Just-In: Terra Luna Classic Dev Submits Major Proposal To Boost Staking, LUNC Price Jumps

Terra Luna Classic developers submitted a joint governance proposal seeking the support of the community and validators on allowing multiple interchain account (ICA) host message types for QuickSilver. The Terra Luna Classic community is actively trying to get LUNC listed for the Quicksilver Protocol. Currently, the proposal is receiving favorable feedback from the community.

Terra Luna Classic Dev Proposes Liquid Staking Derivatives

Developer Parker Lowe submitted a proposal “Allow Various ICA Host Message Types (For QuickSilver)” to Commonwealth and took to Twitter to bring community attention to it. The proposal is signed by Fragwuerdig, Parker Lowe, Rexxaurus, Ohhbilbobaggins, and LuncBurnArmy.

Fragwuerdig said the proposal can massively improve LUNC staking ratio on the Terra Classic chain. CosmoSreXx believes LUNC liquid staking derivatives (LSD) would help bring value to the coin and Terra Luna Classic chain.

“We introduce to the LUNC community our first proposal for liquid staking derivatives with Quicksilver Protocol.”

Excellent proposal 👏

Can massively improve staking ratio on Terra Classic.

Please, read and comment!!! https://t.co/fHbeTc8TJp

— fragwuerdig (@frag_dude) June 24, 2023

According to the proposal, developers seek to change the allowed interchain account host messages to bring QuickSilver support, an interchain liquid staking protocol for the Cosmos ecosystem. This allows the Quicksilver chain to transparently create and control accounts on the Terra Luna Classic chain and execute allowed messages.

It will also allow interchain staking on any validators, as well as maximize liquidity and capital efficiency by improving network security and decentralization. Moreover, it removes the unbonding period wait requirement before a position holder is able to sell his staked assets.

It is similar to liquid staking provider Lido on the Ethereum network, which dominates with almost 30% of all staked ETH tokens.

The governance proposal will open for voting within a week.

Also Read: Terra Classic (LUNC) Dev Teams Proceeds For USTC Repeg To Revive Price To $1

LUNC Price Jumps

LUNc price jumped 3% in the last 24 hours, with the price currently trading at $0.000094. The 24-hour low and high are $0.0000909 and $0.0000948, respectively. Furthermore, the trading volume has increased slightly, indicating a rise in interest.

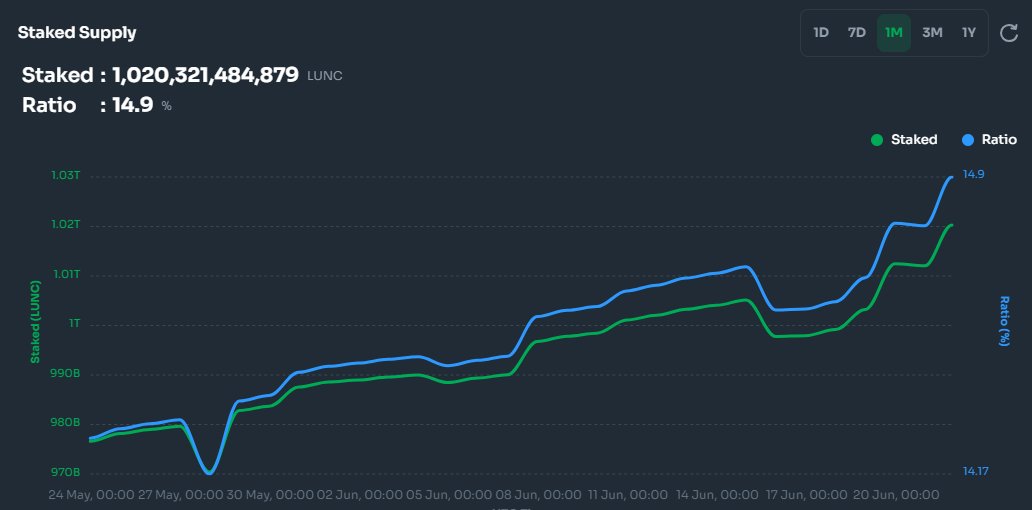

In addition, the rate of LUNC staking on the Terra Classic chain has increased after achieving the 1 trillion milestone, increasing investor confidence in the chain. The stalked supply ratio has reached almost 15%, with 1.02 trillion LUNC staked.

Also Read: BlackRock, Ripple, Nasdaq Among 363 Sales Parties Interested In FTX 2.0

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs