Slump In Ethereum Derivatives Signal Strong Price Action In Short Term

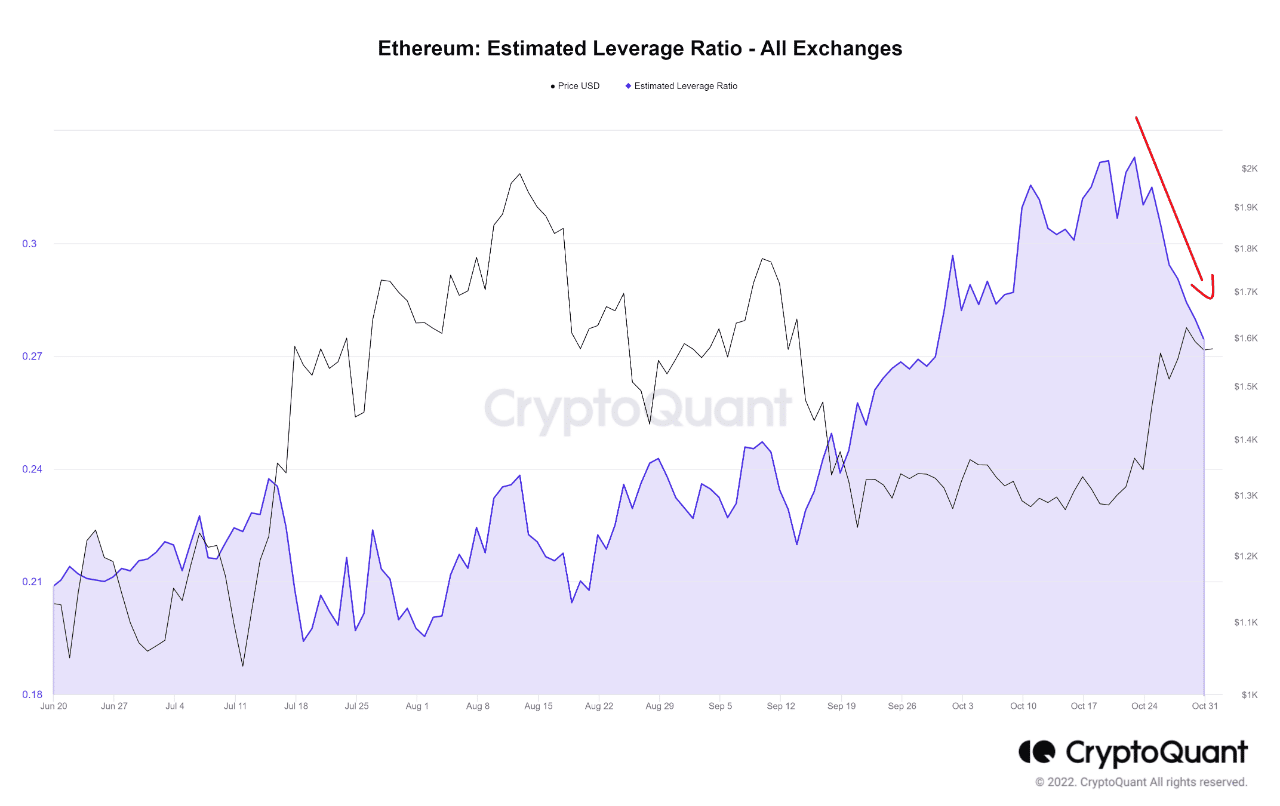

A few weeks back, the crypto market seemed to be dominated by derivatives for both Bitcoin and Ethereum. Additionally, during the past few months, the leverage in Ethereum (ELR) has increased to such high levels which are unheard of (The OI increases too).

This showed investors & traders were taking an extra risk in their positions.

Positive Impact on ETH Price

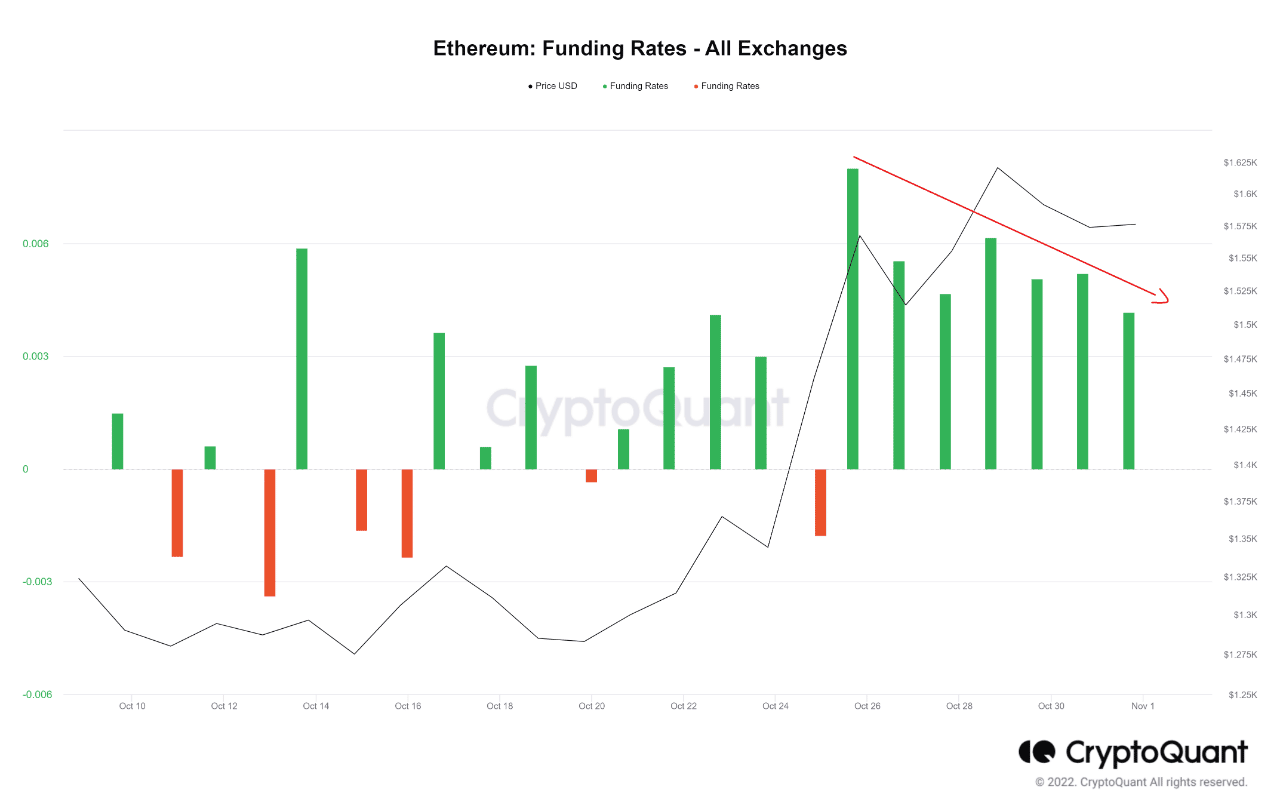

All of these caused Ethereum to rise by almost 30% over the past month. The Funding Rate also revealed that the majority of investors were long on Ethereum.

Tides Might Turn

However, the leverage and the passion reflected in the funding are currently beginning to decline. This can mean that investors who were at first willing to take significant risks have already made the decision to progressively close their positions. The long-term pressure from derivatives appears to be starting to lessen.

At the time of writing, the Ethereum price is $1,559.29 USD with a 24-hour trading volume of $13,427,764,204 USD. Ethereum is down 0.90% in the last 24 hours & down by 66% in the one-year timeframe.

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- Crypto Price Prediction For the Week Ahead: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs