Strategy Makes It 10/10 With 10,100 Bitcoin Purchase, MSTR Stock Rebounds

Highlights

- Strategy made another Bitcoin purchase between June 9 and 15, acquiring 10,100 BTC.

- This is the company's tenth consecutive weekly Bitcoin purchase.

- Saylor's Strategy now holds 592,100 BTC which it acquired for $41.84 billion.

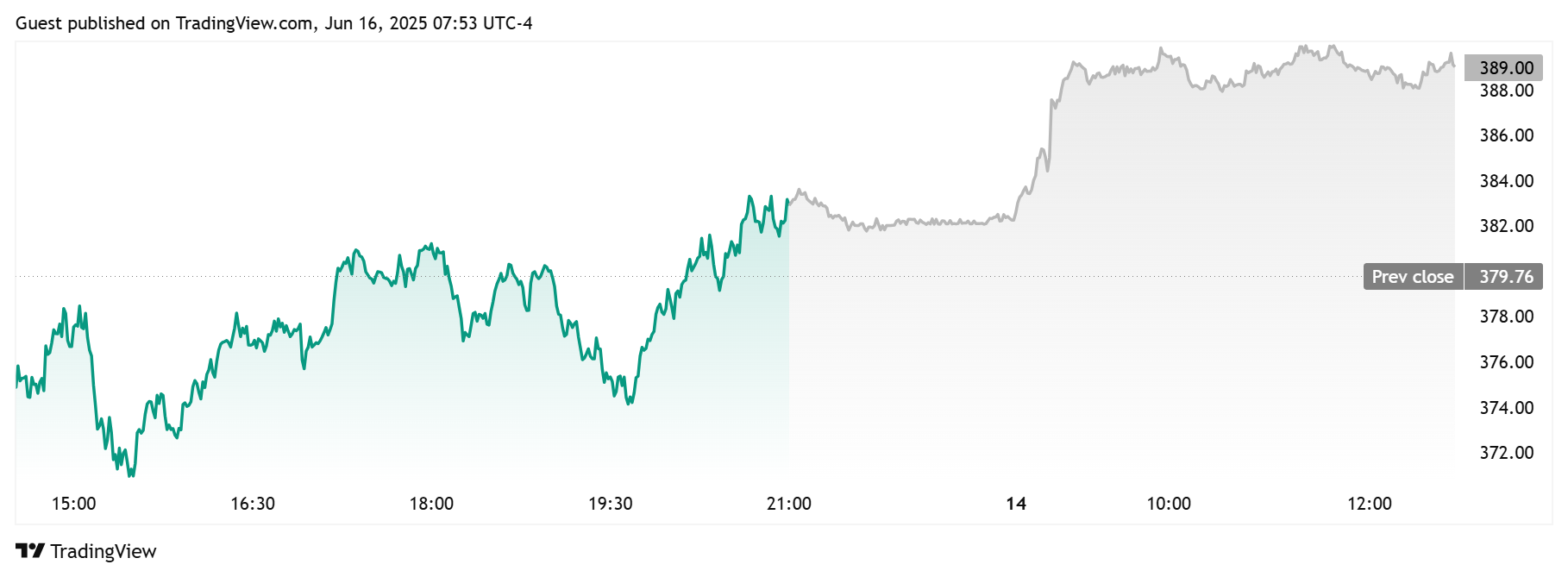

- The MSTR stock has rebounded almost 2% in pre-market trading.

Strategy, previously known as MicroStrategy, has announced another Bitcoin purchase worth just over $1 billion, which it made between June 9 and 15 last week. This marks the tenth consecutive weekly purchase for the BTC Treasury company. Meanwhile, the MSTR stock price has rebounded amid this announcement.

Strategy Acquires 10,100 for $1.05 Billion

In a press release, the company announced that it acquired 10,100 BTC for $1.05 billion at an average price of $104,080 per Bitcoin. It has also achieved a BTC yield of 19.1% year-to-date (YTD). The firm now holds 592,100 BTC, which it acquired for $41.84 billion at an average price of $70,666 per BTC.

The company’s co-founder, Michael Saylor, had hinted about another BTC purchase yesterday, when he flashed Strategy’s Bitcoin portfolio tracker. Meanwhile, this marks the company’s tenth consecutive purchase, dating back to mid-April. The longest documented streak is 12 weeks, when it bought BTC every week between November 2024 and early February.

Bigger Dots are ₿etter pic.twitter.com/vm1UItzmRb

— Michael Saylor (@saylor) June 15, 2025

Last week, the company announced it had acquired 1,045 BTC for $110 million. The STRD stock also went live on Nasdaq last week, with Saylor’s firm raising almost $1 billion, which it plans to use to acquire more BTC.

TradingView data shows that the MSTR stock price has rebounded almost 2% in pre-market trading today, as it looks to reclaim the psychological $400 level.

MarketWatch data shows that the MicroStrategy stock is up over 30% in the last three months and year-to-date. Meanwhile, the stock is up over 154% in the last year.

In a recent X post, Saylor indicated that his company has no intention of slowing down on its Bitcoin Strategy, stating that their business is 100% BTC. However, Peter Schiff has warned MSTR shareholders that their biggest regret will be not selling their shares.

Schiff has remained critical of Strategy’s Bitcoin move and has on several occasions predicted an MSTR price crash. In his latest warning, the renowned economist suggested that BTC would soon crash, taking MicroStrategy’s stock down with it.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs