Spot Bitcoin ETF Notes Largest Net Inflow of $673 Million on Supply Shock

Highlights

- Spot Bitcoin exchange-traded funds (ETF) witnessed $673 million net inflow, breaking all records

- BlackRock iShares Bitcoin ETF (IBIT) recorded $612 million

- BTC price breaks over $63,000 on the back of massive Bitcoin ETF demand and supply shock

- VanEck's HODL joins GBTC in outflows

Spot Bitcoin ETFs recorded another staggering inflow on Wednesday, breaking the record of the largest inflow of $673 million since launch last month. It follows amid a massive BTC price rally towards ATH due to demand outpacing supply creating a “supply shock“.

Bitcoin ETFs Saw $673 Million in Net Inflow

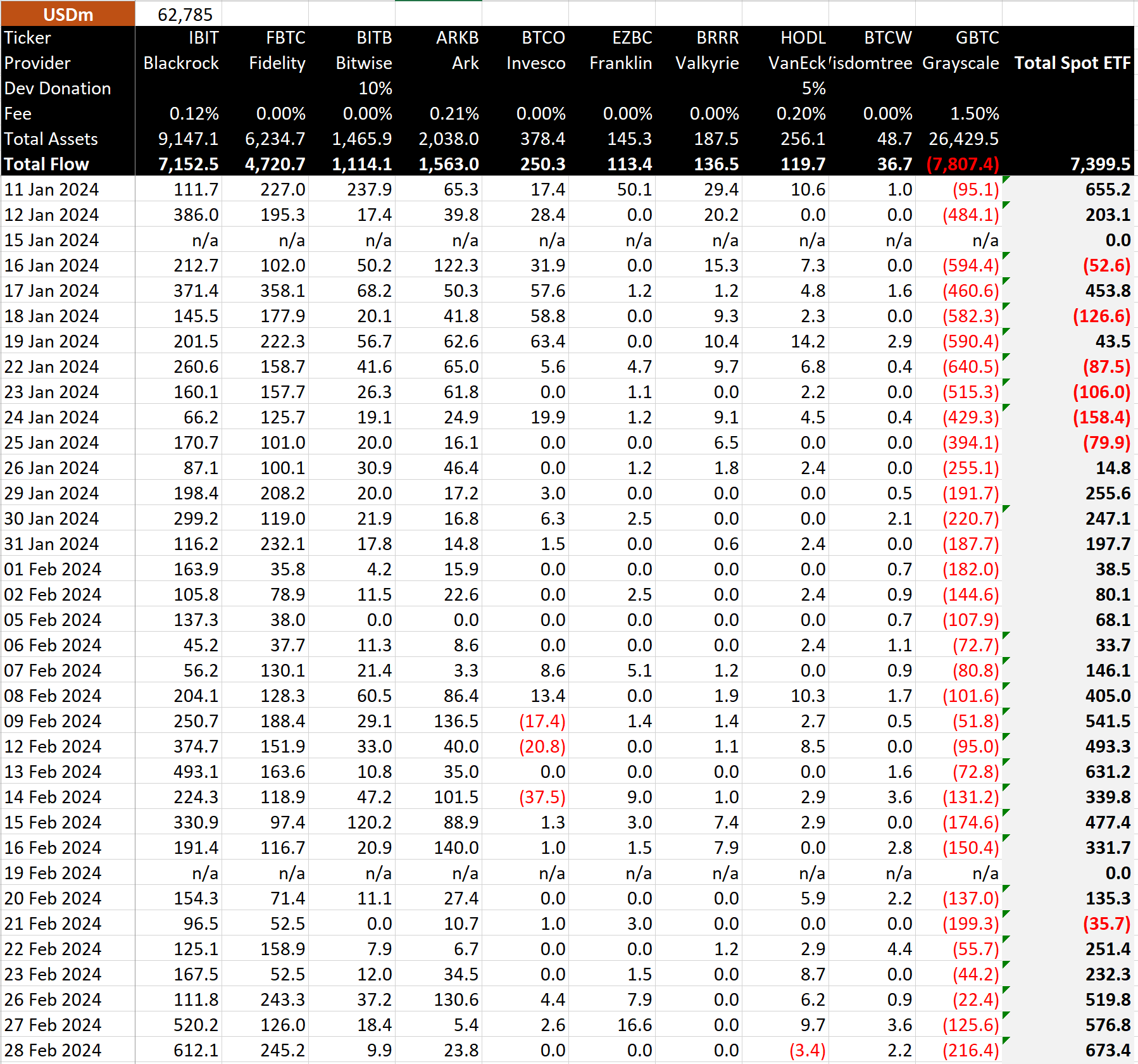

Spot Bitcoin exchange-traded funds (ETF) witnessed $673 million net inflow on February 28, according to data by Bloomberg and BitMEX Research. This was the largest inflow since the U.S. SEC approved spot Bitcoin ETFs in January, said Bloomberg ETF analyst James Seyffart. All spot Bitcoin ETFs recorded massive trading volumes of $8 billion, with BlackRock leading the pack.

BlackRock iShares Bitcoin ETF (IBIT) recorded $612 million, breaking its largest inflow to date record. IBIT also shattered its trading volume record of $1.3 billion, with $3.2 billion, exceeding the daily trade volume of most large-cap US stocks. Following the latest inflow, BlackRock’s net inflow hit over $7.15 billion and asset holdings jumped over $9 billion.

Fidelity Bitcoin ETF (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF saw $245.2 million and $23.8 million, respectively. Bitwise (BITB), Wisdomtree (BTCW) and other spot Bitcoin ETFs saw marginally low inflows, despite strong sentiment among retail and institutional investors.

Notably, GBTC saw a $216.4 million outflow, an increase from Tuesday’s $125.6 million outflow, indicative of investors exodus due to high fees. Bloomberg senior ETF analyst Eric Balchunas said the daily trading volume of nine new spot Bitcoin ETFs except GBTC destroyed the old record as FOMO drives strong BTC price rally above $63K.

Vaneck Bitcoin Trust ETF (HODL) also joins GBTC in outflows, witnessing a $3.4 million outflow.

Also Read: Bitcoin ETF Trading Volumes Double At $6 Billion, $70,000 BTC Price Coming?

BTC Price Moving Towards $70,000

As reported by CoinGape earlier, Wall Street investors are poring money into Bitcoin ETFs as both Bitcoin and Ethereum ROI are higher than oil, stock exchanges, gold, and other assets.

Meanwhile, Crypto Fear & Greed Index has reached a 4-year high near 80, with the market sentiment currently in the ‘Extreme Greed’ zone.

BTC price skyrocketed over $63,000, less than a few percent away from the $68.7K high established 27 months ago. The 24-hour low and high are $57,093 and $63,913, respectively. Furthermore, the trading volume has increased by 150% in the last 24 hours, indicating a rise in interest among traders.

Futures and options open interests (OI) rising to record levels, with total options OI rising over 8% to $33.79 billion, as per Coinglass data. FOMO continues to push Bitcoin price to $100K prediction by multiple experts despite sky-high funding rates.

Also Read: Bitcoin Surge Triggers Record Funding Rates on Binance and OKX

- Bitwise, Granitshares Eyes $63B Sector With New Prediction Markets ETF Filing

- Breaking: Grayscale Sui Staking ETF to Start Trading on NYSE Arca Today

- Prediction Market Lawsuit: Nevada Targets Kalshi in Court After Action Against Polymarket

- Robinhood to Raise $1B IPO to Open Private Markets to Retail Investors

- Elemental Royalty Becomes First to Pay Dividends in Tether’s Tokenized Gold XAUT

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k