Solana Price Targets $420 Rally Amid Grayscale’s SOL ETF Launch Push

Highlights

- Top expert predicts massive Solana price breakout gaining investors' attention.

- Grayscale recently filed with the NYSE to launch SOL ETF in the US.

- SOL price recorded a slump today amid a retreat in the broader crypto market.

Grayscale has made headlines with its recent push to launch Solana ETF in the US. Notably, the asset manager has filed to launch Litecoin ETF and Bitcoin Adapters ETF, which reflects the pro-crypto sentiment hovering in the market under Trump’s presidency. Simultaneously, this latest move has also fueled market optimism over a potential breakout in Solana price ahead.

Solana Price Eyes Rally Amid Grayscale Push To Launch SOL ETF

Grayscale has recently filed with the New York Stock Exchange (NYSE) to launch a Solana ETF in the US, gaining market attention. This filing from the asset manager highlights the growing optimism around crypto ETFs, fueled by a pro-crypto environment under the Trump administration. Besides, experts anticipate a potential rally in Solana price amid this latest development.

Notably, Grayscale’s Solana Trust, the leading investment fund for SOL globally, holds approximately $134.2 million in assets. This accounts for about 0.1% of all Solana tokens in circulation. The firm’s recent filing aims to transform this Trust into a spot Solana ETF, allowing investors to trade on a regulated securities exchange.

Meanwhile, the proposed ETF seeks to mirror the value of SOL held by the Trust, minus expenses, offering a secure and convenient investment option. While the Trust’s current structure doesn’t allow for direct SOL ownership, it provides a cost-effective alternative to traditional investments in digital assets.

Notably, Coinbase Custody Trust Company is positioned as the Custodian, with BNY Mellon handling administrative responsibilities. Grayscale believes these measures will enhance investor confidence while experts anticipate a surge in Solana price.

Pro-Crypto Sentiment Under Trump Sparks Optimism

This latest Grayscale filing reflects the favorable crypto regulatory environment emerging under Trump’s presidency. This is evidenced by similar filings from other asset managers like CoinShares and Canary Capital. It’s worth noting that CoinShares has also recently filed for an XRP ETF launch with the US SEC.

Analysts argue that these moves signify a broader acceptance of digital assets in traditional markets. On the other hand, the recent hint from Donald Trump about a crypto national reserve in the US has further fueled confidence in the top altcoins.

Meanwhile, the trust operates as a Delaware statutory trust under agreements involving multiple prominent financial institutions. This structure is expected to offer an added layer of security and compliance for investors, potentially attracting institutional interest.

Solana Price Breakout Imminent?

Market experts predict Grayscale’s ETF filing could act as a catalyst for a significant Solana price breakout. As institutional interest in crypto grows, Solana could see increased adoption and investment inflows.

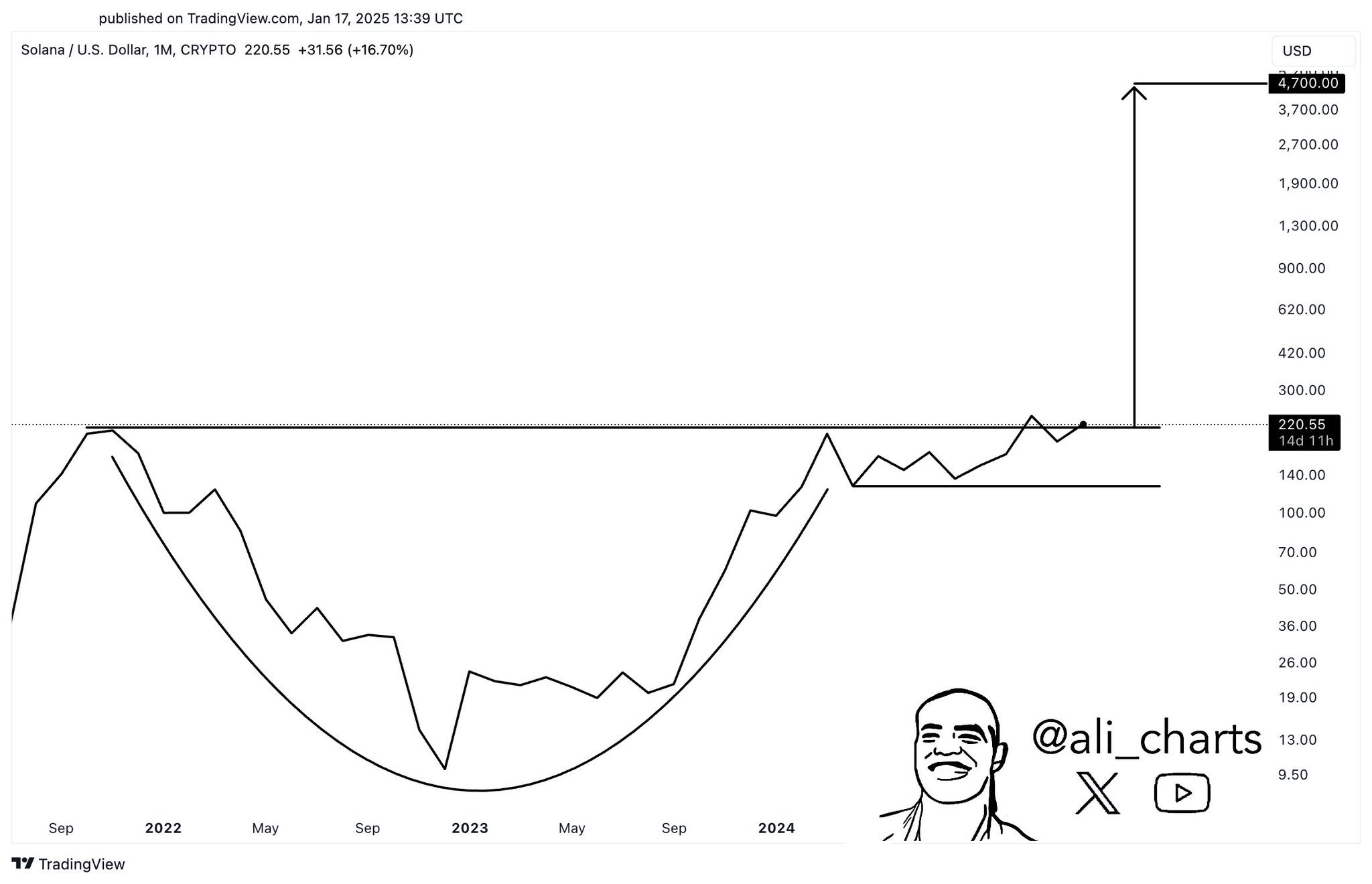

Notably, sharing the Grayscale Solana ETF update on the X platform, top market analyst Ali Martinez has recently shared a bold forecast. Lauding the development, Martinez has reiterated his prediction for Solana price rally to $4,700, which has sparked market optimism.

However, despite these positive developments, SOL price today was down 5% and traded at $247.33, with its trading volume falling 26% to $6.9 billion. Notably, the crypto has touched a 24-hour high of $269, especially after Grayscale’s announcement.

Further, the Relative Strength Index (RSI) for SOL stood at 61, indicating strong momentum ahead for the crypto. However, Solana Futures Open Interest fell 2% during writing, in tandem with the declining price of the asset.

Meanwhile, another popular market expert Rose Premium Signals said that Solana price is likely to hit $424.66 once it breaches the $258 support level. In addition, the analyst also noted that the crypto might target the $513 mark once the $420 level is breached.

- Robert Kiyosaki Reveals Why He Bought Bitcoin at $67K?

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?