Circle Stock Surges 123% As Stablecoin Firm Goes Public on NYSE

Highlights

- Circle goes public on the NYSE after its IPO raised over $1 billion for the company.

- The USDC issuer will trade under the ticker 'CRCL.'

- The CRCL stock opened at $69, 123% above the IPO price of $31 and had to be halted due to volatility.

- Circle CEO Jeremy Allaire said that they are just starting to realize their vision while reflecting on this milestone for the company.

Stablecoin issuer Circle has finally gone public following its successful initial public offering (IPO), which beat expectations. The USDC issuer’s stock, CRCL, will trade on the New York Stock Exchange (NYSE), marking a huge milestone for the company. The Circle stock opened at $69, up 123% above the IPO price of $31.

Circle Stock Opens at $69 as USDC Issuer Goes Public

In an X post, the stablecoin issuer announced that it is now officially a public company on the NYSE under the ticker ‘CRCL.’ The company noted that, with USDC, EURC, Circle Payments, and more, it is pushing forward a future of “frictionless value exchange.”

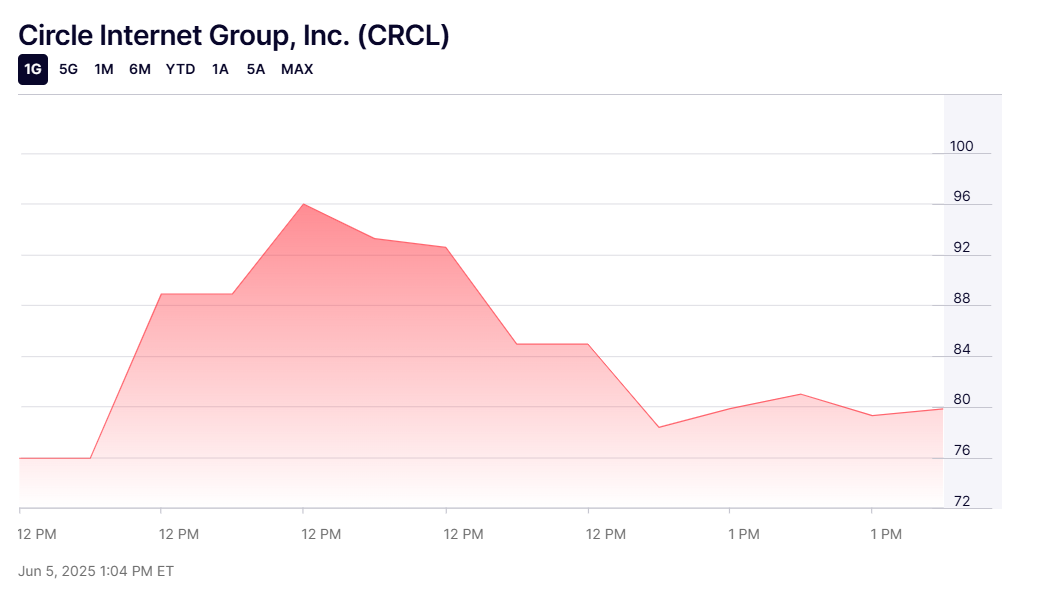

The Circle stock opened at $69, up 123% from the IPO price. Stock trading eventually halted due to volatility as the stock jumped 145% in the first few minutes of opening.

This development follows a recent CoinGape report, which revealed that the Circle IPO could price above the market range. The orders the firm received were 25 times more than the shares available in the public offering. The stablecoin issuer eventually increased the IPO price to $31 and raised over $1 billion in the process.

As part of the public Circle stock listing announcement, the firm declared that it is not just building financial products, but also building the money layer of the internet. The company also thanked everyone who contributed to this moment.

The Company’s CEO Reflects On This Milestone

In an X post, Circle’s CEO, Jeremy Allaire, also reflected on this moment as his company goes public. He remarked that they set out to build a company that could help remake the global economic system by re-imagining and rebuilding it from the ground up, natively on the internet.

He further stated that their mission to raise global economic prosperity has animated their work since then. Allaire also revealed that when they founded the company, he told everyone that it was a multi-decade opportunity and that he sought to build a deeply lasting internet technology platform. Now, over a decade later, the Circle CEO is confident that they are just starting to realize their early vision.

The company’s IPO generated a lot of interest from Wall Street giants like Cathie Wood’s Ark Invest and Larry Fink’s BlackRock. As CoinGape reported, Ark Invest showed interest in acquiring up to $150 million of the IPO shares.

In an X post, Coinbase congratulated its long-time partner Circle on the IPO day. The top crypto exchange stated that the stablecoin issuer’s opening bell rings for all of crypto this morning, adding, “slowly, then all at once.” Strategy co-founder Michael Saylor also congratulated the stablecoin firm.

Congratulations, Jeremy — to you and the entire $CRCL team.

— Michael Saylor (@saylor) June 5, 2025

Update: The Circle stock surged to as high as $95, a gain of over 200%, and is now trading at around $80. Stock trading has resumed after being halted three times.

- Tom Lee’s Bitmine Doubles Down on Ethereum With $34.7M Fresh Purchase

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?