Solana CME Futures Volume Hits Record 1.75M Contracts

Highlights

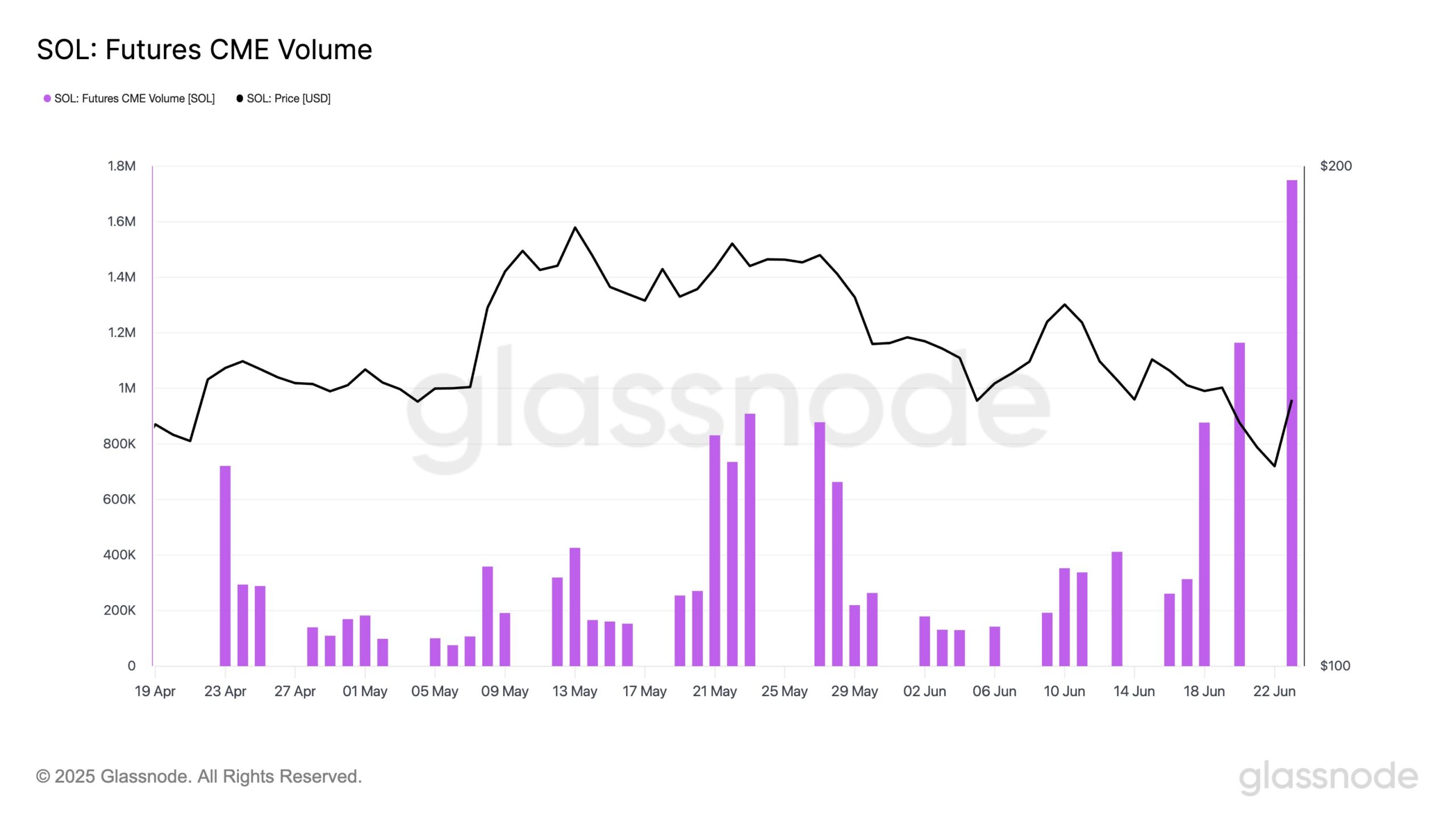

- Solana futures on CME hit 1.75M contracts, hinting at institutional demand.

- Trading volume surge shows renewed confidence as SOL rebounds toward $145.

- Solana joins Bitcoin, Ethereum in attracting major institutional futures trading interest.

Solana’s futures market just broke a major record. On June 24, 2025, trading volume for Solana (SOL) futures on the Chicago Mercantile Exchange (CME) reached 1.75 million contracts. This is the highest level ever recorded for SOL futures.

Institutional Interest Grows as Solana Futures Volume Hits New Peak

The surge in volume suggests more institutions are becoming involved with Solana. Large trading volumes often reflect interest from hedge funds, asset managers, and professional traders. Unlike smaller exchanges, CME’s contracts are designed to attract big players who manage large amounts of money.

The rise in futures trading also shows growing confidence in Solana’s future. The spike happened as Solana price climbed back toward $145. It is up 3.8% in the last 24 hours, according to CoinGape data.

Over recent weeks, the price had fluctuated but now shows strong signs of recovery. As the price rebounded, trading activity in the futures market increased sharply. This suggests that investors appeared eager to position themselves for the next move.

When prices rise along with futures volume, it often means traders are positioning for more upside. However, futures can also reflect hedging activity, where traders try to protect against possible losses.

Source: X (@glassnode)

Record Futures Volume Marks SOL’s Entry into Institutional Spotlight

The chart from Glassnode shows a clear jump in both price and futures activity in June. Earlier in the month, trading volumes were lower even as prices fluctuated. But as the price neared $145, activity surged, hitting the 1.75 million contract record.

This kind of activity can affect the broader market. When futures volume rises sharply, it can lead to higher price swings. That’s because leveraged positions amplify gains and losses. If the market moves too quickly, some traders may be forced to close positions, creating sudden price moves.

Still, the record-setting volume highlights Solana’s growing role in the crypto ecosystem. A year ago, such levels of institutional involvement seemed unlikely for Solana. Now, it stands alongside major assets like Bitcoin and Ethereum in attracting significant futures interest.

Solana’s sharp rise in futures volume shows how fast crypto markets are evolving. Institutional investors are paying attention, and their growing involvement is shaping the future of digital assets.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs