Bitwise Files for spot Solana ETF, Joining VanEck and Canary Capital In The Race

Highlights

- The spot Solana ETF filing coincides with rising anticipation that regulatory policies under the Trump administration.

- The Solana bulls are eyeing for a breakout above $240 SOL price to continue rally to $300.

- Beyond Solana, demand for ETFs tied to assets like XRP, Hedera (HBAR), and Dogecoin (DOGE) is increasing.

On Wednesday, asset manager Bitwise became the latest to submit its documents in filing a spot Solana ETF. The filing shows that the asset manager is in the race with other players like Canary Capital and VanEck, looking to bring SOL ETFs to the market. The filing comes just as the SOL price is less than 10% away from hitting a fresh all-time high.

Bitwise Files for Spot Solana ETF

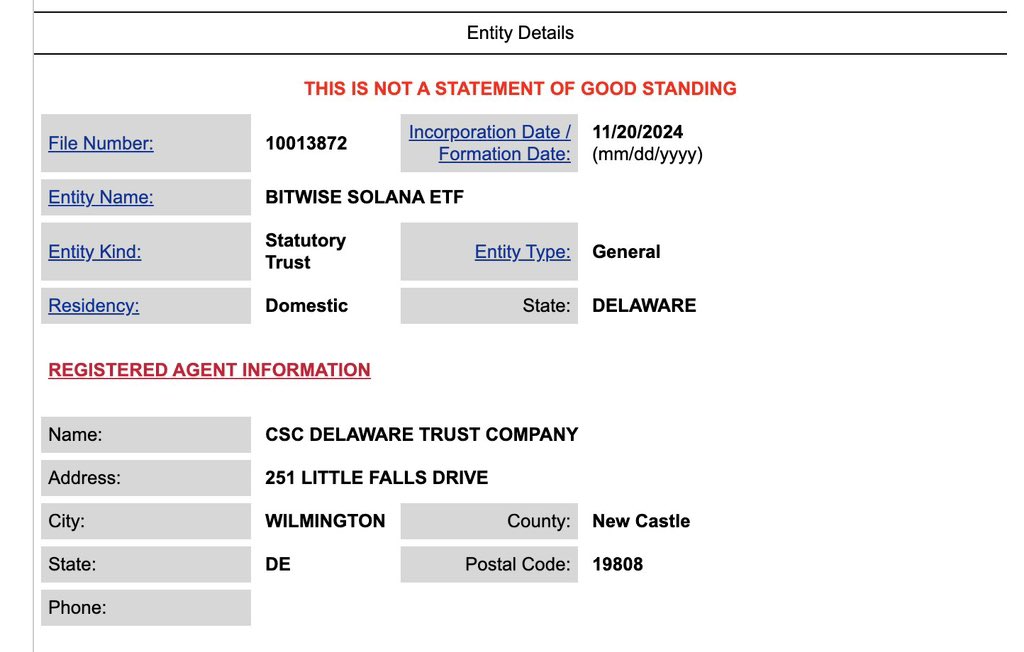

According to the State of Delaware’s Division of Corporations website, Bitwise has currently registered a statutory trust for its proposed Solana exchange-traded fund (ETF). Notably, this is just registration and the asset manager needs to do more groundwork filings with the U.S. Securities and Exchange Commission (SEC).

To join VanEck and Canary Capital in Solana ETF race, Bitwise needs to submit the 19b-4 and S-1 forms to the US SEC. However, the asset manager has been steadfast in its approach to crypto ETFs, with Bitcoin ETF (BITB) and Ethereum ETF (ETHW) already trading on Wall Street. Last month, the asset manager filed for the spot XRP ETF.

With Donald Trump set to take charge of the White House in January 2025, the euphoria for spot Solana ETF has increased tremendously. Under the Trump administration, there’s renewed hope for a crypto regulatory framework and more clarity. The Trump-Vance transition team is holding discussions with crypto industry players to set up a White House post that will look into crypto policies.

Demand Grows for XRP, HBAR, DOGE ETF

Citing this wave of developments in the crypto ETF space, ETF Store President Nate Geraci said that there are ongoing spot ETF filings for several major cryptocurrencies, including Solana (SOL), Ripple’s XRP, and Hedera (HBAR). Last week, Canary Capital submitted the first filing for a spot HBAR ETF.

He also speculated that ETF issuers could expand their offerings further to other assets like Cardano (ADA) and Avalanche (AVAX). Commenting on this, Bloomberg’s senior ETF analyst Eric Balchunas stated that he expects a DOGE ETF filing to arrive by December 31, 2024. This comes amid the mega Dogecoin price rally so far in November.

12/31 feels like a good over/under date for Doge filing

— Eric Balchunas (@EricBalchunas) November 21, 2024

The Solana price remained firm at its crucial resistance level of $240. Market analysts are predicting a new all-time high for SOL with a rally past $300 by the year-end. Currently, it’s a tough fight between the bulls and the bears, as the market awaits another catalyst for further rally amid anticipation for spot Solana ETF.

- Tom Lee’s Bitmine Doubles Down on Ethereum With $34.7M Fresh Purchase

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?