SOL Rises as Nasdaq-listed Forward Completes $1.65B Raise For Solana Treasury

Highlights

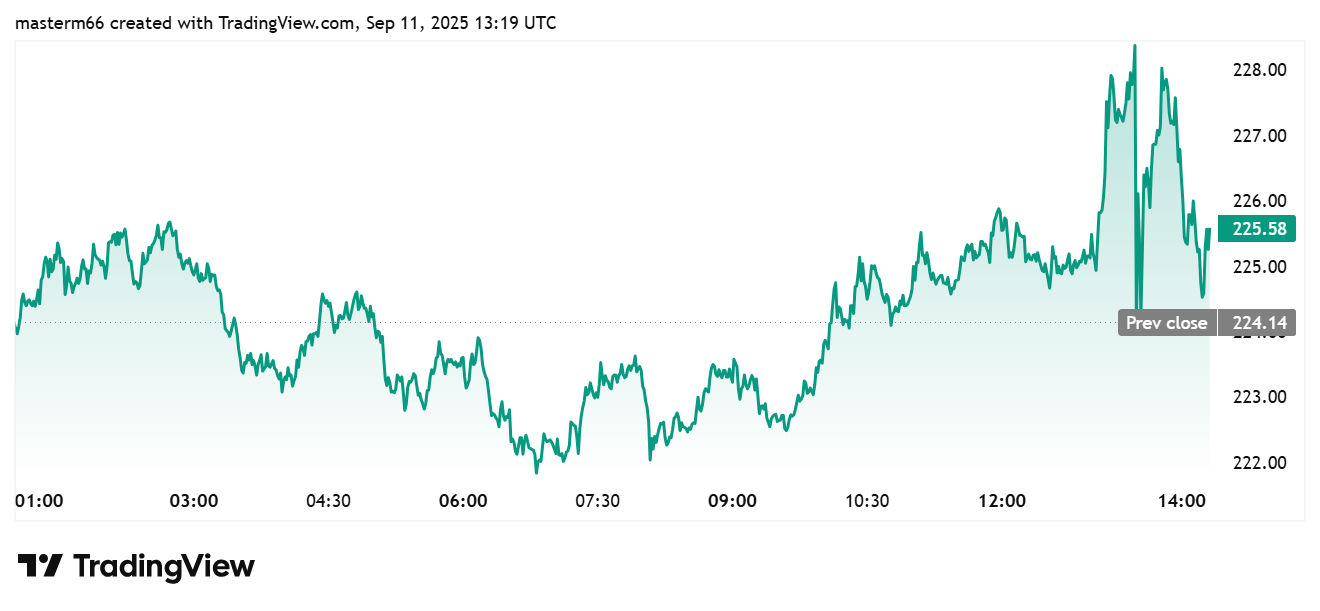

- Solana price climbs above $227 as institutions boost confidence with billion-dollar raise.

- Forward Industries secures $1.65B to build Solana treasury and boost ecosystem growth.

- Galaxy, Jump Crypto, Multicoin secure board roles after Forward’s landmark Solana financing.

Solana (SOL) price climbed above $227 after Nasdaq-listed Forward Industries secured $1.65 billion to build a Solana treasury. The move is a signal of growing institutional confidence in the Solana ecosystem.

Solana Gains Momentum With $1.65 Billion Treasury Investment

The value of SOL extended its rally on Wednesday, climbing 1.41% to $227.31. The token has now gained 7.75% in a week, almost 30% in a month, and over 70% across six months, according to TradingView data. The latest surge followed confirmation that Nasdaq-listed Forward Industries, Inc. (NASDAQ: FORD) had secured $1.65 billion to build a Solana treasury.

According to the official statement, the financing round was led by Galaxy Digital, Jump Crypto, and Multicoin Capital. The company confirmed that proceeds will be directed toward purchasing Solana’s native token, SOL. It would also cover working capital needs and digital asset-related expenses.

Galaxy, Jump, and Multicoin together contributed more than $300 million. Other institutional participants included Bitwise Asset Management, Borderless Capital, Coinlist Alpha, FalconX, ParaFi, Ribbit Capital, RockawayX, and SkyBridge Capital.

The support from all categories of investors shows that Solana continues to attract interest from institutions and retail leaders in the crypto space. Recently, another Solana treasury firm SOL Strategies secured approval to list on Nasdaq. The move further underscores how public market exposure is becoming a key component of the Solana treasury landscape.

Angel investors also participated in the raise. Their move indicate confidence in the long term growth of the Solana ecosystem. These backers include Cindy Leow of Drift, Guy Young of Ethena, Howard Lindzon of Stocktwits, Lucas Bruder of Jito, Lucas Netz of Pudgy Penguins, Robert Leshner of Superstate, Tarun Chitra of Gauntlet and Tory Green of io.net.

Boardroom Shakeup Sees Galaxy, Jump Crypto Execs Take Helm After Landmark Deal

Forward Industries’ market capitalization currently sits near $50 million, far below the scale of its $1.65 billion raise. Still such a significant financing directed at Solana could accelerate institutional adoption and expand liquidity for SOL. This is especially true as the network continues to advance with upgrades like the Alpenglow proposal aimed at boosting speed and efficiency.

The completion of the PIPE deal also triggered board-level changes. Kyle Samani, co-founder of Multicoin, has been appointed Chairman of Forward Industries’ Board. Chris Ferraro, President of Galaxy, and Saurabh Sharma, Chief Investment Officer of Jump Crypto, also joined the board.

Interim Chief Executive Officer Michael Prutti will remain in his role. The appointments signal the growing influence of top digital asset firms over Forward’s strategy. Existing management will continue to oversee the company’s operations.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs