Tom Lee’s Bitmine Immersion (BMNR) Adds Another $103M ETH to its Ethereum Stash

Highlights

- Bitmine Immersion Technologies added an additional 23,823 ETH worth about $103.68 million.

- BMNR stock closed 1.50% lower at $59.10, but analysts maintained a price target of $71.

- ETH price slips 3% amid profit booking in the broader crypto market.

Bitmine Immersion, the largest Ethereum treasury company, quietly added another 23,823 ETH to its total Ethereum holdings. This comes as ETH price dropped to $4,273 amid massive profit booking due to macro jitters, especially as Jerome Powell’s speech offered no Fed rate cut cues.

Bitmine Immersion Buys $103 Million in Ethereum

Tom Lee-backed Bitmine Immersion Technologies scooped up another 23,823 ETH (worth about $103.68 million) from BitGo, according to Arkham data shared by Lookonchain on October 10. The latest purchase expanded Bitmine’s total Ethereum holdings to 2.87 million ETH worth $12.6 billion at the current market price.

Bitmine keeps accumulating $ETH — 5 hours ago, they received another 23,823 $ETH($103.68M) from BitGo.https://t.co/DLOO6fgc7Khttps://t.co/w5uTBr9jZg pic.twitter.com/nScuFMDf5X

— Lookonchain (@lookonchain) October 10, 2025

On Wednesday, Bitmine bought another 20,020 ETH worth $89.7 million. On Monday, the Ethereum treasury firm disclosed 2,830,151 ETH holdings, 192 BTC, $113 million stake in Eightco Holdings, and $456 million cash. Tom Lee targets at least 5% supply of Ethereum amid demand from Wall Street and AI firms.

BMNR Stock and ETH Price Action

BMNR stock closed 1.50% lower at $59.10 on Thursday. The 24-hour low and high were $56.51 and $59.31, respectively. The stock has rallied more than 715% year-to-date, as per Yahoo Finance.

Meanwhile, analysts have maintained the price target of $71 as the company sold 5.22 million shares at a premium of $70.00 per share last month.

While most are watching price charts turning red, Bitmine is moving differently and quietly stacking more ETH. Earlier, Tom Lee predicted $4,300 as a crucial level to watch.

ETH price extended its fall and slipped 3% in the past 24 hours, with the price currently trading at $4,342. The 24-hour low and high are $4,273 and $4,411, respectively. Furthermore, trading volume has increased by 2% in the last 24 hours, indicating a lack of interest among traders.

The derivatives market showed selling in the last few hours, as per CoinGlass data. At the time of writing, the total ETH futures open interest dropped 0.20% to $59.43 in the last 4 hours.

The 24-hour ETH futures OI increased more than 1.20%, but it was down 2.70% on CME and other top crypto exchanges such as Binance and OKX.

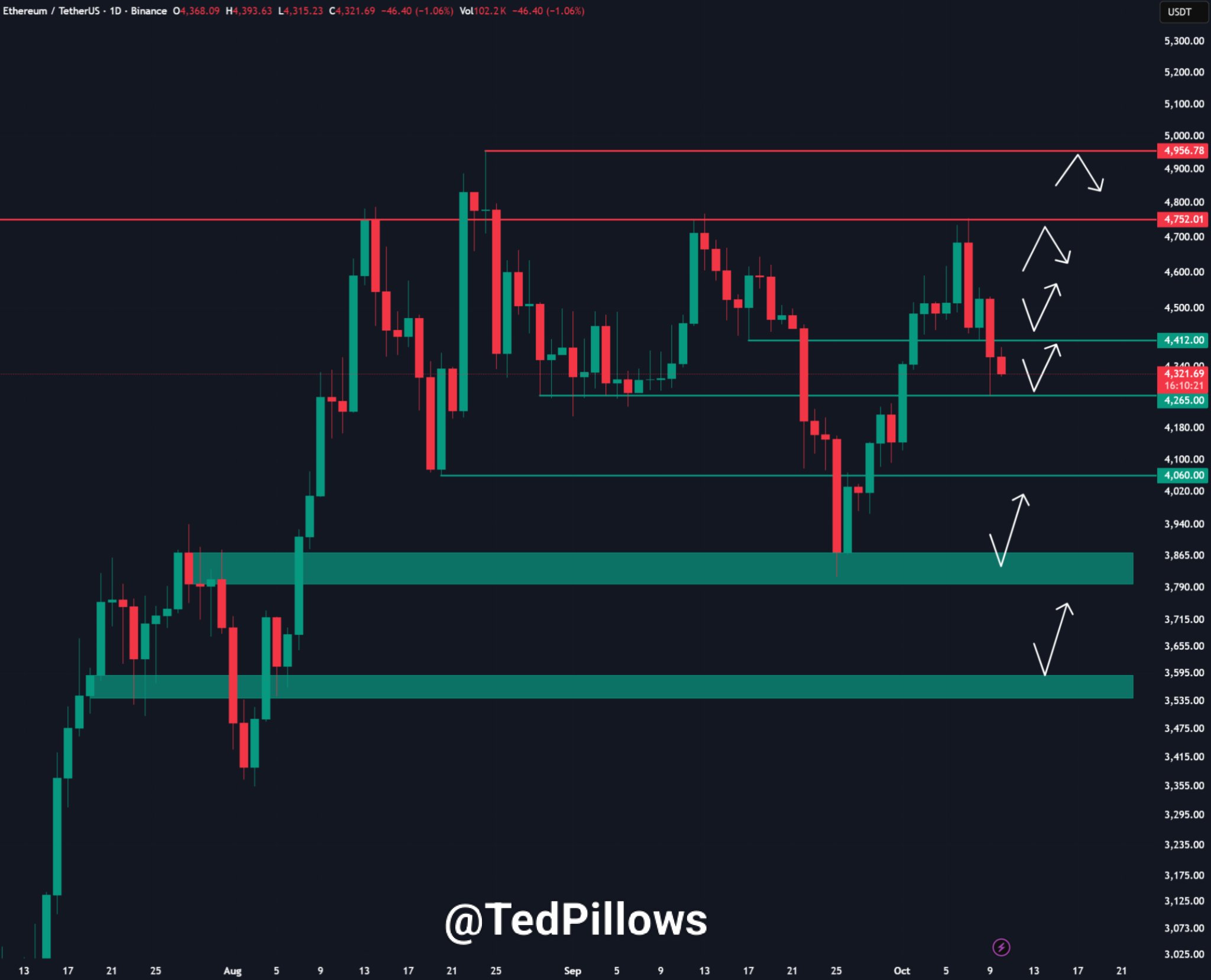

Analyst Ted Pillows pointed out that Ethereum could show some recovery after it rebounded from the $4,250 support level. If ETH fails to hold this level, a correction towards the $4,000 level is expected.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs