These Altcoins Defy Broader Market Correction, ETH Whales Accumulate

The broader cryptocurrency market is facing strong selling pressure over the last 3-4 days slipping under the $800 billion market cap. However, a few altcoins like Chainlink (LINK), Tron (TRX), and Litecoin (LTC) have seen renewed investor interest thus defying the market correction.

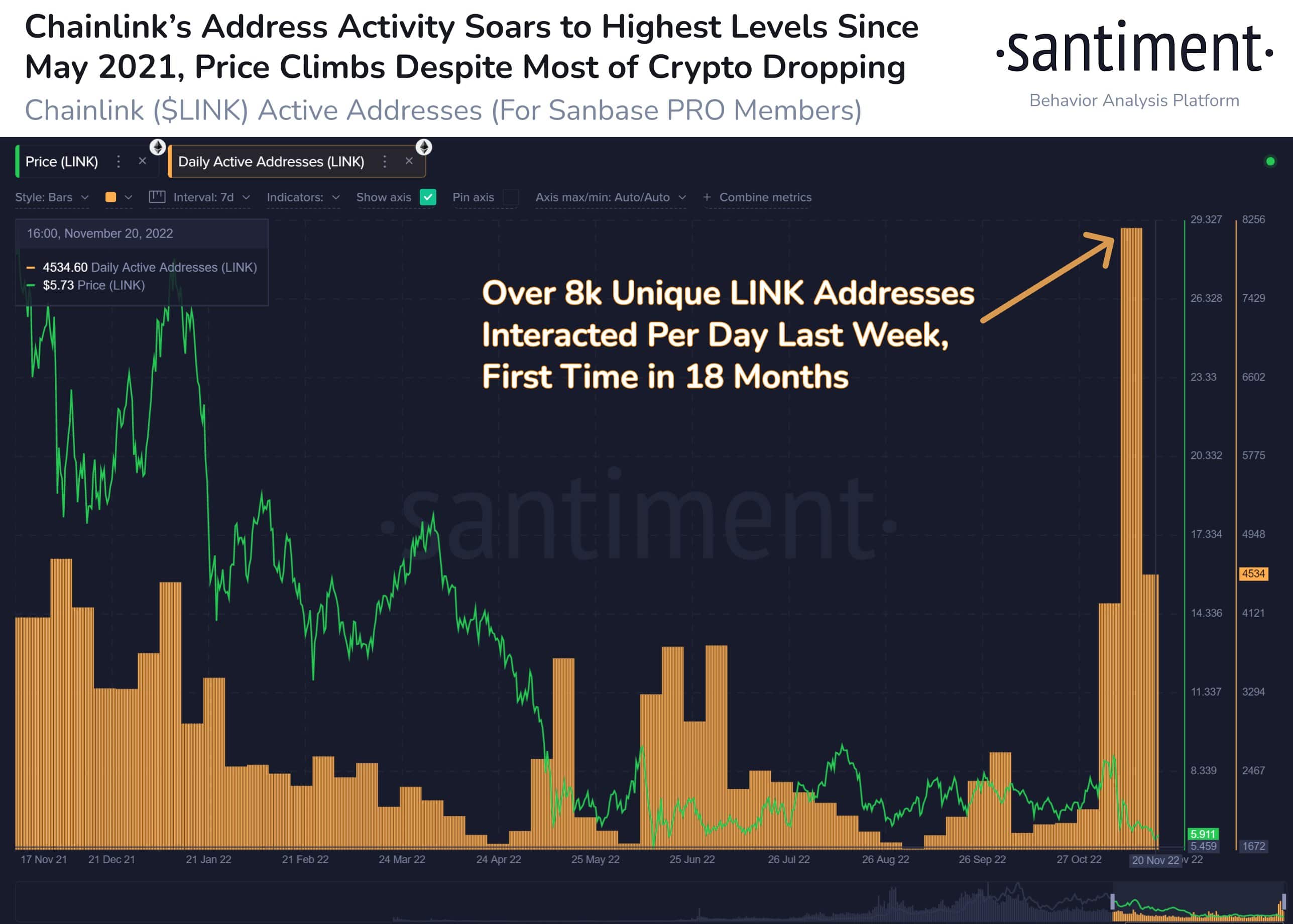

While Bitcoin and Ethereum were under heavy correction earlier on Monday, oracle service provider Chainlink (LINK) witnessed a good uptick. As of press time, Chainlink (LINK) is up 5.96% trading at a price of $6.07. This happens as the Chainlink address activity is currently on a sharp uprise. On-chain data provider Santiment reported:

Chainlink jumped a mild +3% Monday despite #Bitcoin & #Ethereum falling. The bigger story is the $LINK‘s sudden active address surge, which began surging approximately when the @FTX_Official fallout occurred, & it is still up at one-year high levels.

As of press time, other digital assets and altcoins are also doing well. Tron’s native cryptocurrency TRX is up by 3.6% trading at a price of $0.05191 and a market cap of $4.7 billion. The altcoin is also trading in the positive zone on the weekly chart.

Earlier this month, Tron DAO shared an important milestone. In the period between November 7 to November 13, the total number of accounts associated with the Tron blockchain reached 119,949,499 with the total tally of transactions hitting a high of 4.19 billion. The blockchain height for Tron has surpassed 45.83 million with the total-value-locked (TVL) peaking at $12.3 billion.

Litecoin (LTC) is another altcoin showing strength as of now and trading 3% up at a price of $62.07 with a market cap of $4.4 billion. It has also flipped Solana to become the fifteenth-largest cryptocurrency by market cap. In the last seven days, the LTC price is up by 8%. Earlier on Monday, the Litecoin Foundation shared an important milestone for the blockchain.

The Litecoin Network just processed its 135,000,000th transaction.

Over 11 years of continuous immutable, uncensorable, flawless uptime. pic.twitter.com/bMbcp7ecHg

— Litecoin Foundation ⚡️ (@LTCFoundation) November 20, 2022

Altcoins Ethereum Sees Resumed Whale Buying

The world’s second-largest cryptocurrency Ethereum (ETH) has been at the receiving end of the FTX collapse. The news that an FTX hacker is amassing a large quantity of Ethereum (ETH) led to concerns about a massive dump coming. As a result, the ETH price has tanked to $1,100 in the recent market mayhem.

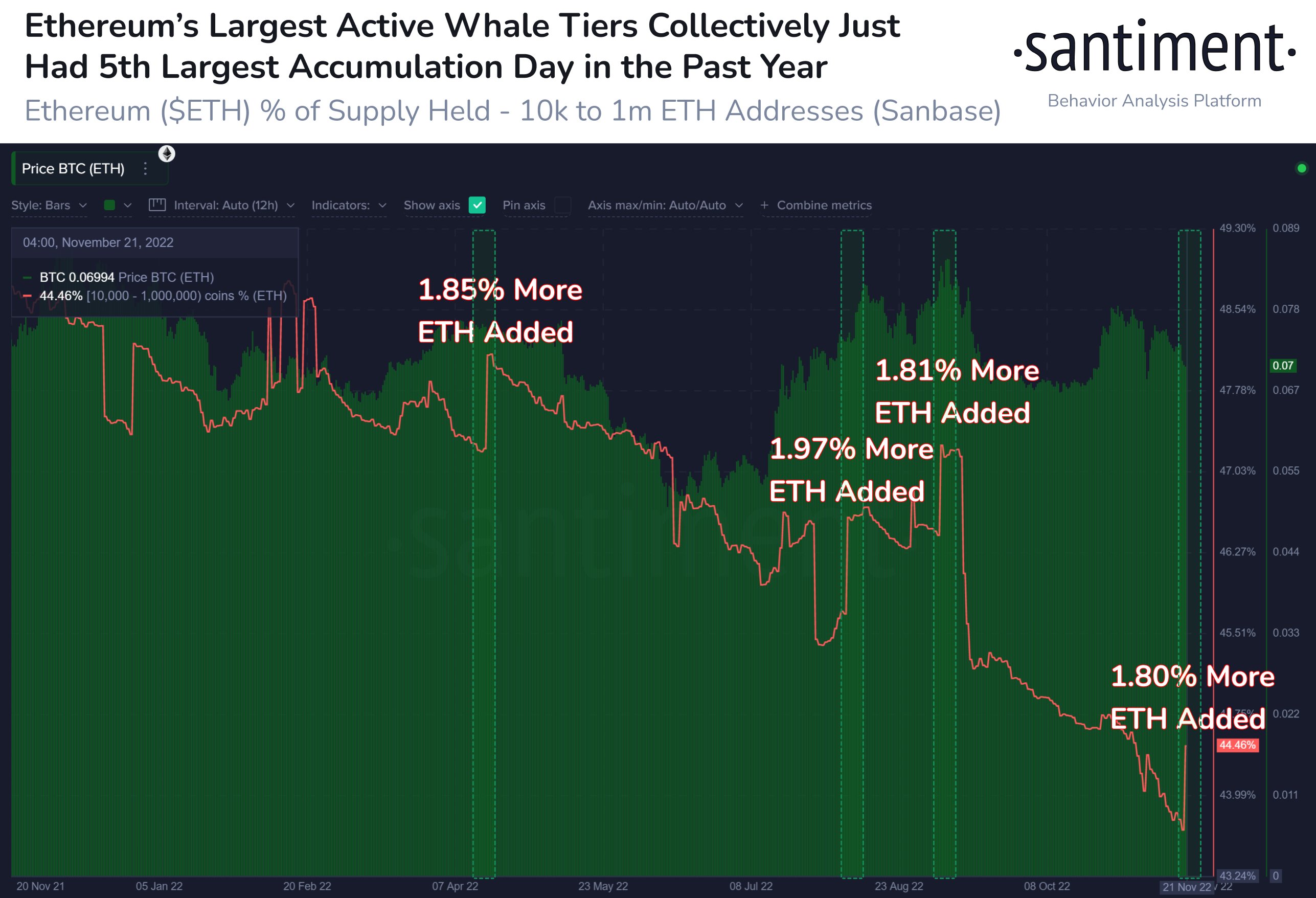

However, on-chain data shows that Ethereum whales have resumed accumulation at their end. On-chain data provider Santiment reported:

Ethereum’s large whales (holding $10.9M to $1.09B) have added 947,940 more $ETH yesterday worth ~$1.03B. This is the 5th largest single day add in the past year. The past 4 instances, $ETH‘s price vs. $BTC rose an average of +3.2% the following 3 days.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs