Solana Price Eyes Rally To $200 As Network Adoption Hits New ATH

Highlights

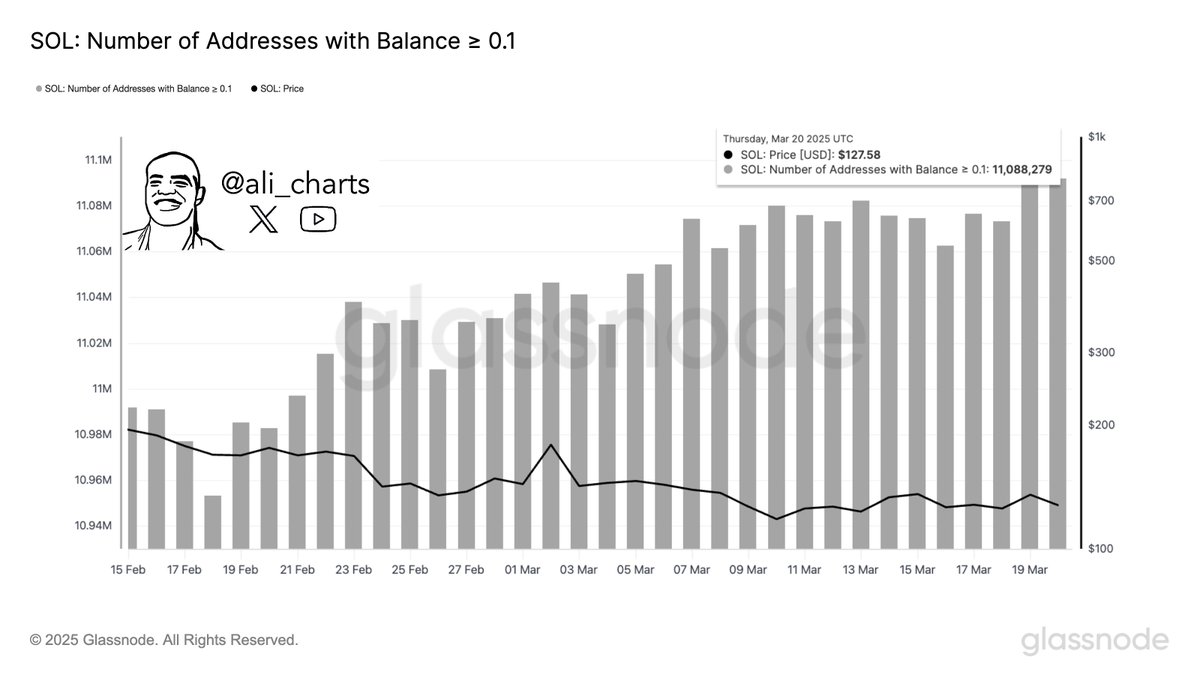

- Solana network adoption hits new ATH with 11.09M addresses holding SOL.

- Volatility Shares introduces first Solana futures ETFs on Nasdaq.

- Fidelity registers 'Fidelity Solana Fund' boosting institutional confidence.

Solana (SOL) is gaining attention in the crypto market after hitting a new all-time high (ATH) in network adoption. The number of addresses holding SOL has surpassed 11 million, signaling increasing interest in the network.

This surge in adoption comes amid recent developments, including the launch of Solana futures ETFs and rising institutional interest. With these factors, analysts are now eyeing a potential rally for Solana’s price, possibly pushing it towards the $200 mark.

New Adoption Milestone for Solana

On-chain analytics reveal that more than 11.09 million addresses currently hold the SOL token on the Solana network. This is the new ATH in terms of network adoption of Solana which is a signal in the context of its long-term development. The increase in address activity indicates that more users are participating in the Solana ecosystem, which is further expanding progressively as a decentralized network.

From the statistics, this uptick is expected to compliment the Solana price in the coming months especially after the development of Network.

Solana’s increase in the adoption rate can be attributed to the increasing institutional interest in cryptocurrencies. The introduction of Solana futures ETFs, followed by the possibility of the spot Solana ETF, has attracted corporate investors/traders. Analysts see these as optimisms within the market that could lead to another push up in the price of Solana. The breakout from the current range and continued institutional participation could lead to new highs for Solana price.

Solana Futures ETFs Spark New Interest

In March 2025, Solana still saw one of the most important events in its existence by launching own futures ETFs. These include the Volatility Shares Solana ETF (SOLZ) and the leveraged Volatility Shares 2X Solana ETF (SOLT).

These are funds that give investors direct access to Solana futures contracts and are present on Nasdaq. The listing of Solana’s futures ETFs is a sign that Solana is gradually gaining more recognition in mainstream finance, meaning that more investors can invest in Solana token.

While the launch has brought Solana into the spotlight, some market analysts have noted mixed reactions. Despite this, the debut of these financial products has led to an increase in Solana’s price, with the token briefly rising above $136. Analysts believe that these products could provide long-term support for Solana’s price as they bring more liquidity and market visibility to the SOL price hitting $200 again.

Institutional Support and Increased Market Confidence

There is growing support by institutions such as Fidelity Investments with the latest accruing to Solana network. This new Fidelity Solana Fund was recently filed with the registry of Delaware shows that Solana might stand on the entity of mainstream finance.

Given that Fidelity has a network of $4.9 trillion in assets, its entrance to the Solana ecosystem could be a major boost to the project. With a growing number of institutions seeking to invest in Solana to diversify their portfolio the future appears promising for the network.

These institutional backs are encouraging by the increasing growing rate in the cryptocurrency market and for Solana in particular. Polymarket further reveals that the probability of Solana attaining an ETF has risen to 88% this year. With more institutions investing in Solana, it is perhaps only a matter of time before regulators change their stance and approve SOL spot ETFs boosting Solana price rally towards $200.

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- Fed’s Chris Waller Says Support For March Rate Cut Will Depend On Jobs Report

- Breaking: Tom Lee’s BitMine Adds 51,162 ETH Amid Vitalik Buterin’s Ethereum Sales

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?