Solana To Dive Below $127, Analyst Predicts As SOL Price Rallies

Highlights

- A prominent analyst predicts Solana's correction to $127.

- The Solana price has rallied nearly 15% and crossed the $170 mark recently.

- Derivatives data suggests a bullish sentiment among the traders.

Solana (SOL) is currently in the limelight as the current price rally has pushed it up by 15% over the past week to surpass the $170 milestone. This impressive rally underscores a heightened investor interest in the digital asset.

However, amid the unprecedented surge, a cautionary note from prominent crypto analyst Ali Martinez is sparking discussions about a potential correction in SOL’s price trajectory.

Analyst Signals Potential Correction in SOL Price

The Solana’s rally over $170 has renewed hopes among investors, with several market watchers expecting the rally to sustain. However, a warning from the prominent crypto analyst Ali Martinez has sparked speculations in the crypto market.

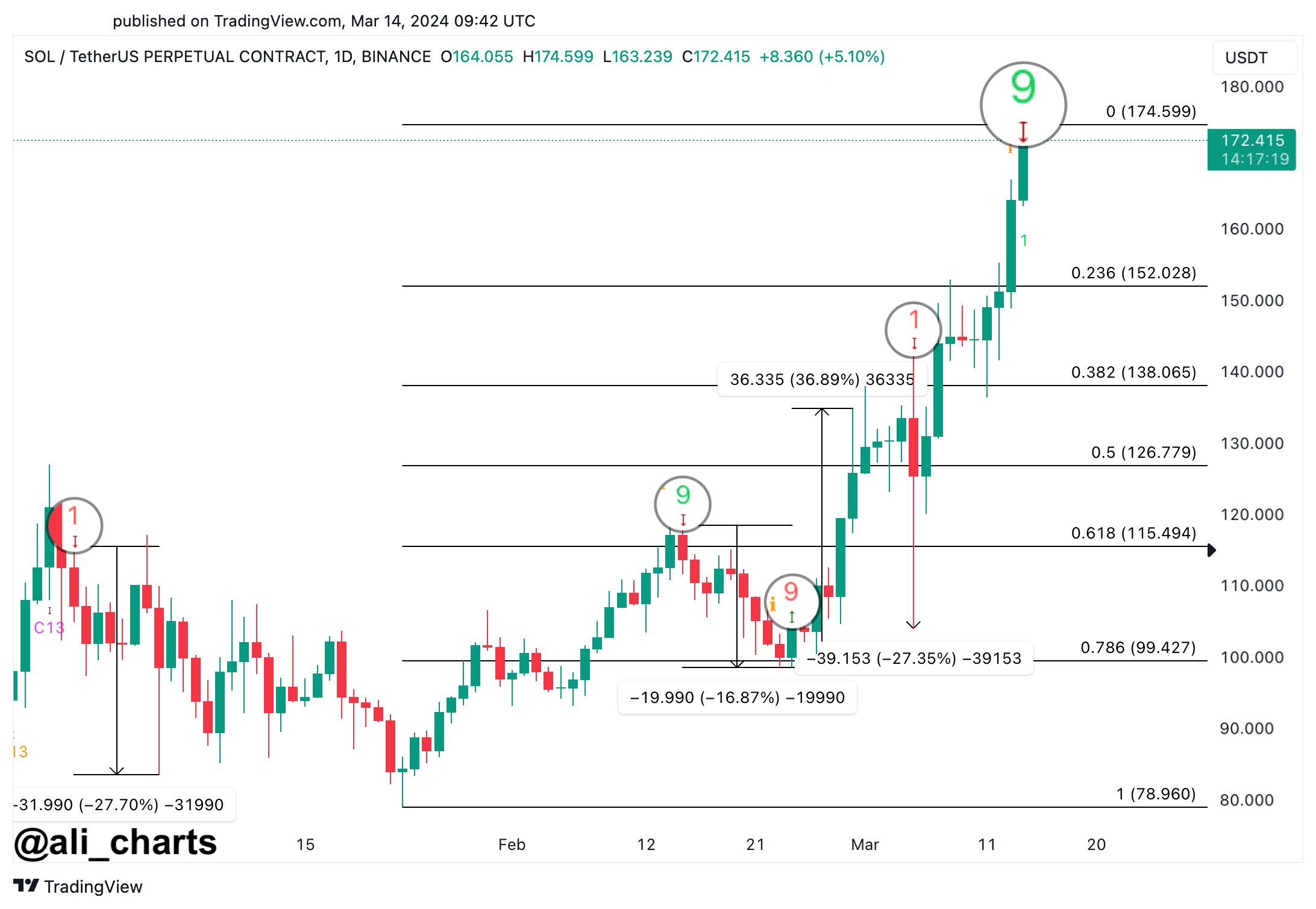

Meanwhile, in a recent post on the X platform, crypto analyst Ali Martinez sounded the alarm regarding Solana’s price outlook. Martinez pointed to the TD Sequential indicator, which has historically signaled sell-offs whenever SOL reached certain levels since December 2023. Notably, Martinez said:

“Since December 2023, every time this indicator suggested selling, the price of SOL dropped by 17% to 28%.”

Notably, the warning suggests a possible retracement for SOL, potentially dipping to $152 or even $127. Subsequently, Martinez’s cautionary message has injected a sense of prudence into the cryptocurrency market, prompting investors to reassess their strategies amid the ongoing rally.

However, despite this warning, Solana’s derivatives data paints a conflicting picture, indicating a bullish sentiment and hinting at the possibility of further upward movement in SOL’s price.

Also Read: Why AI Coins May Skyrocket In March?

Market Indicators Amid Price Rally

The ongoing rally in Solana price and the recent warning have sparked discussions among the crypto market enthusiasts. However, the derivatives data suggests that the SOL price could sustain the rally, given the strong confidence of the investors.

For instance, the Solana Futures Open Interest (OI) surged by 16.74% to reach $2.83 billion, with the highest OI recorded on Binance at approximately $1.18 billion, trailed by Bybit at $775.27 million, the CoinGlass data showed. certain investors view the surge in cryptocurrency prices as a chance to secure profits, prompting a cautious approach for the market participants.

Meanwhile, according to CoinGlass data, over 80,000 traders faced liquidations in the crypto market totaling $237.78 million over the last 24 hours. Notably, Solana experienced a total liquidation of $17.43 million, split between $3.85 million in long positions and $13.56 million in short positions within a 24-hour period.

On the other hand, Solana’s relative strength index (RSI) signaled an overbought condition at 84.16. So, investors are advised to exercise diligence and caution in navigating the volatile crypto landscape. As Solana continues to capture attention with its price movements, prudent risk management remains crucial for investors looking to capitalize on opportunities in the dynamic crypto market.

Meanwhile, as of writing, the Solana price was up 15.50% to $166.78, a mild correction from its best price for the day. Notably, its trading volume soared 26% to $7.04 billion over the last 24 hours. Per market data, the crypto has touched a high of $173.81 and a low of $150.46 in the last 24 hours, suggesting the volatile nature of the crypto market.

Also Read: Ripple Partner Tranglo’s XRP Use In ODL Ignites Controversy

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Core Scientific Sells 1,900 BTC as Bitcoin Miner Pivots to AI, CORZ Stock Dips

- Bitcoin News: VanEck CEO Projects Gradual BTC Rally in 2026 as ETFs Sees $458M Inflows

- Bitcoin, Gold Slip as Donald Trump Says “Unlimited Munition Stockpiles” for US-Iran War

- Crypto Prices Today: BTC, ETH, XRP Prices Surge Despite Iran’s Strait of Hormuz Closure

- Nasdaq Brings Prediction Markets to Wall Street with New SEC Filing

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

Buy $GGs

Buy $GGs