Solana, Terra and MATIC Price Analysis: These De-Fi Coins Noted Steady Inclination

Solana staged a comeback after trading bearishly over the past week and a half. At the time of writing, the coin was exchanging hands at $181.29 post gaining 8.7% in 24 hours.

Solana is currently the fifth-largest cryptocurrency by market share, and in recent times, Solana has introduced incentivizing game developments by funding developers to build gaming applications on top of Solana. This development has had a positive impact on Solana’s prices.

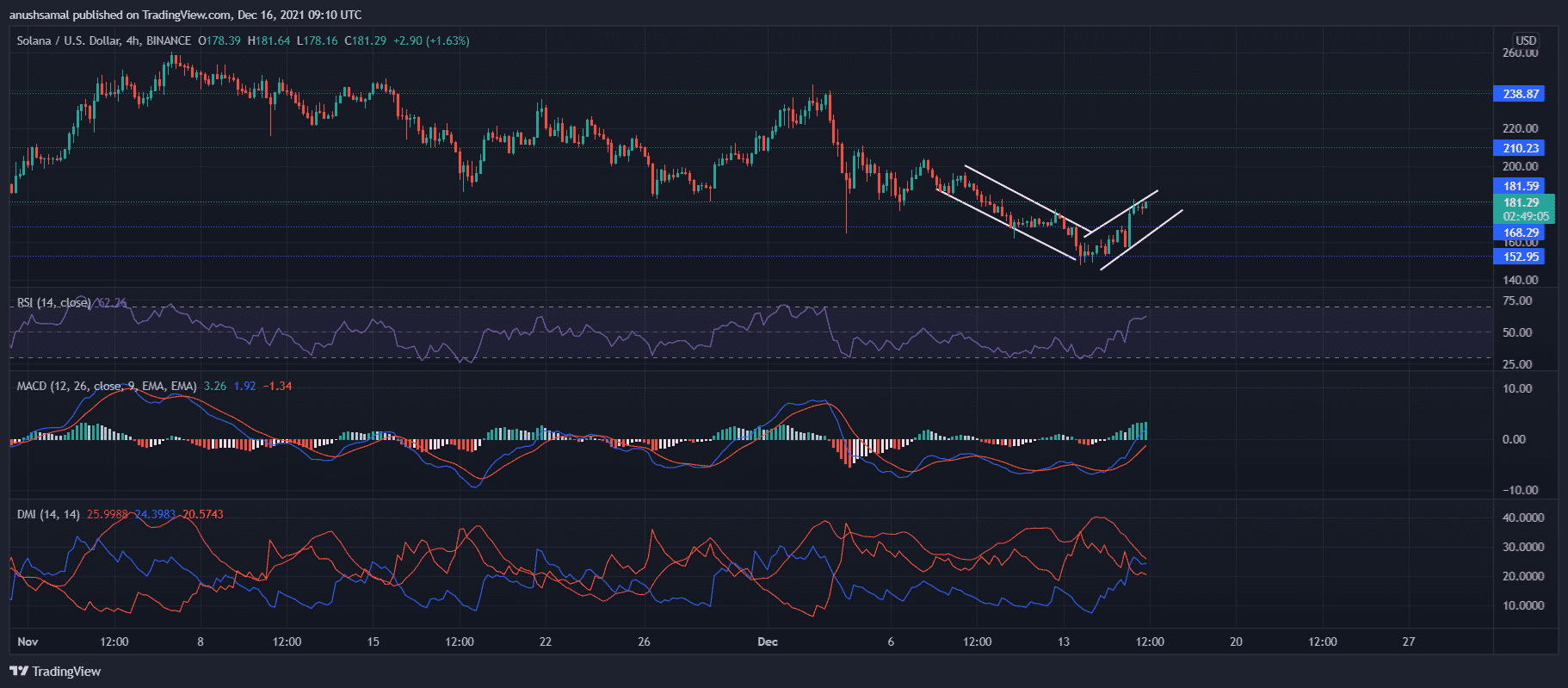

SOLANA/USD Four-Hour Chart

Solana’s bears were quite active in the past couple of weeks and had brought down the number of buyers in the market. At the time of writing, however, buying strength had revived itself on the four-hour chart, which helped the coin recover right after it plummeted significantly. The upward channel attests to the fact that SOL’s price movements are bullish at the moment. Although the coin moved north, it traded 36% lower than its ATH.

Immediate resistance of SOL was at $210.23. If SOL successfully holds onto its current price sentiment, traders can expect prices to reach the above level. The Relative Strength Index was seen, preferring the bulls as the indicator propelled above the half-line. Directional Movement Index also resonated with RSI’s readings. Lastly, MACD, following the other hands, also agreed with the bulls.

This bullishness can invalidate itself if selling pressure takes over, in the case of which the next trading level for SOL stood at $168.29.

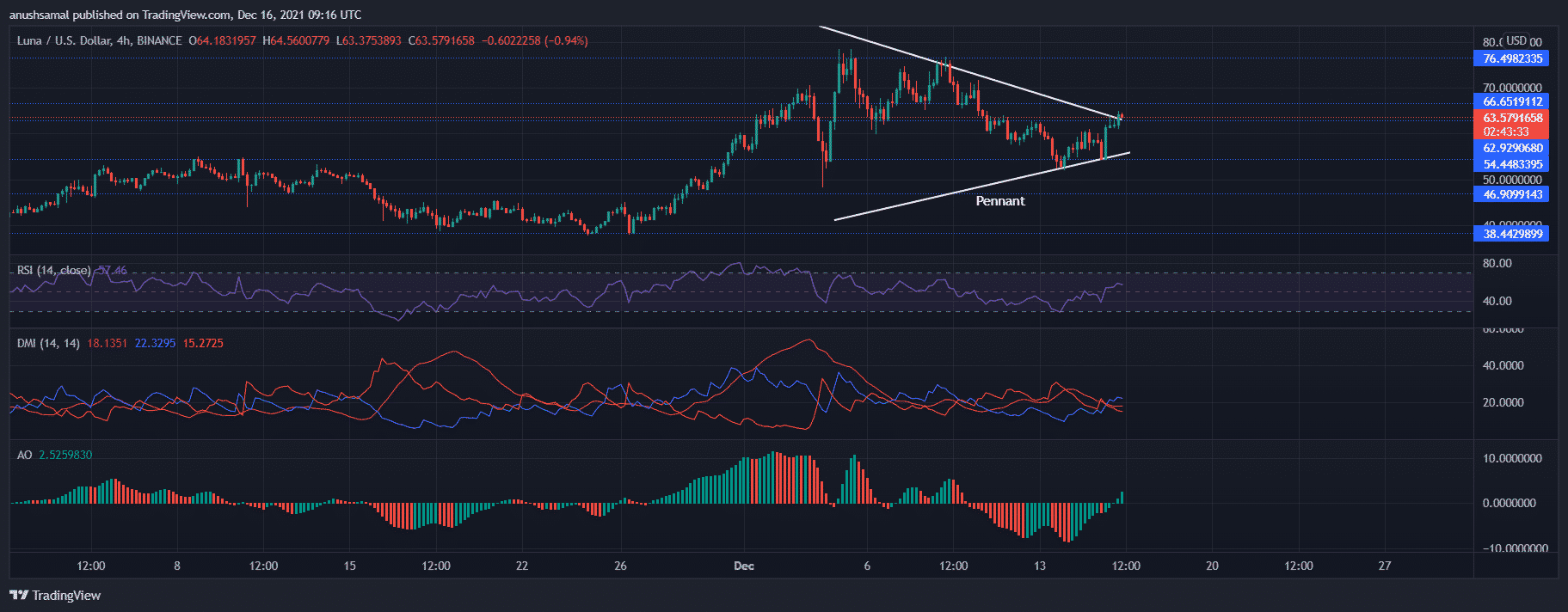

LUNA/USD Four-Hour Chart

Terra had registered its ATH on December 5, ever since which the coin infrequently has moved up and down the charts. The coin had formed a symmetrical triangle, following which Terra broke to the upside. The coin was priced at $63.57 after bagging double-digit gains over the past 24 hours. Terra had broken above its resistance mark of $62.92, and with a continued push from the bulls, it could attempt to retest $66.65 and subsequently the $76.49 price level.

The Relative Strength Index seemed to have found support above the mid-line, hinting at bullish price action. The Directional Movement Index also affirmed the positive price action. Awesome Oscillator projected positive price action by signaling amplified green signal bars at the press time.

If prices reverse, the coin would fall to trade near the $54.44 level and then at $46.90.

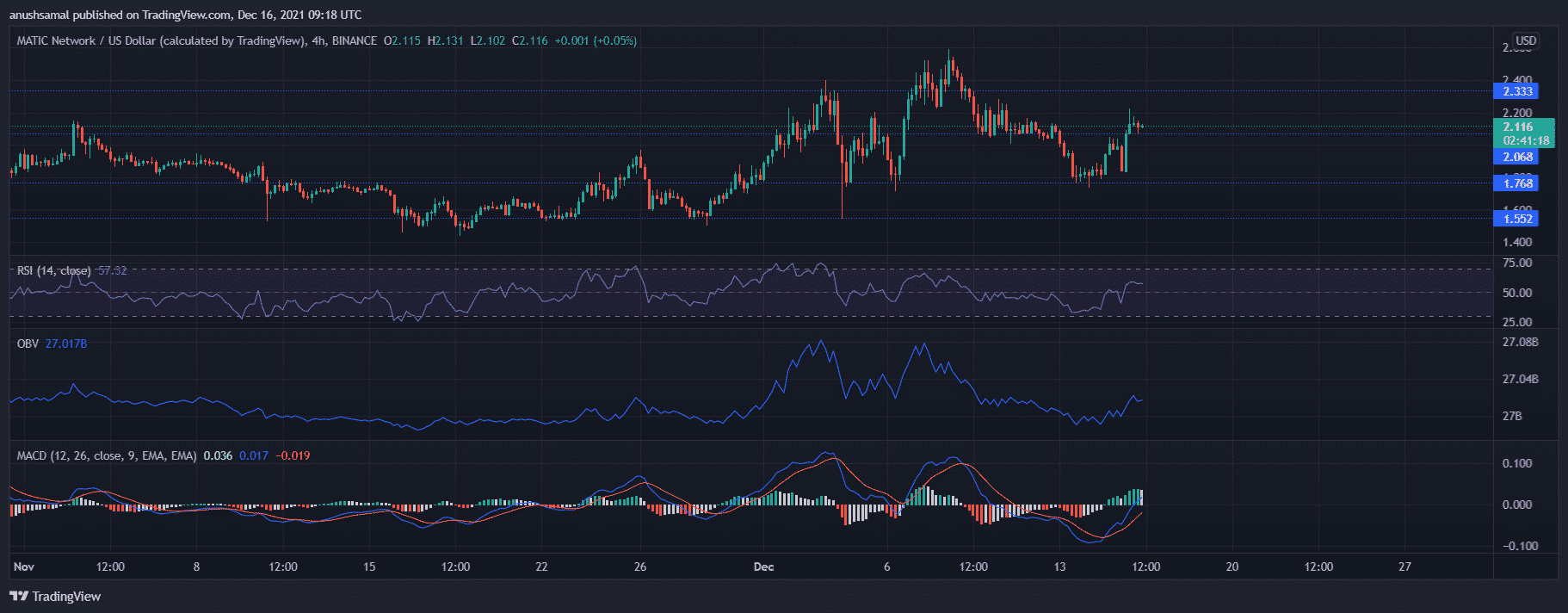

MATIC/USD Four-Hour Chart

Matic was trading for $2.11 after it toppled over its price ceiling of $2.06. The coin displayed signs of steady appreciation. With continued northbound movement, Matic could trade near the $2.33 price mark. The digital currency had increased ROI ever since the end of November and could retest its ATH. Matic’s technical indicators highlighted short-term bullish price action, as the coin slowly was on the rise to retest its long-standing resistance mark of $2.22.

The Relative Strength Index stood strong above the half-line as buyers re-entered the market. On-Balance Volume also exhibited declining selling pressure as the indicator recorded a downtick at press time. MACD lines displayed bullish crossover, implying positive price action.

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL