Bullish Trio: SUI, LDO, and XMR Emerge as Top Gainers

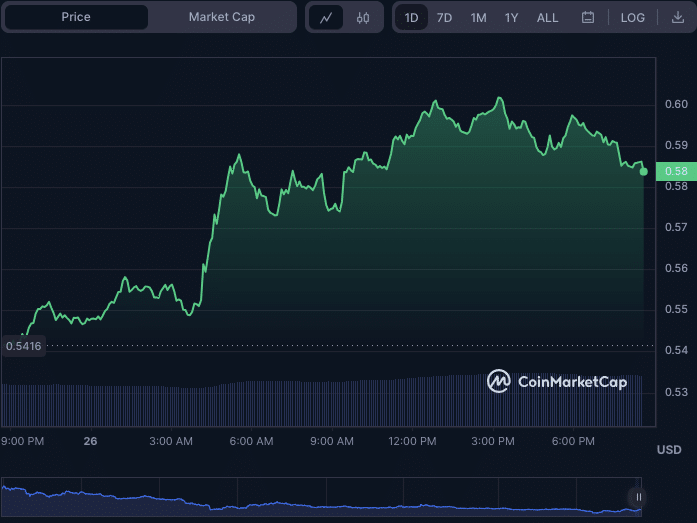

In the past 24 hours, Sui (SUI) bulls have been in control, driving the price from an intraday low of $0.5405 to a 24-hour high of $0.6018. A bullish breakout past the $0.6018 resistance level may set eyes on the next resistance level at $0.6500.

With strong buying pressure and positive market sentiment, SUI has the potential to continue its upward trend and attract more investors. However, a retracement from the current high could see SUI finding support at the $0.5900 level before attempting another rally.

SUI/USD 1-day price chart (source: CoinMarketCap)

At press time, SUI was priced at $0.5837, a 7.88% surge from the intraday low. Consequently, the SUI market capitalization and 24-hour trading volume surged by 7.82% and 18.75% to $422,139,298 and $209,373,794, respectively.

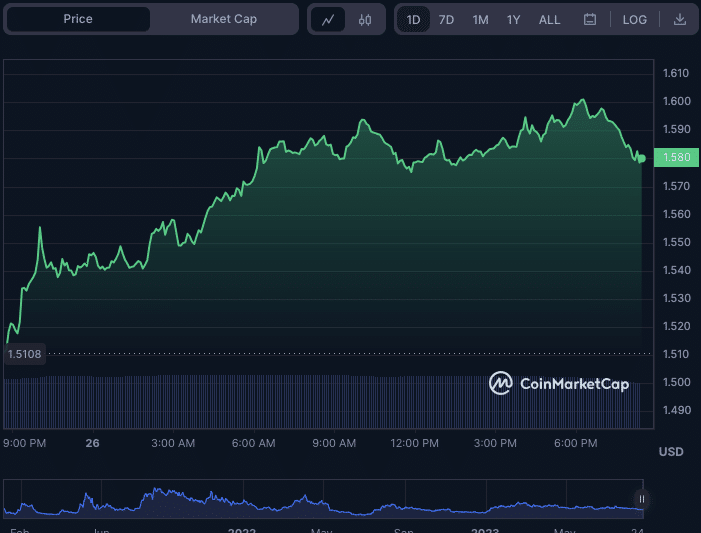

LDO/USD

From a 24-hour low of $1.51, Lido DAO (LDO) bulls swept the bearish momentum under the rug, pushing the price to an intra-day high of $1.60 before retracing slightly to $1.58 at press time. The next resistance level for LDO/USD is around $1.65, while a potential support level could be found at $1.55.

LDO/USD 1-day price chart (source: CoinMarketCap)

LDO’s market capitalization and 24-hour trading volume surged 5.01% and 3.98% to $1,401,856,843 and $62,121,300, respectively. This surge reflects the increasing interest and activity in LDO trading. As the market capitalization and trading volume continue to rise, it indicates growing confidence in LDO as an investment opportunity.

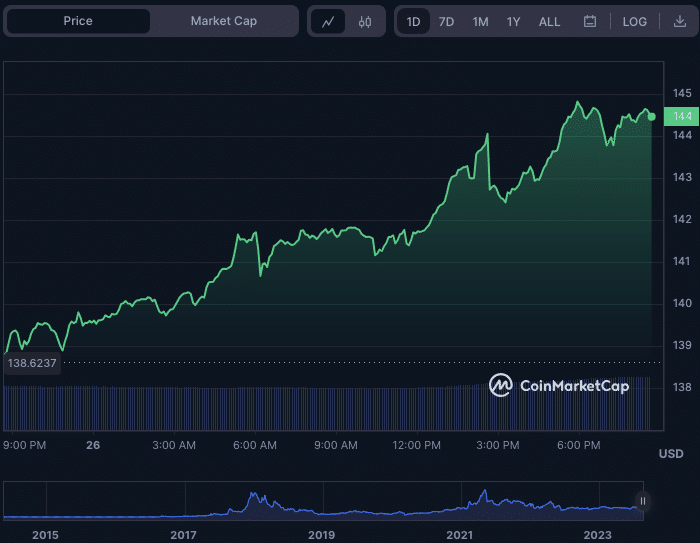

XMR/USD

A bullish reign has prevailed in the Monero (XMR) market, with bulls soaring to a 24-hour high of $144.86 before facing resistance. With bulls setting support at an intra-day low of $138.80, the XMR price has shown resilience and potential for further upward movement.

The market capitalization and trading volume increase in XMR/USD pairs by 4.39% and 22.46% to $2,647,245,247 and $ 77,523,495 further solidifies the bullish sentiment.

XMR/USD 1-day price chart (source: CoinMarketCap)

If the bulls breach the $144.86 resistance, the next resistance level to watch out for would be around $150.00. This level has historically acted as a strong psychological barrier for XMR and could trigger a further surge in buying pressure. However, a break below the support level of $140.00 could indicate a shift in sentiment and lead to a potential downward movement.

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?