Breaking: Strategy (MSTR) Buys $26M in Bitcoin While Stock Price Slips 2%

Highlights

- Strategy made its 11th consecutive weekly Bitcoin purchase between June 16 and 22.

- It now holds 592,345 BTC with the $26 million Bitcoin purchase.

- This is the company's second smallest BTC purchase this year.

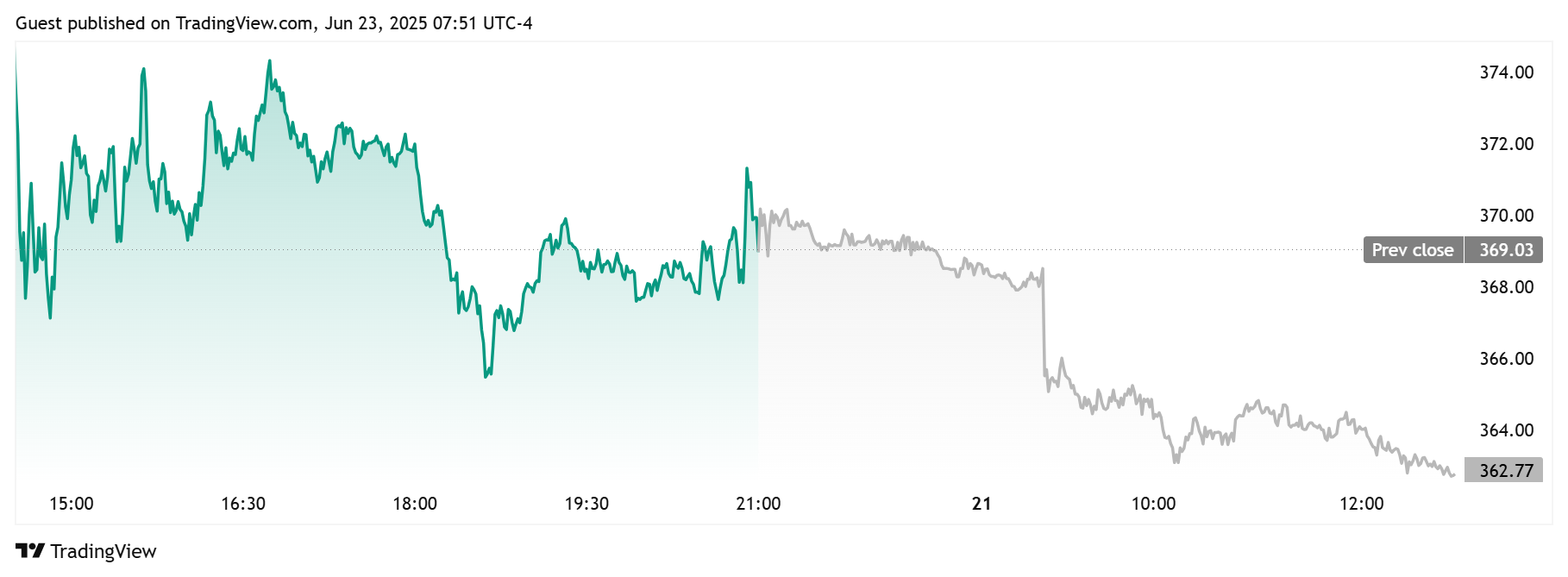

- The MSTR stock is down almost 2% in premarket trading.

Strategy, formerly MicroStrategy, isn’t relenting on its Bitcoin acquisition plans despite the recent bearish price action. Michael Saylor’s company has bought the dip, marking its eleventh consecutive weekly BTC purchase. Meanwhile, the MSTR stock has dropped, down around 2% in premarket trading.

Strategy Acquires 245 BTC For $26 Million

In a press release, the company announced that it acquired 245 BTC for $26 million at an average price of $105,856 per Bitcoin. It has also achieved a BTC yield of 19.2% year-to-date (YTD). The firm now holds 592,345 BTC, which it acquired for $41.87 billion at an average price of $70,681 per BTC.

Notably, this is Strategy’s second-smallest Bitcoin purchase this year. The company made its smallest purchase earlier in March when it bought 130 BTC for $10.7 million.

In his usual fashion, Michael Saylor had yesterday hinted that they had made another Bitcoin purchase when he posted Strategy’s Bitcoin portfolio tracker. This purchase comes despite the Israel-Iran conflict, which caused Bitcoin to drop below $100,000 for the first time in 45 days.

However, Strategy and Saylor continue to show that they are unbothered by the dip, as they continue to accumulate more Bitcoin at an unprecedented scale. Saylor recently reaffirmed his confidence in the flagship crypto by predicting that BTC will reach $21 million in 21 years.

Amid the announcement of the latest purchase, the MicroStrategy stock is down along with Bitcoin. TradingView data shows that the MSTR stock price is down around 2% in premarket, trading at around $363.

Thanks to its recent decline, MSTR has shed some of its YTD gains and is now up just over 27% since the year began. However, the Strategy stock is still up over 169% this past year, according to MarketWatch data.

It is worth noting that the latest purchase is the company’s eleventh consecutive weekly purchase. Another weekly purchase this week will tie the firm’s record of twelve consecutive weekly Bitcoin purchases, which it made between November last year and early February this year.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

Buy $GGs

Buy $GGs