This Hedge Fund Loses Majority of Funds Due To FTX Bankruptcy

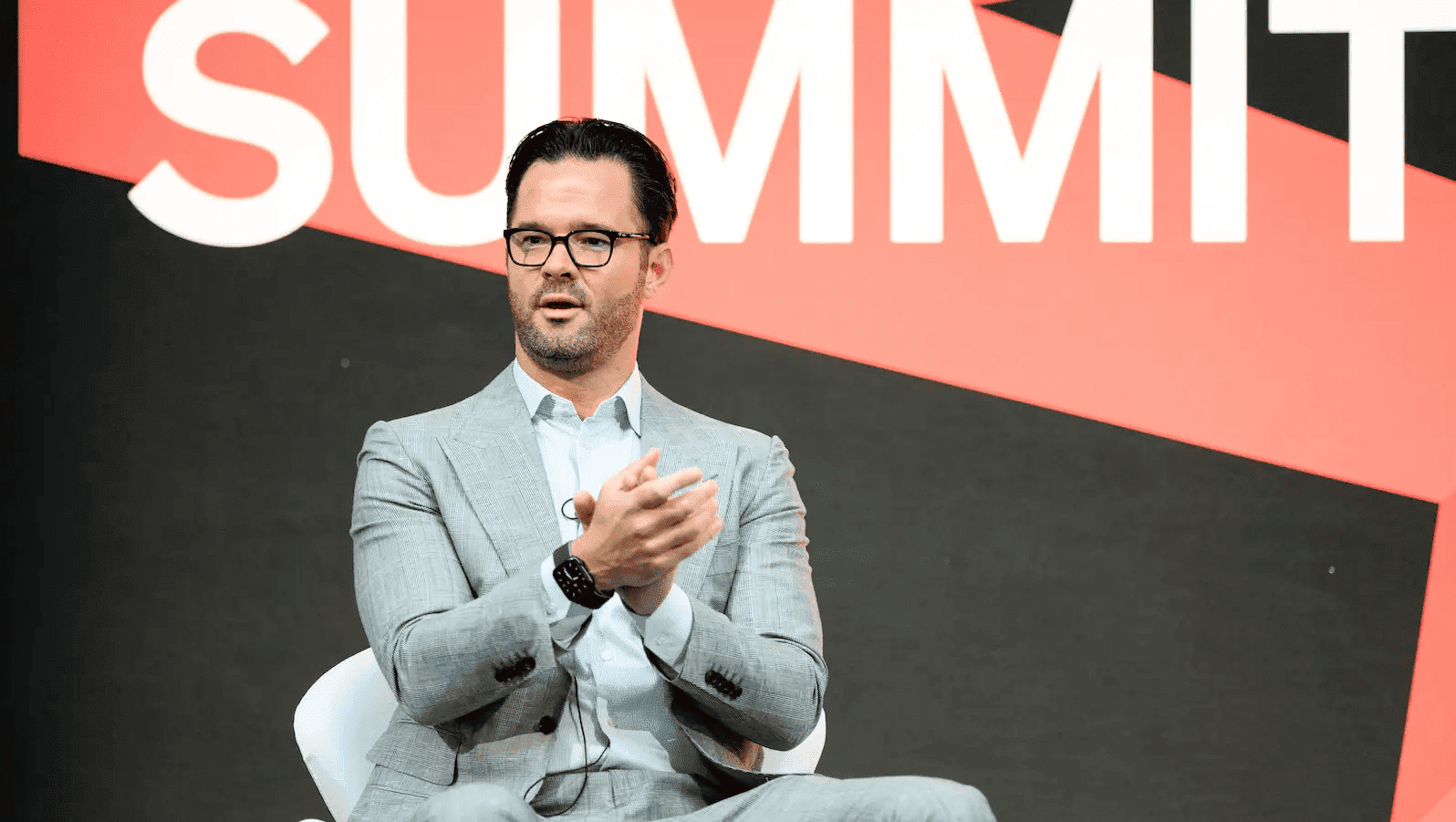

Travis Kling, the company’s founder and chief investment officer, said that the California-based hedge fund Ikigai Asset Management had a “vast majority” of its assets on the now-defunct cryptocurrency exchange FTX.

On Monday, Kling stated through Twitter that Ikigai got affected by the FTX crash last week. The majority of the assets of the hedge fund were on the FTX exchange and they received very little amount by the time they tried to withdraw on Monday morning. They are currently stranded like everyone else due to the FTX collapse.

Unfortunately, I have some pretty bad news to share. Last week Ikigai was caught up in the FTX collapse. We had a large majority of the hedge fund’s total assets on FTX. By the time we went to withdraw Monday mrng, we got very little out. We’re now stuck alongside everyone else.

— Travis Kling (@Travis_Kling) November 14, 2022

Ikigai’s Current Roadmap

According to Kling’s Twitter thread, the company will continue trading its non-FTX-stuck assets and will soon decide what to do with its venture fund which was not affected by the FTX meltdown.

He stated that there is a great deal of ambiguity surrounding the timeline and likelihood of recovery for FTX consumers. “But at some point, we’ll be able to make a better call on whether Ikigai is going to keep going or just move into wind-down mode.” he added.

Read More: SBF Resigns, John Ray III Joins As New FTX CEO

Kling claimed that he had been in frequent contact with Ikigai’s investors since Monday and accepted full responsibility for the possible loss of funds. According to him, he has sincerely apologized to his investors for losing the money they trusted him with and further said:

“I have publicly endorsed FTX many times and I am truly sorry for that. I was wrong.”

About Ikigai

Ikigai was established in 2018 and in May, it launched a new venture fund with $30 million in funding from its current investors. Ikigai had more than 275 investors worldwide, according to a press release given during the investment round.

Kling further stated that,

“It’s obvious now that the space has not done enough to identify and expel bad actors. We’re letting way too many sociopaths get way too powerful and then we all pay the price. If Ikigai continues on, we pledge to fight harder in this regard. It’s a fight worth fighting.”

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Soars on Rumors of Trump’s 0% Tax Policy for Digital Assets

- Hong Kong Set to Launch Tokenized Bond Platform and Issue First Stablecoin Licenses

- US Senator Launches Probe Into Binance After Fortune Report on Sanctions Violations

- CLARITY Act Odds, Bitcoin Drop as Trump Skips Crypto in State of the Union Speech

- Tokenized Stock Market Gains Boost as Kraken and Binance Launches New Products

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card