely open the door to a much deeper selloff. A move to that level, he said, would mark an 84% decline from Bitcoin’s all-time high of $126,000 reached last October. While Bitcoin has had such crashes in the past, Schiff said that this time is different.

If Bitcoin breaks $50K, which looks likely, it seems highly likely it will at least test $20K. That would be an 84% drop from its ATH. I know Bitcoin has done that before, but never with so much hype, leverage, institutional ownership, and market cap at stake. Sell Bitcoin now!

— Peter Schiff (@PeterSchiff) February 19, 2026

Peter Schiff has always maintained a bearish trend for the token’s price movement. Earlier in the month, Schiff predicted the BTC price crash would continue for a long time, highlighting Michael Saylor’s Strategy unrealized losses.

When asked what kind of technical analysis he did to come to that conclusion, Schiff dodged the question.

“Every time Bitcoin makes a new high, pumpers say that kind of volatility is a thing of the past. Then, after the crash, they say, ‘Well, that’s just how Bitcoin works.’ Volatility is a feature, not a bug,” he said.

In a previous interview, he said that BTC is not a good reserve currency for central banks because it is too volatile to hold in large quantities without upsetting the markets. Schiff thinks that while governments have placed small bets on Bitcoin-related products, those bets are still small.

He has also expressed reservations about the sustainability of institutional interest. Schiff believes that the interest of institutional investors in Bitcoin may fade with time and that some of the newer players in the market may end up losing money if the BTC price crashes sharply.

Bitcoin ETFs See Third Day Outflow Streak

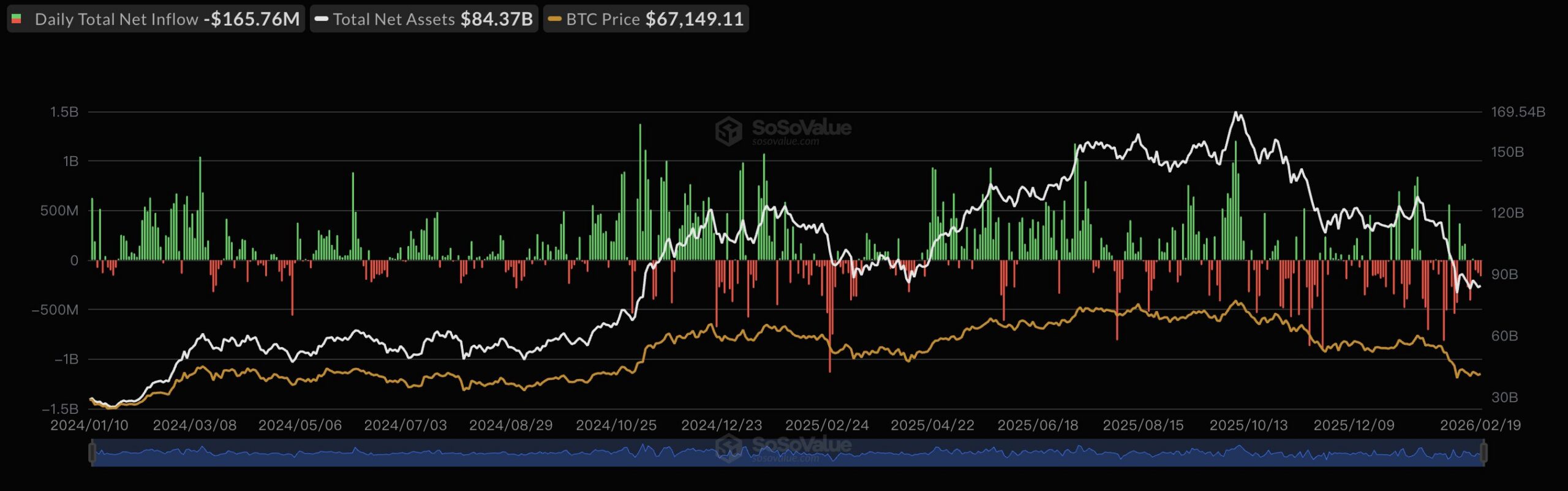

Based on SoSoValue data, the total net outflow for Bitcoin spot ETF was $165.76M yesterday. The BTC ETF with the largest net outflow was BlackRock’s ETF IBIT, with a net outflow of $164.06 million. This is the third consecutive day of outflows.

The price crash of BTC also continued yesterday in connection with the initial jobless claims, which were lower than expected. The cryptocurrency fell another 2% but held the $67,000 level.

In addition, Glassnode recently published an analysis that the cryptocurrency is currently undergoing a critical test at the $70,000 level. They explained that every attempt to reclaim the level since early February has led to the exhaustion of demand. The company further explained that the current situation of low liquidity makes it difficult to enter the $70,000 to $80,000 region.

It is also important to note that investors are preparing for the verdict of the Supreme Court on Trump’s tariffs, which is expected to be released later today. A negative verdict may further worsen the situation for the largest cryptocurrency and the crypto market in general.

- Metaplanet CEO Simon Gerovich Defends Bitcoin Strategy Amid Anonymous Allegations

- 8 Best Decentralized Crypto Banking Solutions in 2026 – Top List Reviewed

- Top 8 Companies Leading the Tech and Compliance for RWA Tokenization

- US PCE Inflation Estimates by JPMorgan, BofA, & Other Wall Street Banks

- CLARITY Act: Banks and Crypto Make Progress Following “Constructive” Dialogue at White House Meeting

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?