These On-Chain Metrics Paint a Bullish Outlook As Bitcoin (BTC) Crosses $57,000

While the broader crypto market has been under a consolidation phase, the world’s largest cryptocurrency Bitcoin (BTC) continues to inch upwards. Bitcoin (BTC) started the week on a pretty good note with the BTC price climbing past $57,000 on Monday, October 11.

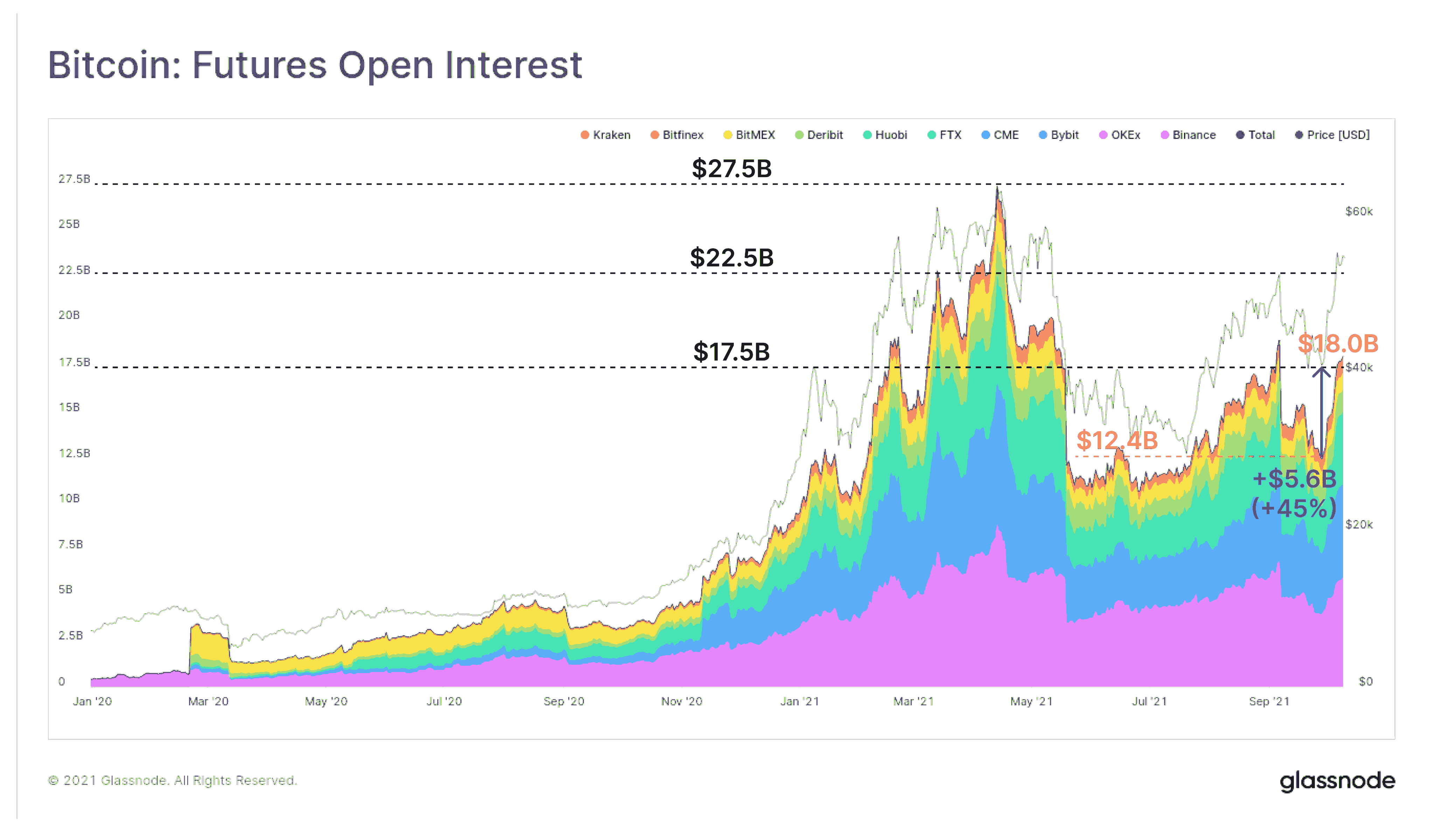

As per data from Glassnode, the bitcoin futures open interest is soaring back to the early September levels. As Glassnode reported:

Bitcoin futures open interest climbed by $5.6B through October, up 45% since the September lows. Whilst elevated, the $17.6B in open interest is lower than the $22.5B worth of contracts last time prices were trading at $56k.

Popular crypto analyst Lark Davis mentions that the Bitcoin futures open interest can pump even higher. However, “such spikes often come before a correction as a long squeeze comes into effect,” he adds.

Bitcoin Gaining Price Dominance

Observing the current movement in the market, it is clear that Bitcoin is gaining a dominant position over altcoins. On-chain data provider Santiment reports that is converting altcoins traders into BTC-weighted portfolio allocations. Thus, the sentiment is turning to be mildly euphoric for Bitcoin. furthermore, the euphoria levels don’t show extreme greed so far.

📈 With #Bitcoin's price dominance converting #altcoin traders temporarily back to $BTC-weighted portfolio allocations, sentiment has turned mildly euphoric. With positivity scores surging, watch to see if the threshold moves into #FOMO danger territory. https://t.co/GnfV2tDtUc pic.twitter.com/15v3NOSCAe

— Santiment (@santimentfeed) October 11, 2021

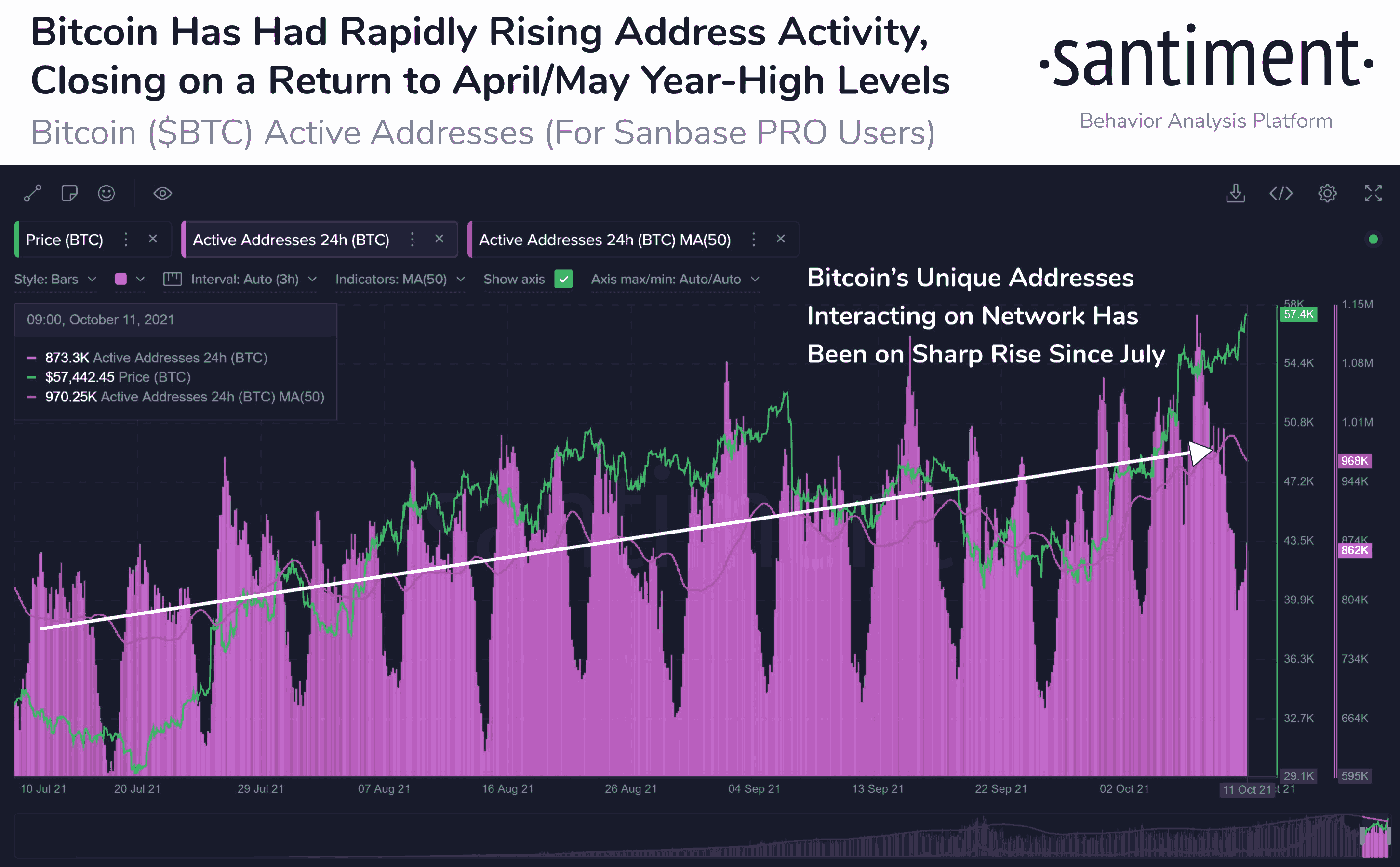

Furthermore, Santiment also explains that the unique addresses interacting on the Bitcoin network have been on a sharp increase to April/May levels. The data provider states:

If you like #Bitcoin dominance, this has been the week for you. As #altcoins are mostly treading water, $BTC climbed all the way above $57.6k for the first time in 5 months. Addresses interacting on the network continue to indicate increased utility.

With Bitcoin showing strength recently, analysts have been gaining confidence in BTC touching $100K by the end of the year. As of press time, Bitcoin is trading at $56,878 and has a market cap of $1072 billion. The immediate resistance for Bitcoin is $58,000. If BTC crosses this, it can touch an all-time high and beyond very soon.

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act