These Bullish and Bearish Signals for Ethereum (ETH) Can Determine the Price Action

The world’s second-largest cryptocurrency Ethereum (ETH) recently touched a new all-time high above $4800 and is currently flirting close to those levels. While there have been expectations of ETH reaching $5000 levels very soon, the network congestion and high gas fee prove to be a kind of barrier.

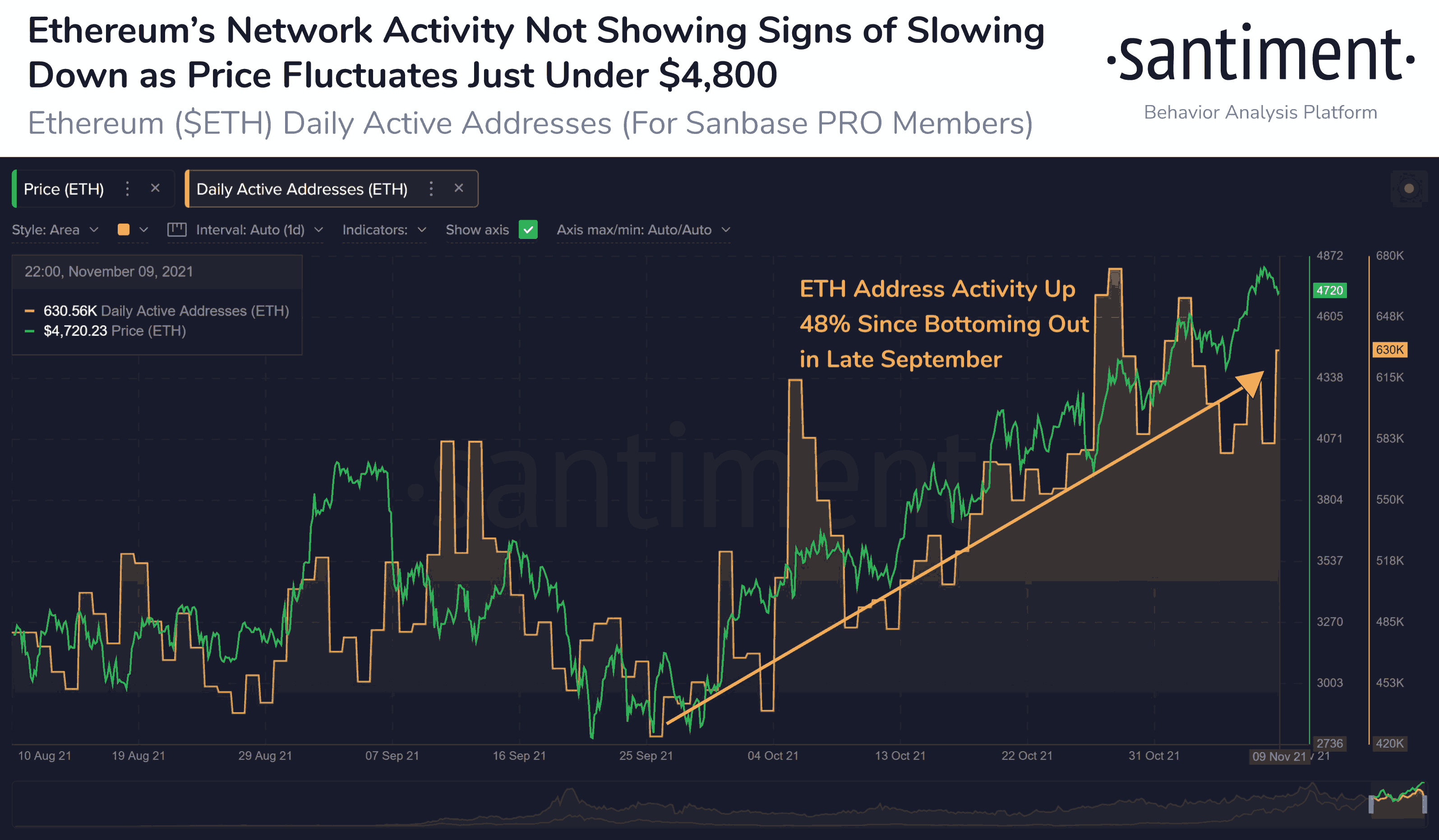

It’s difficult at this point to say in which direction Ethereum (ETH) will move. On-chain data provider Santiment reports that the Ethereum address activity is up by 48% after the number of unique ETH addresses bottoming out in late September.

Furthermore, Crypto Quant CEO Ki-Young points out that the ETH supply in the market isn’t increasing anymore. Post the London hardfork, the rate of ETH supply has become almost zero. thus, Ethereum is turning out to be a scarce asset that can be a bullish signal for the world’s second-largest crypto.

$ETH supply doesn't increase anymore.

Its rate of change became almost zero after the London hard fork.

Just like Bitcoin, ETH is now a scarce asset with limited supply.

Source 👇https://t.co/EqrqzuO4kt pic.twitter.com/ZIxxDy1gQI

— Ki Young Ju 주기영 (@ki_young_ju) November 11, 2021

However, the ETH price action and its trading volumes have been forming a bearish divergence recently.

On-Chain Bearish Indicators for Ethereum

On-chain data provider Santiment reports that there’s a strong bearish divergence between the ETH price and its trading volume. Although the Ethereum trading volume has been trying to pick up with the price, it hasn’t succeeded well and instead moved down. This is particular true since the end of October.

A similar scenario appears for Ethereum (ETH) social volume and the ETH network profit and loss. The on-chain data provider Santiment notes:

A bunch of long lasting divergencies is pointing us to idea that we need to go down. These are really worrying. We see network activity going down even though the price is pushing up.

People too relaxed to take profits even though ETH is going up (visible in NPL). There is a good chance they will be punished.

There is 50/50 chance market quite often moves up one more time after divergence. Just to confuse traders.

It will be interesting to see as to what price action does Ethereum follows from here onwards.

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Breaking: U.S. PCE Inflation Rises To 2.9% YoY, Bitcoin Falls

- BlackRock Signals $270M Bitcoin, Ethereum Sell-Off as $2.4B in Crypto Options Expire

- XRP News: Dubai Tokenized Properties Trading Goes Live on XRPL as Ctrl Alt Advances Project

- Aave Crosses $1B in RWAs as Capital Rotates From DeFi to Tokenized Assets

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?