Terraform Labs (TFL) Files For Bankruptcy Protection, LUNA & LUNC Price Slip 7%

Terraform Labs Pte Ltd (TFL), the company behind the TerraUSD (UST) stablecoin that collapsed the cryptocurrency market in 2022, has filed for Chapter 11 bankruptcy in Delaware, United States, according to court papers filed on Sunday. The move comes after a suggestion for bankruptcy was filed in Terraform Labs vs U.S. SEC lawsuit.

Terraform Labs chief executive officer (CEO) said Chris Amani said the move is important for the company and its investors. It will allow them to continue working for goals while resolving the legal challenges that remain outstanding.

Terraform Labs (TFL) Files Bankruptcy

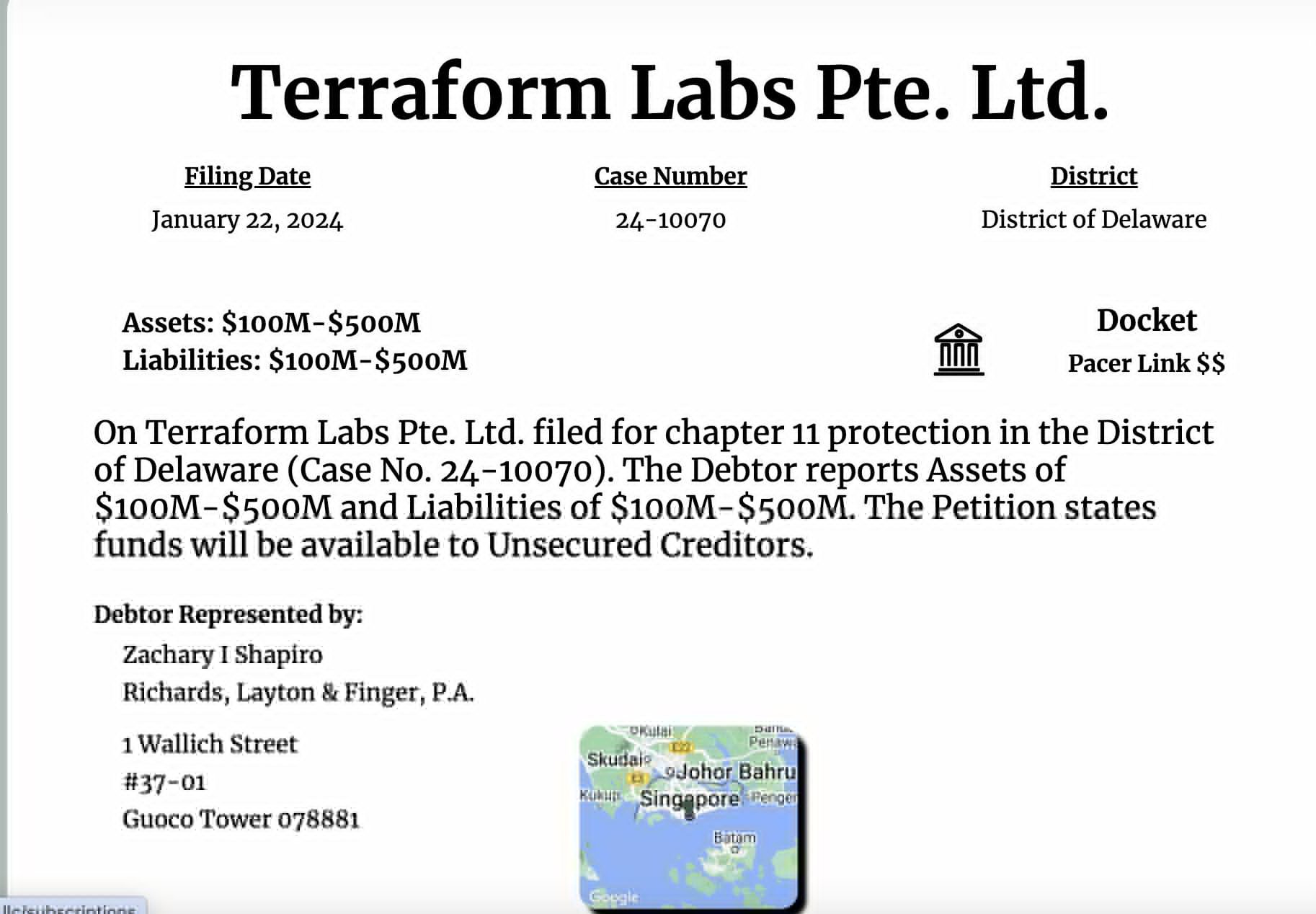

According to documents filed in Delaware bankruptcy court on January 21, Singapore-based Terraform Labs co-founded by Do Kwon filed for Chapter 11 bankruptcy protection.

The company’s estimated assets and liabilities are nearly $100 million to $500 million, as per the court documents. Also, the number of creditors is between 100 and 199. Do Kwon is the majority shareholder with 92% of Terraform Labs. Whereas, South Korean entrepreneur Daniel Shin owns the remaining shares of the Singapore-incorporated company,

“The Terra community and ecosystem have shown unprecedented resilience in the face of adversity, and this action is necessary to allow us to continue working toward our collective goals while resolving the legal challenges that remain outstanding,” said Terraform Labs chief executive officer Chris Amani.

Co-founder Do Kwon and Terraform Labs are indicted on fraud charges, while being sued by the U.S. Securities and Exchange Commission.

In December, Judge Jed S. Rakoff ruled in favor of the US SEC, agreeing that Terraform Labs and Do Kwon sold unregistered securities, violating securities laws. However, the Judge ruled out allegations that the company had made transactions in unregistered security-based swaps. The SEC’s fraud case against Terraform must be tried by a jury.

Also Read: XRP Holder’s Lawyer Slams SEC Lawyers Over Bitcoin (BTC) Statement

Terra (LUNA) tumbled 7% in the last 24 hours, with the price currently trading at $0.61. The 24-hour high and low are $0.611 and $0.666, respectively.

LUNC price fell 7% in the last 24 hours, with the price currently trading at $0.000102. The 24-hour high and low are $0.000102 and $0.000112, respectively. Moreover, trading volume has decreased by 1% in the last 24 hours.

Also Read: 5 Small Cap Coins With 10x-100x Upside Potential

- CLARITY Act Odds Spike to 90% as Coinbase CEO Confirms “Great Progress” On Crypto Bill

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand