The First Bitcoin (BTC) Mined After Halving, Miners Await The 6.25 BTC Subsidy Hit The Exchanges

At block height 630,000, the Bitcoin network halved its miner rewards. Now, for every mined block, a successful pool will be rewarded 6.25 BTC plus subsidy or roughly $56,250 when each coin is changing hands at $9,000.

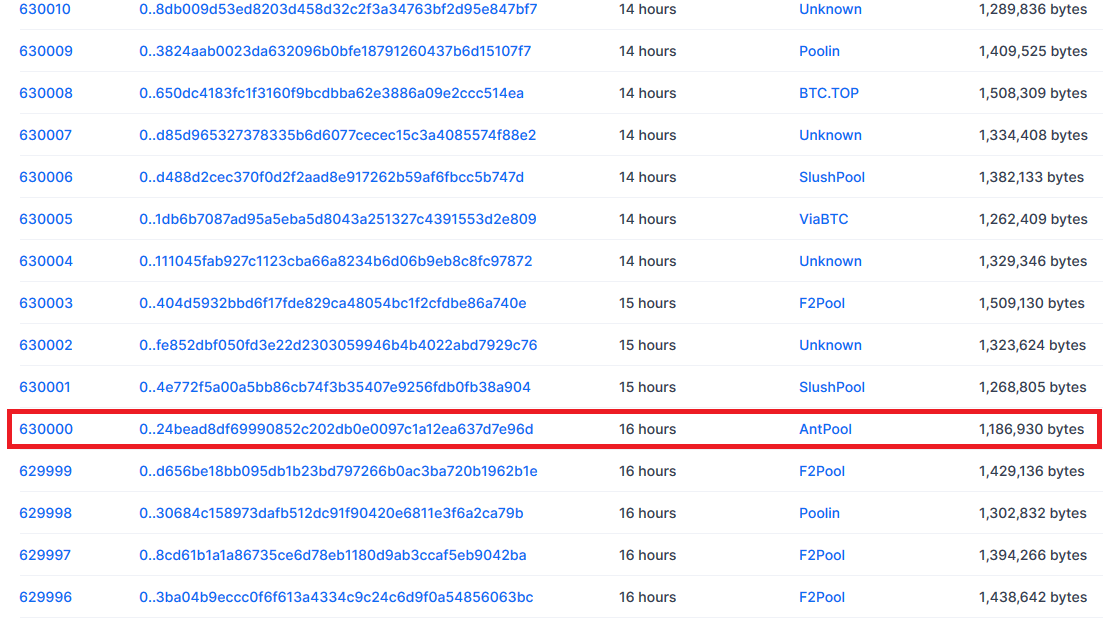

AntPool, one of the leading Bitcoin mining pool, was successful in mining the block. As designed by the Bitcoin network, they can now spend the coins after the first 100 blocks have been mined.

14 blocks remaining before new subsidy coinbases are made spendable starting with block 630,000.

Coinbases UTXOs go through a 100-block waiting period before they are allowed to be spent.

We have yet to see the 6.25 BTC subsidies hit the exchanges.

— Melik Manukyan [Unban Zerohedge] (@melikmanukyan) May 12, 2020

Depending on the individual miners who received the block rewards and plugged to AntPool, these coins—regardless of the amount, can hit different exchanges where they can be liquidated for cash to cover operating expenses as electricity, or other coins.All this depends on the miner preference.

However, what’s important to note is, regardless of what they do with these coins, they were privileged to mine the first 6.25 BTC of the Fourth Bitcoin Epoch.

What Bitcoin Halving Means for Miners

Nonetheless, while the trading community was abuzz with the event, it represents additional challenges for miners.

With the network rewarding a successful pool 6.25 BTC for every confirmed block, it means miners have to not only mine faster to recoup the same revenue as when mining in the third epoch, but there is a risk that the Bitcoin mining community will not be decentralized as originally meant.

The first mining reward of #bitcoin's 4th epoch is 7.16 BTC (6.25 block subsidy + 0.91 in fees).

That means 12.7% is made up of transaction fees.

An indication of the brave new world of fee-based security we're venturing toward? pic.twitter.com/lh3te5vxkV

— Mario Gibney (@Mario_Gibney) May 11, 2020

For perfect decentralization, miners in this fourth epoch must therefore invest in efficient, high hash-rate gear to stay ahead of the pack if they stand to chance to be profitable.

Miner Revenue Will Fall

This is because while the network has halved their rewards, the competition for the next available block will be cut-throat and expensive. Same inputs operating with constant costs will need to be expended by mining gears at halve the potential revenue.

Even though there are gains to be made from transaction fees, the primary revenue source will be slowly closed amid a rising commitment from miners—the hash rate continues to edge higher, and an adjustment of difficulty in the next two weeks.

Depending on the adjustment, it is expected that some miners will drop off, consequently ceding to others with enough capacity to mine with halved rates.

- CLARITY Act Odds Spike to 90% as Coinbase CEO Confirms “Great Progress” On Crypto Bill

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand