Tether Adds $60 Million to its Inventory, USD Stablecoin Supply Rises over $2.5 bln

The stablecoin supply of cryptocurrencies has been in a strong uptrend in March 2020. Last night, $60 million was added to the inventory of Tether, as the firm prepares for issuance of more USDT.

? ? ? ? ? ? 60,000,000 #USDT (59,854,340 USD) minted at Tether Treasury

— Whale Alert (@whale_alert) April 2, 2020

Paolo Ardoino, CTO of Bitfinex and Tether tweeted on the update,

PSA: inventory replenish. Note this is an authorized but not issued transaction, meaning that this amount will be used as inventory for next period issuance requests.

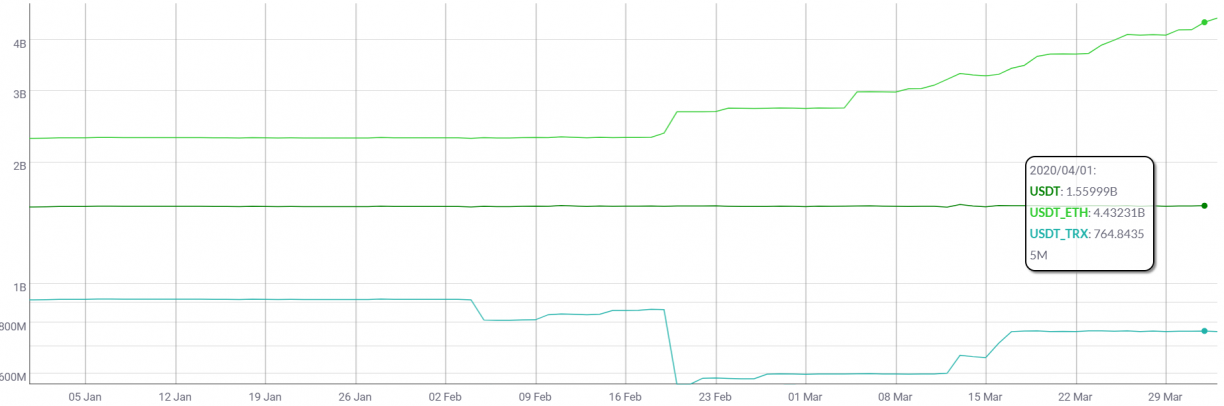

The total liability (asset issued on-chain) has increased to $6.43 billion. As reported only a week earlier, Tether (USDT) supply was at $6.19 billion; it has risen by $240 million since then. Nic Carter, the founder of Coin-metrics tweeted,

Stablecoins collectively tacked on over $2b in March 2020 – by far their best month ever. Nontether stablecoins grew by $500m. Big winners: Tether, USDC, Binance Dollar

As the traders remain in the fear of a downtrend due to the economic slowdown, the increase in stablecoin volume points towards bulls in the future.

In the past as well, the rise in the supply of Tether has acted as a precursor to a bull season in crypto markets. The last time a rise in the supply was witnessed was before the bull run of 2019 in May 2019; USDT increased from $2.56 billion to $3.28 billion in less than a month.

The massive QE program which the Governments of the world ($6 trillion by the US alone) have undertaken to address the coronavirus crisis might also be influencing an increase of USD based stable coins.

Apart from acting as a fundamental bullish indicator, Tether also adds sufficient liquidity for swings in price. Sid Shekhar, co-founder of market tracker TokenAnalyst told the media,

The more Tether there is in existence (and specifically the more sitting on exchanges), the more there is opportunity for sharp swings

How do you think the issuance will affect the crypto markets? Please share your views with us.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs