Breaking: Strategy Buys 196 Bitcoin as Michael Saylor Says ‘Always Be Stacking’

Highlights

- Strategy bought 196 Bitcoin between September 22 and 28.

- This marks the company's ninth consecutive Bitcoin purchase.

- The MSTR stock is up almost 2% amid this development.

Strategy, previously MicroStrategy, has announced another weekly Bitcoin purchase, despite the decline in the flagship crypto and MSTR stock. The company’s co-founder, Michael Saylor, has already suggested that they plan to continue ‘stacking’ more BTC, even if it comes at the expense of their stock.

Strategy Acquires 196 BTC For $22 Million

In a press release, the company announced that it had acquired 196 BTC for $22.1 million at an average price of $113,048 per Bitcoin. It now holds 640,031 BTC, which it acquired for $47.35 billion at an average price of $73,983 per Bitcoin.

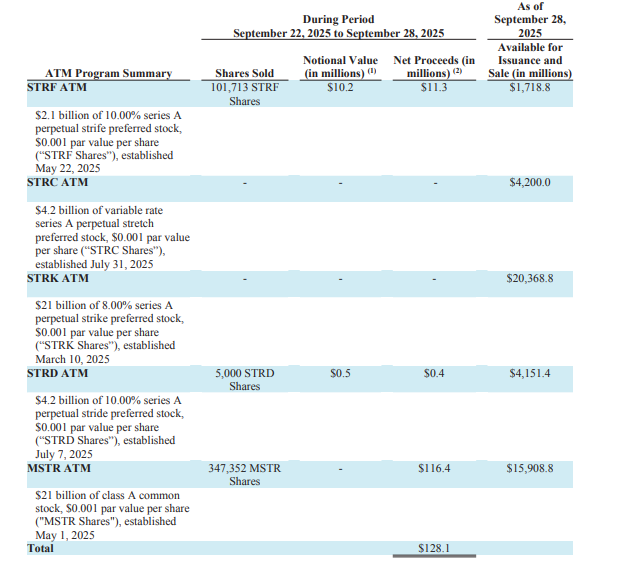

Strategy again sold MSTR shares alongside STRF and STRD shares to fund this BTC purchase. It raised $116.4 million, $11.3 million, and $400,000 from the sales of these stocks, respectively, but only used $22 million of the net proceeds to buy Bitcoin.

Michael Saylor had hinted about the purchase yesterday in his conventional Sunday X post. This time around, he simply said, “Always ₿e Stacking,” indicating that they had bought more BTC during the week and possibly alluding to their plans to keep buying more BTC despite the current market conditions.

Always ₿e Stacking pic.twitter.com/XMT5rA0DYL

— Michael Saylor (@saylor) September 28, 2025

Notably, this marks Strategy’s ninth consecutive weekly Bitcoin purchase, with the most recent ones coming amid the decline in the Bitcoin price and MSTR stock. Saylor and his company have also made these purchases despite criticism about how they turned back on their word not to sell the common stock to fund BTC purchases with the mNAV at the current level.

MSTR Pare YTD Gains To 3%

Amid these purchases, MSTR has almost all its year-to-date (YTD) gains, currently boasting a YTD gain of just 3%. The stock had risen to as high as $455 earlier this year but is now trading just above $300.

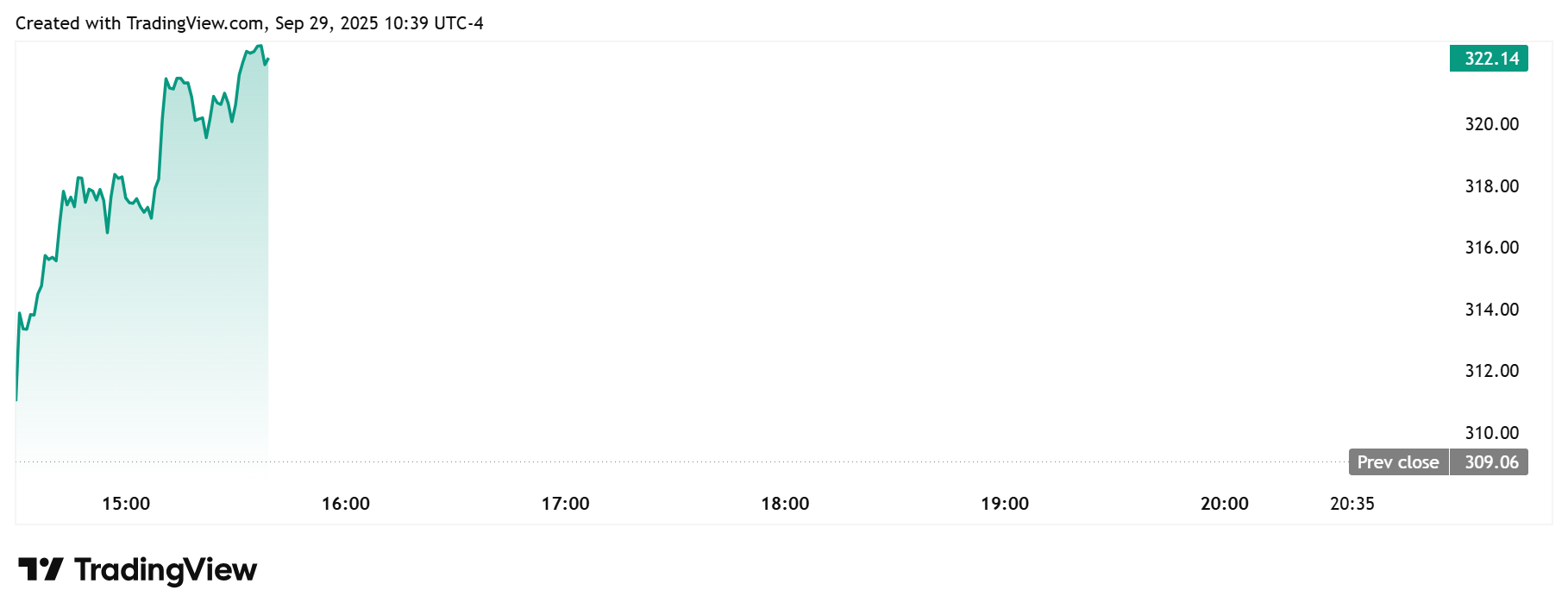

As CoinGape reported, the Strategy stock had dropped below $300 last week, following Bitcoin’s decline to around $108,000. However, it has since bounced alongside BTC, with the stock closing last week at around $309.

Meanwhile, TradingView data shows that the MSTR stock is up almost 2% today from its last week’s close. The stock is currently trading at around $314, with these gains coinciding with Bitcoin’s break above $112,000 today.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs