Will The Slow Down In BTC Mining Hamper Bitcoin’s Short Term Price?

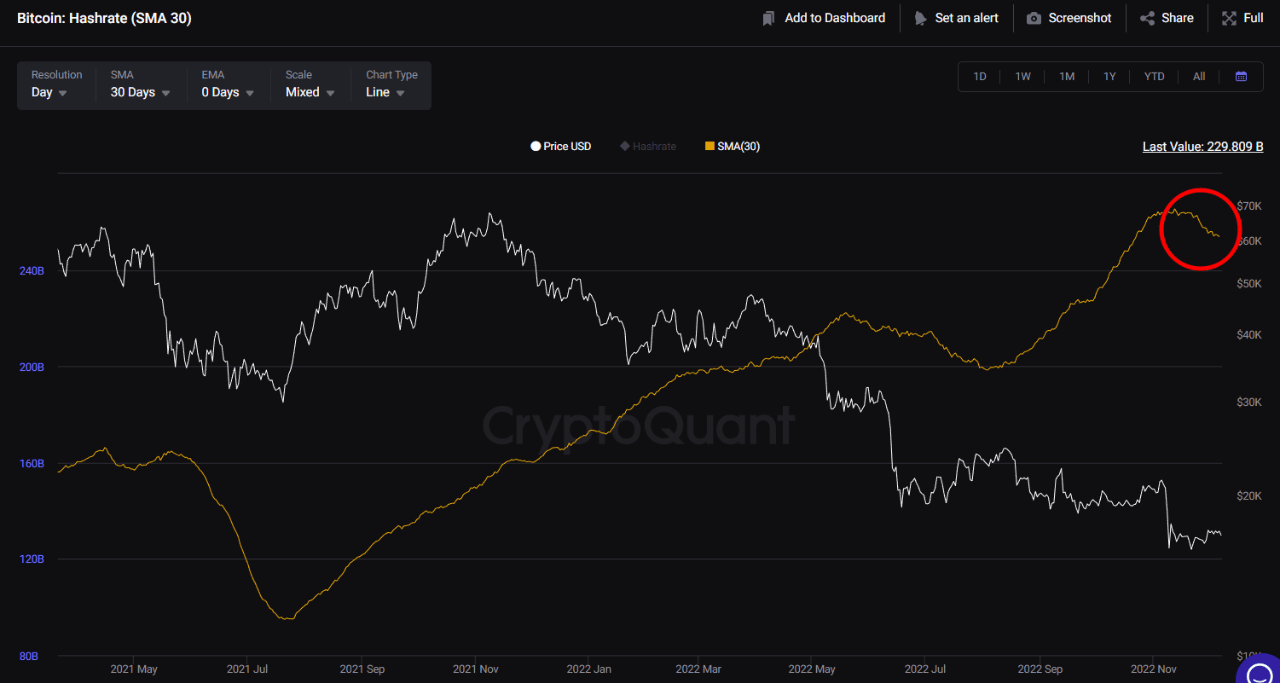

After a tumultuous month for Bitcoin in November, few indicators are pointing out that the BTC price can see a major downtrend in the month of December and in the near short term. The core factor leading to this is the declining hashrate and mining difficulty, coupled with the dwindling mining operations & their poor state of affairs in the current bear market.

Bitcoin’s Mining Difficulty

The mining difficulty of Bitcoin experienced a significant drop on December 6th and it was an extremely unusual occurrence as the last time it took place was in July of 2021. According to the data on the BTC.com mining pool, the level of difficulty decreased by 7.32 % at a block height of 766,080.

Bitcoin miners seem to be turning down their mining machines as a result of the ongoing bearish market sentiment that has affected the whole cryptocurrency market. This is the lowest level seen since a 28% decline in July of last year, when China banned the mining of cryptocurrencies.

Read More: Kazakhstan Passes Stringent Crypto And Mining Bills

Moreover, on-chain data shows that the Bitcoin hashrate (MA30) has also recently started to subside, along with the difficulty level.

Bitcoin Mining Industry Stutters

The ripple effect can be seen in mining companies as well, with a few inching towards shutting down or declaring bankruptcy.

Core Scientific Inc., the largest publicly traded Bitcoin mining business in the U.S., reported a $1.7 billion loss for the first nine months of the year. The firm further issued a warning in October that it might have to declare bankruptcy if it can’t obtain more capital to pay off its debt, which totals more than $1 billion. It suffered a $434 million loss in the third quarter.

Read More: After Core Scientific, Another Bitcoin Miner Flags Default Risks

The value of the company’s stock has decreased by approximately 99% this year, to just 16 cents ($0.16). Another mining company — Stronghold Digital Mining (SDGI) has fallen over -25.4% on news of the NASDAQ delisting crisis.

Crypto analysts and experts anticipate a domino effect once one of the top mining units suspends operations and files for bankruptcy proceedings.

Read More: Popular Analysts Predict Bitcoin and Ethereum Prices For Christmas

Combined with declining hashrate, mining difficulty and companies struggling to sustain, crypto analysts expect the Bitcoin (BTC) price to further dip in the near short term.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs