Tom Lee’s BitMine Boosts Ethereum Treasury by $1.87B, Now Holds 2.151M ETH

Highlights

- BitMine boosts Ethereum treasury to $10.8B, adding 82,000 ETH this week.

- BMNR stock jumps 15.28% daily, recording 25.63% five-day surge.

- Ethereum trades at $4,535, down 1.55% but up weekly and monthly.

The Ethereum holdings for BitMine Immersion Technologies have surged to $10.8 billion after rapid accumulation. Yet, ETH price is down 1.88%, showing strong sell pressure.

BitMine’s $1.87B Ethereum Purchase Highlights Institutional Confidence

According to the press statement, BitMine increased its Ethereum holdings to 2.151 million ETH, now valued at $10.8 billion. The new holdings confirm BitMine as the largest Ethereum treasury in the world and the second-largest overall crypto treasury, trailing only Strategy Inc.

In addition to Ethereum, the company owns 192 Bitcoin, a $214 million stake in Eightco, and $569 million in cash reserves. The latest Ethereum purchase marks a $1.87 billion gain from last week, when the treasury was worth $8.9 billion.

Chairman Thomas “Tom” Lee linked the company’s strategy to structural changes in finance, comparing it to the end of Bretton Woods in 1971. In the last week alone, the company added 82,000 ETH to its balance sheet. Every $100 move in Ethereum’s price now changes the value of BitMine’s treasury by more than $200 million, highlighting the scale of exposure.

The market also reflects BitMine’s rising influence. The press release also revealed that BMNR shares rank as the 28th most traded equity in the United States, with average daily turnover of $2 billion.

That places the stock ahead of Arista Networks and just behind Eli Lilly, unusual for a crypto-focused firm. Institutional backing from ARK’s Cathie Wood, Founders Fund, Galaxy Digital, and Pantera further reinforces confidence in its strategy.

The company’s $1.87 billion increase in holdings within one week underscores its conviction regarding Ethereum. Also, it is a proof of growing institutional shift towards the leading altcoin.

Meanwhile, BitMine has assured its investors that there are no future lockup expirations for its stock. In an official post, the company explained that all PIPE shares have been tradable for free for weeks. This statement responds to speculation concerning the potential restrictions that would impact the liquidity or trading activity of the BitMine stock.

In case you are wondering 🤔

BitMine does not have any upcoming “lockup expirations”

– All PIPE shares have been freely tradeable for several weeks ⛓️💥

ETH = good

Tom Lee @fundstrat, gentleman and scholar 🧐, is Chairman of Bitmine

Ticker: $BMNR @BitMNR pic.twitter.com/vlS5hsjybX

— Bitmine (NYSE-BMNR) $ETH (@BitMNR) September 15, 2025

Ethereum Consolidates Near $4,500 as BMNR Stock Posts Gains

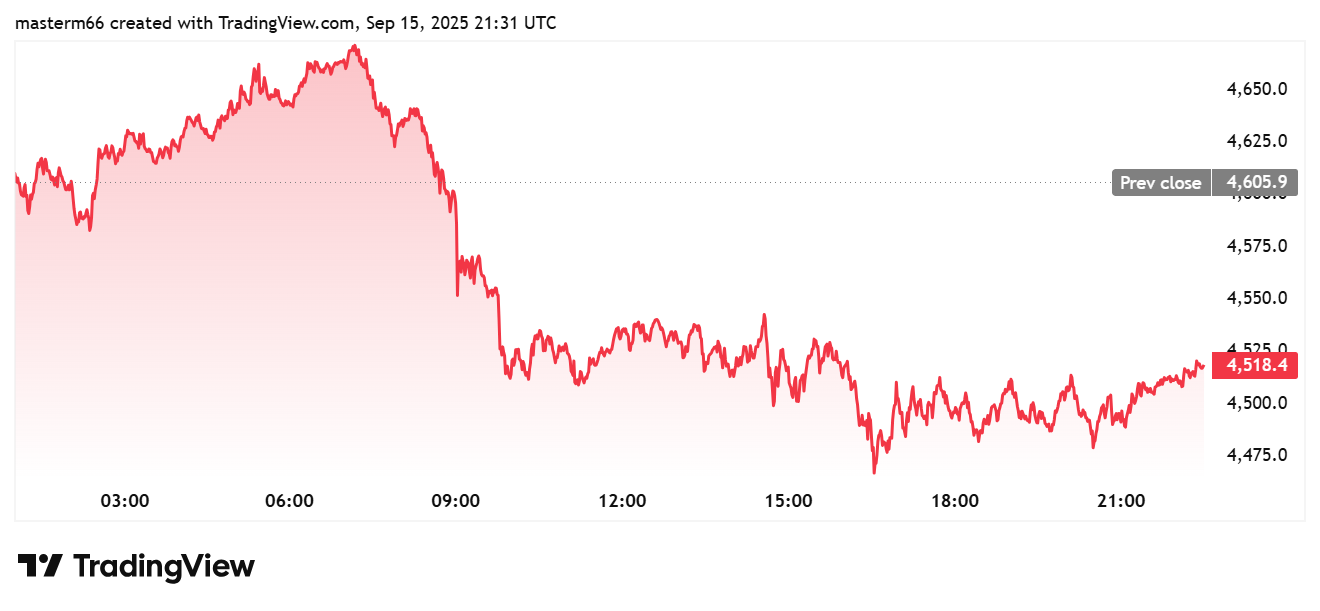

Ethereum price adds context to the accumulation. At the time of writing, ETH is trading at $4,535, which represents a 1.55% drop in the last day. The token had soared up to $4,619 earlier in the session before it retreated. It is also up 5.36% and 2.07% in the last week and month, respectively.

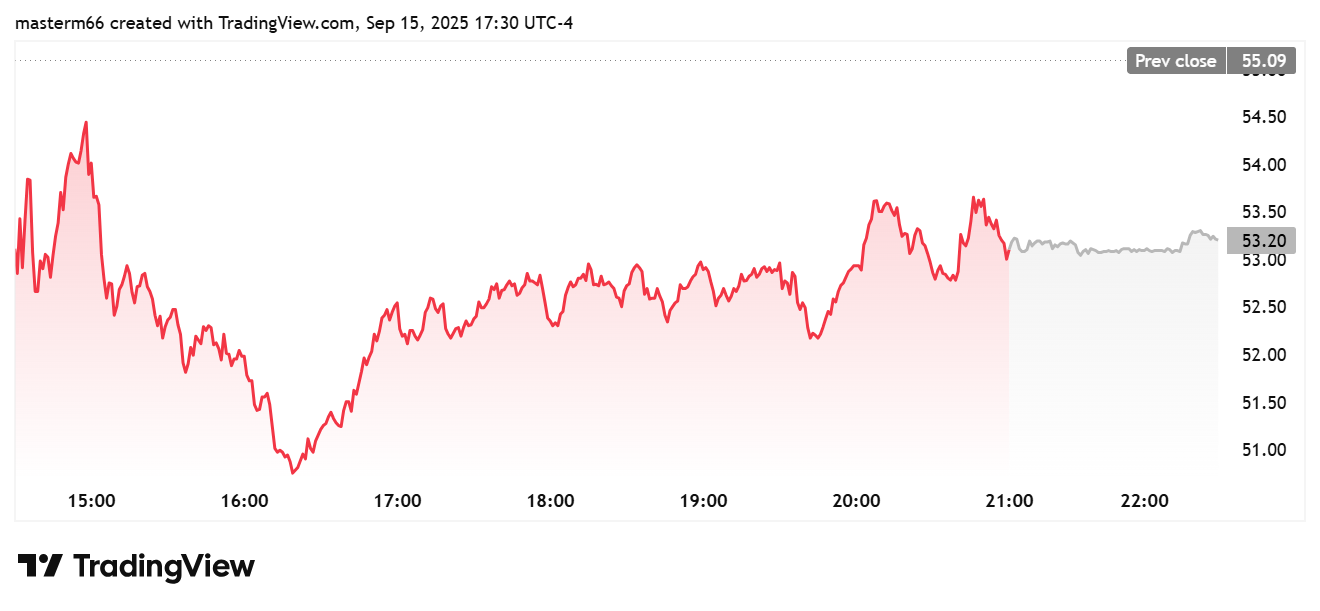

The company’s stock performance mirrors its expanding Ethereum strategy. BitMine’s BMNR shares closed at $55.09, up 15.28% in a single day, according to TradingView data. Over the last five days, BMNR has climbed 25.63%, although it remains down 18.07% over the past month.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs