Solana (SOL) Ecosystem Faces Biggest Rug Pull Days After ATH

Solana (SOL) became the first altcoin to hit ATH after the May crash this year. The Defi protocol which peaked at $80 on August 18 has become a victim of the largest rug pull since its inception. LUNA Yield, an IDO platform on Solana Launchpad went dark this morning after it shut down its website and all other social media platforms, raising concerns about a possible rug pull.

Luna Yield, the latest IDO on our Launchpad, seems to have some problems. The Luna Yield Team took down their website and all other social media. They also withdraw all liquidity. SolPAD still can't reach Luna Yield Team to figure out what happened.

— SolPAD (@FinanceSolpad) August 19, 2021

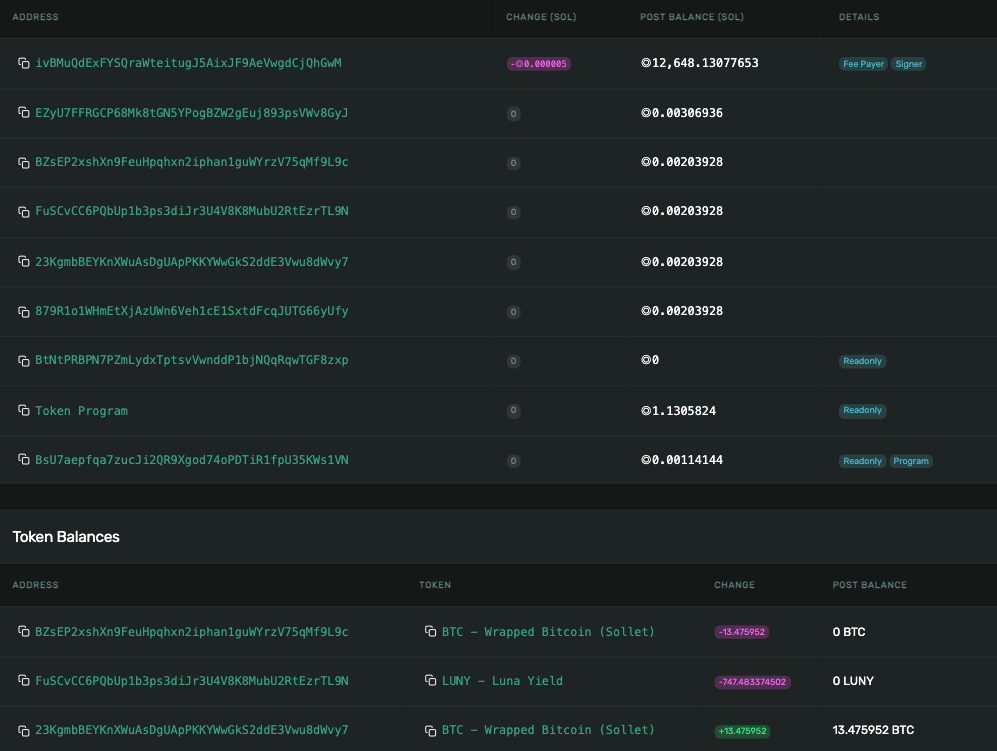

Users tried to unstake their funds after the platform went off social media platforms, but failed as the IDO protocol has already shifted funds from their staking pools. Early estimates suggested that the project took away nearly $10 million worth of crypto assets from these staking pools.

Further investigation showed that the approval for the fund transfer from the staking pool was given by the owner, thus solidifying the rug-pull theory.

Solana users experienced issues while transferring funds due to the rug pull crisis. A developer on the Solana network gave a full detailed overview of the hack confirming the creators of the staking pool were behind the movement of funds.

Ok… So I was going to attempt finishing the Serum library tests and stream it tonight but Luna Yield decided to rug pull and steal something like $~8M (can't attest atm)

A THREAD to, hopefully, pill all of you degens on #Solana to pay attention to what you're doing.

— hoakegani (@hoaktrades) August 20, 2021

Solana Ecosystem Criticized For Lack of Transparency

The Solana ecosystem is often criticized for lack of transparency and the latest rug-pull is only going to mount the pressure further. The official Twitter account for the Solana Launchpad assured that they are working with developers to help users with their lost funds. They also claimed that a third-party investigation would be carried out to find the solution.

“We are trying to find ways to support users and contact some third parties to investigate the problem. Please be patient, and provide us any information related to Luna Yield. Thank you for your cooperation.”

Defi ecosystem has made significant progress over the past two years, but security seems to be a growing issue. Recently, the cross-chain Defi Protocol PolyNetwork became a victim of the largest Defi hack, leading to $610 million in stolen assets.

- XRP News: Ripple Taps Zand Bank to Boost RLUSD Stablecoin Use in UAE

- BitMine Keeps Buying Ethereum With New $84M Purchase Despite $8B Paper Losses

- Polymarket Sues Massachusetts Amid Prediction Market Crackdown

- CLARITY Act: Bessent Slams Coinbase CEO, Calls for Compromise in White House Meeting Today

- Crypto Traders Reduce Fed Rate Cut Expectations Even as Expert Calls Fed Chair Nominee Kevin Warsh ‘Dovish’

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting