Breaking: Michael Saylor’s Strategy Adds 1,955 Bitcoin Amid S&P 500 Snub; MSTR Stock Falls

Highlights

- Strategy bought 1,955 BTC between September 2 and 7.

- The company now holds 638,460 BTC.

- The MSTR Stock is down amid this development.

Strategy, previously MicroStrategy, has announced another weekly Bitcoin purchase, despite failing to make the S&P 500 last week. This comes as the Bitcoin price rebounds, breaking above $112,00 today, although the MSTR stock is still down in premarket trading.

Strategy Acquires 1,955 BTC For $217 Million

In a press release, the company announced that it had acquired 1,955 BTC for $217.4 million last week at an average price of $111,196 per Bitcoin. It has also achieved a BTC yield of 25.8% year-to-date (YTD) and now holds 638,460 BTC, which it acquired for $41.17 billion at an average price of $73,880 per Bitcoin.

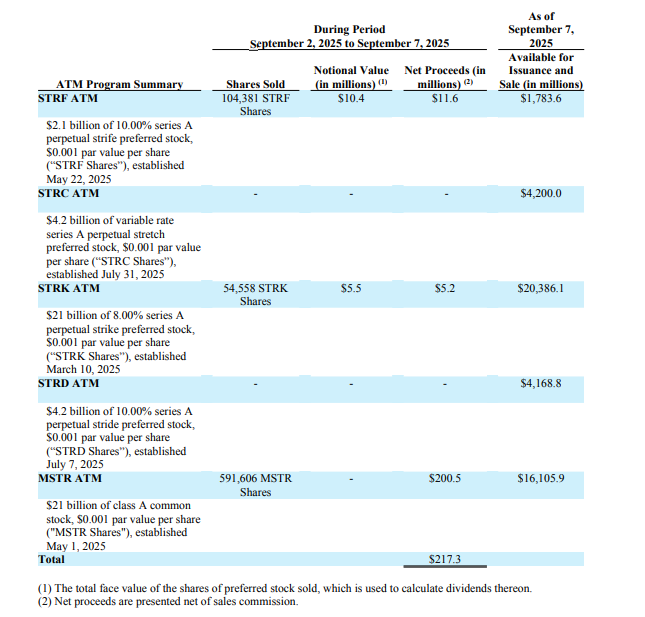

The SEC filing shows that Strategy again mainly sold MSTR shares to fund this purchase. The company raised $200.5 million from the sale of 591,606 MSTR shares and an additional $11.6 million and $5.2 million from the sale of STRF and STRK shares.

Notably, this latest purchase comes amid the company’s failure to make the S&P 500 last week. It had met all the criteria for a potential inclusion in the stock index. However, the Committee picked Robinhood, AppLovin, and Emcor over Michael Saylor’s company.

Meanwhile, Saylor had hinted about the purchase yesterday in his conventional X post. He shared a picture of Strategy’s Bitcoin portfolio tracker, with the caption, “Needs More Orange,” which indicated a new purchase.

Needs More Orange pic.twitter.com/yvgqvmKtOb

— Michael Saylor (@saylor) September 7, 2025

This marks the company’s sixth consecutive weekly Bitcoin purchase. Last week, it announced a purchase of 4,048 BTC for $444 million. It is worth noting that Strategy now holds over 3% of BTC’s total supply with these latest purchases.

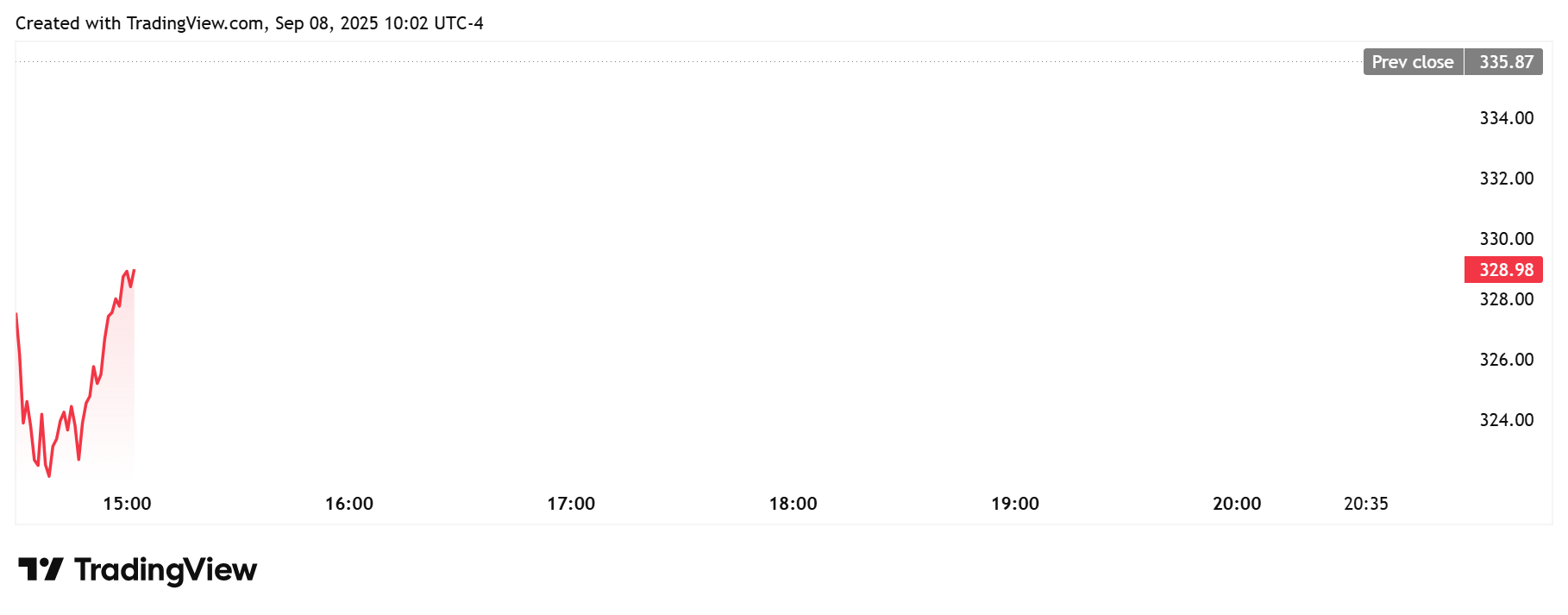

MSTR Stock Down Over 2%

The Strategy stock is down over 2% today amid the announcement of this latest Bitcoin purchase. TradingView data shows that the stock is currently trading at around $327, down from last week’s close of $335.

The MSTR stock had dropped following the S&P 500 Committee’s decision, which came in after trading hours on Friday. Notably, the stock traded flat last week but is down over 10% in the last month.

This coincides with the start of when Saylor’s company restarted selling MSTR shares to fund BTC buys, reneging on an earlier promise not to use the common stock to buy shares when the mNAV is below 2.5x.

Meanwhile, the drop in the Strategy stock has occurred despite the rebound in the Bitcoin price today. BTC climbed above $112,000 today, but MSTR has yet to react positively to this despite the correlation between both assets due to the company’s Bitcoin exposure.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs