Ethereum Supercycle Strengthens as SharpLink Gaming Withdraws $78.3M in ETH

Highlights

- SharpLink Gaming withdraws $78.3 million in ETH, and this supports the Ethereum supercycle of Tom Lee.

- According to Tom Lee, the increase in stablecoin demand on Ethereum explains how the network's fundamentals are driving its price.

- Ethereum network activity, TVL, and price rise signal renewed long-term market confidence.

Ethereum’s fundamentals continue to strengthen as major investors and analysts signal renewed confidence in the asset. Institutional investors like SharpLink Gaming are moving millions in ETH. In addition, analysts and on-chain data confirm the network’s growing dominance in decentralized finance.

SharpLink $78 Million ETH Move Supports Supercycle Outlook

On-chain data showed SharpLink Gaming moving $78.3 million worth of ETH from FalconX. The transfer, revealed by analyst Ted Pillows, reflects growing accumulation among institutional players buying into the recent market dip. A recent surge in large ETH purchases by BitMine and SharpLink reinforce the ongoing accumulation narrative.

SharpLink Gaming withdrew $78,300,000 in $ETH today.

Smart money is buying the dip. pic.twitter.com/Nwe7KGc4Nc

— Ted (@TedPillows) October 26, 2025

The transaction came just hours after Fundstrat’s Tom Lee reaffirmed that Ethereum remains in what he calls a “supercycle.” According to Lee, Ethereum’s fundamentals are now leading its price rather than following it.

He noted that stablecoin demand is surging, and Ethereum’s daily transaction count has reached new all-time highs. This shift, he explained, indicates a phase where fundamentals begin to push price action higher rather than simply react to it.

This perspective echoes recent technical insights from John Bollinger, who identified a potential “W bottom” pattern in Ethereum price structure. This setup that often precedes major bullish reversals

Data posted by Token Terminal (TT) confirms the optimism by Lee. The platform disclosed that the volume of stablecoin supply on Ethereum and the amount of transactions completed on the network per day are increasing at a massive rate.

All these are indicators of good network usage even when its price isn’t rising as expected. In the chart by TT, Ethereum is still on an upward trend when it comes to stablecoin demand.

Moreover, daily transactions are moving towards levels that are not seen in previous cycles. The trend asserts its position as the building blocks of big DeFi and institutions builds the reinforced applications.

Ethereum Layer-1 Evolves as Price Rises Above $4,000

In another update, Token Terminal noted that Ethereum Layer-1 has now become the platform of high-value financial activity. The total value locked (TVLs) on the network have steadily increased, but contract deployments (an indicator of developer experimentation) are down.

This indicates that Ethereum now caters for proven financial protocols and less of experimental or early-stage projects. According to Token Terminal, enabling innovation on the main chain of Ethereum again could have a tenfold to a hundredfold rise in total value locked.

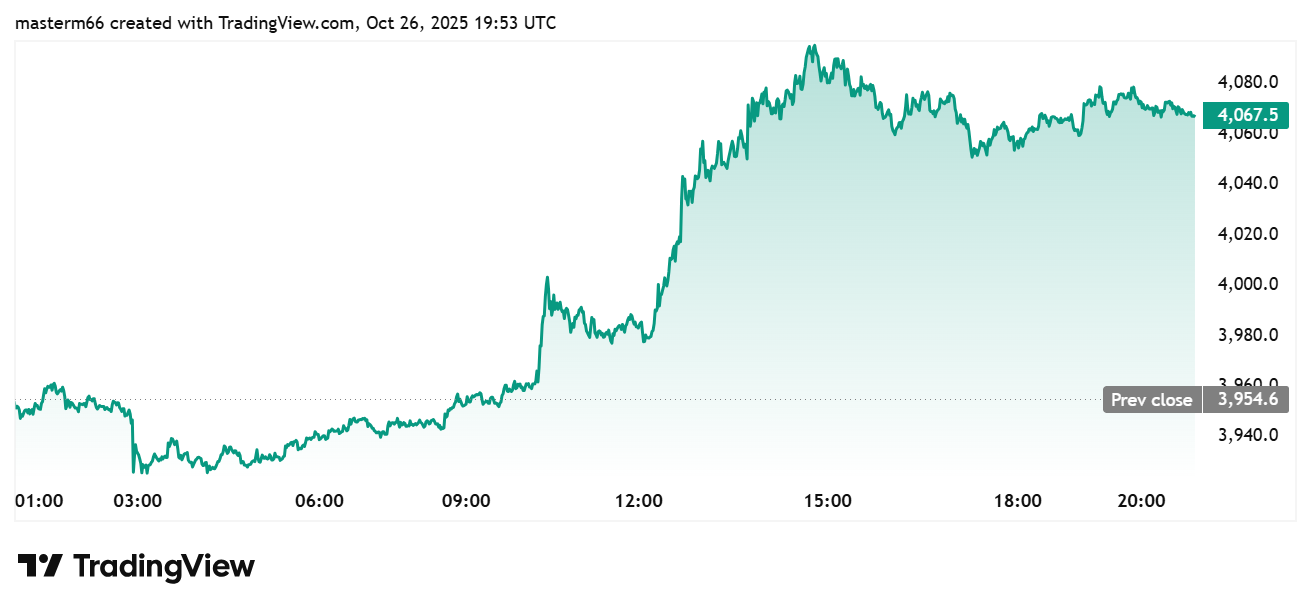

In the meantime, market performance for Ethereum shows a sign of rising optimism. Per Tradingview data, ETH price is trading at $4,078 rising by 3.12% in 24 hours.

It is by almost 5% this week. In the last 6 months, ETH has risen 126%. This exemplifies its excellent performance despite broader market conditions.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs