Stacks (STX) Skyrockets 15% As STX20 Inscription Minting Causes Network Congestion

Bitcoin layer for smart contracts Stacks recording a massive increase in the number of transactions in the last few hours, similar to the Bitcoin blockchain amid Ordinals inscriptions activity. Today, the Stacks block 132,377 contained 10,371 transactions, the highest ever transaction count in a block in Stacks history. As a result, STX price pumps over 10%.

Stacks Records 10,371 Transactions In A Single Block

As per the data obtained from Stacks explorer, it was revealed that Stacks contained a total of 10,371 transactions within block 132,377 on December 18. A few hours ago, Stacks blockchain recorded 8000 transactions in a block.

The move comes after degens take over the chain driving higher the STX20 inscription minting activity. The rising STX20 inscription minting activity is also leading to higher fees and congestion on the network.

Stacks stated the project brings Ordinals and Stacks closer. However, it flagged that the network is recording increased fees and likely congestion as a result.

In addition, Bitcoin blockchain is also witnessing congestion and high fees. Several contributors reached out to the team and offered support for possible increased efficiencies for their users and the network.

“It’s clear that building on Bitcoin is growing and while it might be a little painful at the moment, this is one more reason to be excited about Nakamoto!”

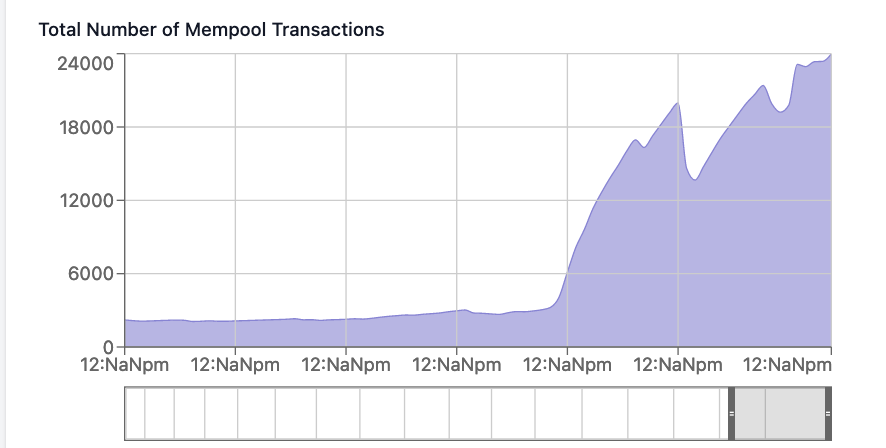

Stacks mempool experiencing unusual surge with mempool transactions jumping from below 6,000 to 24,000 amid STX20 inscription minting.

Also Read: Veteran Investor Shifts Bitcoin (BTC) Price Forecast From $100K To $200K

STX Price Pumps 15%

STX price jumped 15% in the past 24 hours, with the price currently trading at $1.15. The 24-hour low and high are $1.00 and $1.15, respectively. Furthermore, the trading volume has increased by more than 170% in the last 24 hours, indicating a rise in interest among traders.

The price has pumped 30% in a week and almost 90% in a month. Analysts expect a further rise in price amid increase in trading volumes.

Also Read: FTX Plans to End Bankruptcy Soon, Return Billions to Creditors

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise