Breaking: Michael Saylor’s Strategy Adds 705 Bitcoin For $75M, MSTR Stock Rebounds

Highlights

- Strategy acquired 705 BTC between May 26 and June 1.

- The company now holds 580,955 BTC.

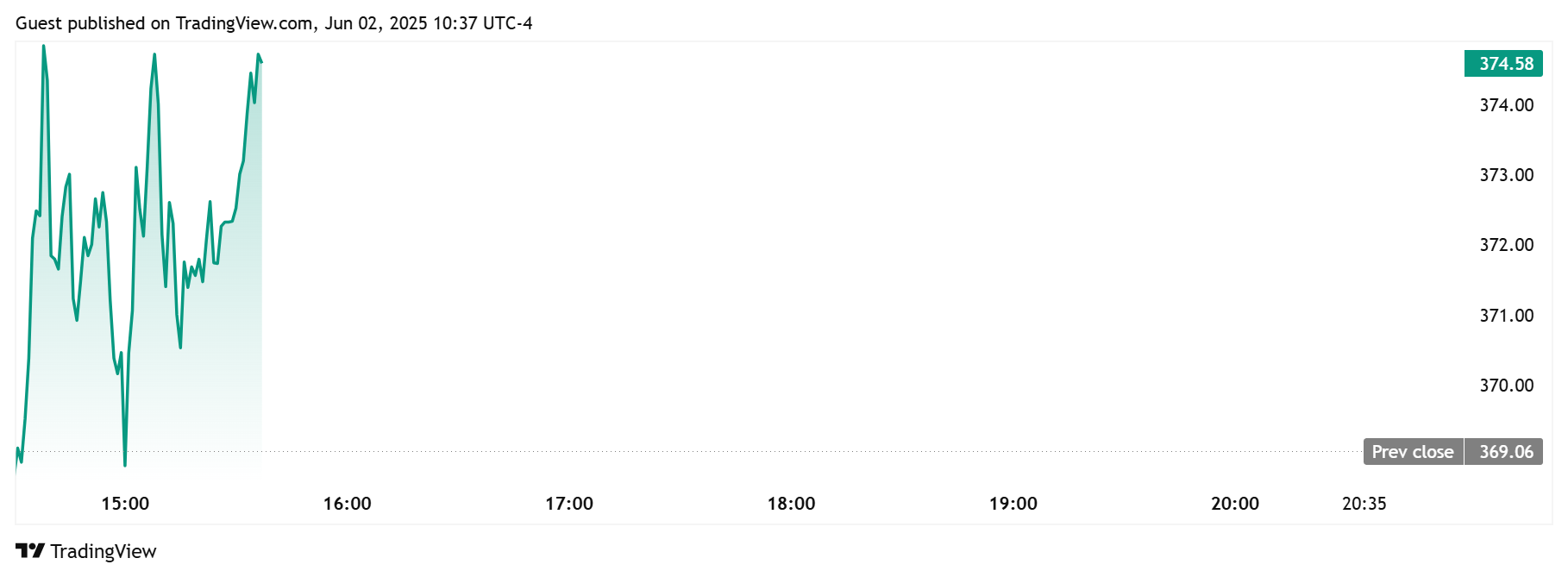

- The MSTR is down almost 1% from last week's closing price of $369.

Strategy, previously known as MicroStrategy, made another Bitcoin purchase between May 26 and June. The company bought 705 BTC for $75 million, bringing its total holdings to 580,955. The MSTR stock price remained unchanged following the announcement but has now rebounded at the open of today’s trading session.

Strategy Acquires 705 BTC, MSTR Stock Rebounds

In a press release, Michael Saylor’s company revealed that it has purchased 705 BTC for $75.1 million at an average price of $106,495 per bitcoin. The company has also achieved a BTC yield of 16.9% year-to-date (YTD).

This latest purchase brings Strategy’s Bitcoin holdings to 580,955 BTC, which it acquired for $40.68 billion at an average price of $70,023 per Bitcoin. As CoinGape reported, Michael Saylor had yesterday signaled another Bitcoin purchase when he posted the company’s BTC portfolio tracker.

This is the company’s eighth consecutive weekly purchase. Last week, it acquired 4,020 BTC for $427 million at an average price of $106,237 per Bitcoin. Meanwhile, despite this recent purchase, the MicroStrategy stock is in the red.

Nasdaq data showed that the MSTR stock price dropped almost 1% in pre-market trading, trading at around $366. The stock had closed out last week in the red, trading at around $369. However, the stock has rebounded at the open to today’s market, up almost 2%.

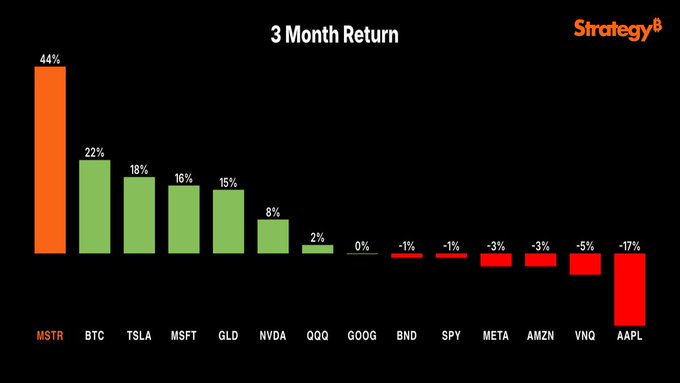

However, the stock is still up over 27% YTD and 126% in the last year. In an X post, Saylor highlighted how the Bitcoin move has worked out well for Strategy, stating, “Your portfolio needs a Strategy.”

He shared an image that showed MSTR has enjoyed the most returns over the last three months among major assets, including Bitcoin. During this period, the MicroStrategy stock has recorded a gain of 44% while BTC is up 22%. The closest stock, TSLA, is up 18% during this period.

Saylor’s company is expected to keep accumulating more BTC in the foreseeable future. As CoinGape reported, the company recently announced plans to raise $2.1 billion for more Bitcoin purchases.

Meanwhile, Saylor recently spoke up against the idea of a proof-of-reserve for the company’s Bitcoin holdings, citing vulnerabilities that it can expose them to. However, following his comments, the on-chain analytics platform Arkham traced and identified wallets holding their BTC holdings.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Gold vs. Bitcoin: Can Gold Outperform BTC Amid US–Iran Conflict?

- Bitcoin Faces $1.8B in Panic Selling as U.S.-Iran Airstrikes Escalate; Will BTC Crash Below $60k?

- Gold ETF vs Tokenized Gold: Who Could Outperform in 2026?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs