Solana Price Leads Altcoin Rally As Ethereum Futures ETFs Debut In The US – Time To Buy SOL?

Solana price bulls increased their presence in the market up 4.5% to trade at $24 on Monday. This bullish outlook started with the hype around the US Securities and Exchange Commission (SEC) greenlighting the first Ether futures exchange-traded funds (ETFs).

Investors have from Friday increased exposure to cryptos, triggering rallies across the board but more significantly with Bitcoin (BTC) above $28,000, Ethereum above $1,700, and Solana above $24.

Solana Price On the Verge of Validating Move To $30

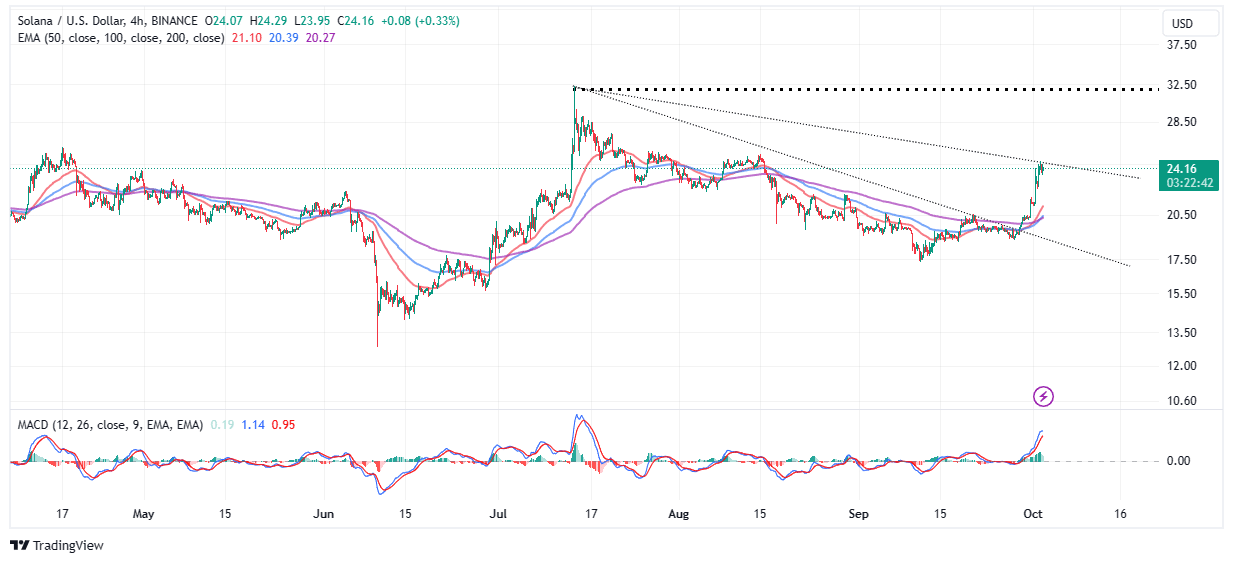

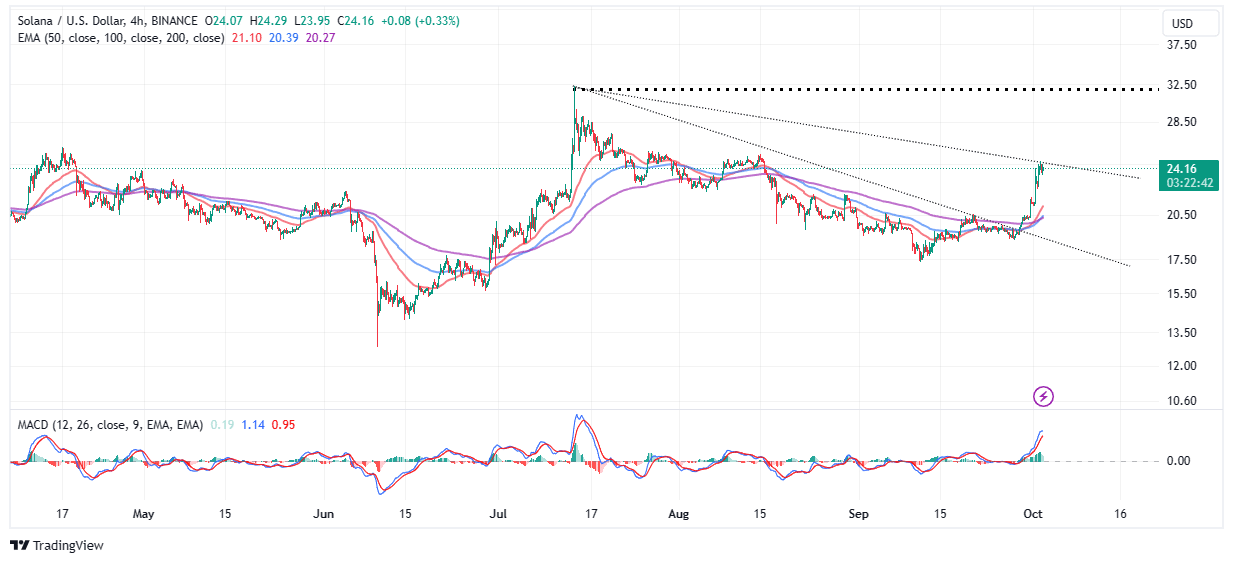

Solana price is facing a crossroads where it might validate another breakout to $30, or invalidate the uptrend due to resistance at $25. According to the microenvironment on the daily chart, a bullish outcome is highly likely.

A buy signal from the Moving Average Convergence Divergence (MACD) indicator upholds the bullish outlook with a buy signal.

However, traders with ongoing exposure to long positions in SOL may be more interested in the position of the momentum indicator – currently above the mean line (0.00). As the MACD ascends into the positive region, traders are encouraged to keep their positions open bolstered by the expectation of an extended breakout to $30.

Solana’s position above all three moving averages, starting with the 50-day Exponential Moving Average (EMA) (red), the 100-day EMA (blue), and the 200-day EMA (purple) reveals that buyers have the upper hand.

In other words, there is a higher probability of the uptrend carrying on above $25 and closing the distance to $30 than dropping below $20.

TradingBrokersView, an anonymous analyst on Tradingview, has recently highlighted a repeated trend, where Solana price has broken several falling trendline resistances, rallied and formed a bullish/bearish fractal pattern before retracing.

According to the analyst, “all two prior breakouts over such Resistance in the past 12 months have ended with a new Higher High on our main Channel Up pattern.” Hence, the likelihood of the ongoing breakout stretching to $33 before correcting and holding onto higher support, preferably above $25.

Invalidating Solana Price Bullish Outlook

The resistance at $25 coincides with a descending trendline on the four-hour chart. To continue with the uptrend, Solana must break above this barricade, otherwise, there will be a significant level of risk, with Solana retreating to seek support and liquidity toward $20.

Traders should also ponder the technical outlook from the aspect of the currently bullish MACD indicator. Following a sharp move above the mean line (0.00) to +1.13, a trend reversal is likely. In other words, there is the need to prepare for a sudden pullback, with the backing of the Relative Strength Index (RS) if it starts retreating from the resistance area or is overbought.

Related Articles

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- CLARITY Act: Banks, Crypto Yet To Agree On New Crypto Bill Draft As March 1 Deadline Looms

- Michael Saylor Predicts $50T From Bonds Could Flow Into Bitcoin Ecosystem as Digital Credit Evolves

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale