Breaking: Strategy Grabs 3% of Bitcoin Supply With 3,081 BTC Buy, MSTR Stock Sinks

Highlights

- Strategy acquired 3,081 Bitcoin between August 18 and 24.

- It now holds over 3% of Bitcoin's supply.

- Michael Saylor had hinted about the purchase yesterday.

- The MSTR stock is down over 4%.

Strategy, previously Strategy, has announced its fourth consecutive weekly purchase, as it continues to widen the gap between it and other Bitcoin treasury companies. This comes at a time when the MSTR stock continues to reach new lows, alongside the Bitcoin price, which is on a decline.

Strategy Adds More BTC To Bitcoin Treasury

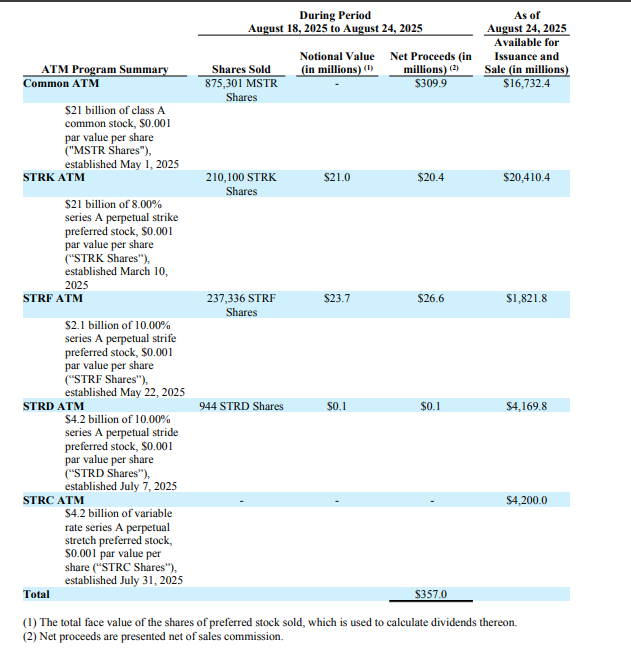

In a press release, the company announced that it had acquired 3,081 BTC for $356.9 million at an average price of $115,829 per Bitcoin, achieving a BTC yield of 25.4% year-to-date (YTD). It now holds 632,457 BTC, which it acquired for $46.50 billion at an average price of $73,527 per bitcoin.

With this latest purchase, Strategy now holds just over 3% of Bitcoin’s total supply of 21 million. Notably, the company funded the purchase with mainly MSTR stock sales just one week after it said that it wouldn’t sell the common stock to buy BTC when the mNAV is below 2.5x.

Meanwhile, this follows Michael Saylor’s hint yesterday about another Bitcoin purchase. The Strategy co-founder posted the company’s BTC portfolio tracker and declared that “Bitcoin is on sale.”

Bitcoin is on Sale pic.twitter.com/azJIYk2xDe

— Michael Saylor (@saylor) August 24, 2025

This marks the company’s fourth consecutive weekly Bitcoin purchase. Last week, the company announced a 430 BTC purchase for $51.4 million. This was also when Strategy issued a new guidance on how they intend to raise capital using the MSTR stock. The company revealed it will only actively sell its common stock to buy BTC when the mNAV is above 4.0x.

MSTR Stock Sinks Over 4%

The MSTR stock continues to struggle amid this latest purchase. TradingView data shows that the stock is down over 4% in today’s trading session, trading at around $343 from last week’s close of $358.

As a result, the Strategy stock has pared its year-to-date gains and is now just up around 19% since the start of the year. Meanwhile, the stock is down over 15% in the last month.

Despite this setback for the MSTR stock, individuals like pro-crypto lawyer John Deaton are still bullish on Saylor’s company and the stock’s trajectory. He predicted that the stock could reach $500 as the Bitcoin price rallies to as high as $250,000 within the next year.

- Breaking: CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29

- White House to Hold CLARITY Act Meeting With Ripple, Coinbase, Banks Today

- Senator Warren Warns Fed Against Bitcoin Crash Rescue Amid Liquidity Pump Claims

- Top 5 Reasons Ethereum Price Is Down Today

- Crypto Market Slides as Hawkish FOMC Minutes Trigger BTC, ETH, XRP Sell-Off

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum