Tom Lee’s BitMine Ethereum Treasury Tops $6.6B, Overtakes MARA in Crypto Holdings

Highlights

- BitMine’s Ethereum holdings surpass $6.6B, overtaking Marathon Digital’s crypto treasury.

- Chairman Tom Lee highlights Ethereum’s institutional demand and Wall Street migration.

- BMNR stock slips 4% daily but posts 775% six-month surge.

BitMine Immersion’s Ethereum treasury has surged past $6.6 billion, overtaking MARA. Its stock ranks among the most traded in the U.S. despite a recent price dip.

Bitmine’s Ethereum Holdings Soar Past $6.6B As Stock Liquidity Surges

As of the time of this writing, BitMine has reported holdings of more than 1.52 million Ethereum, valued at $4,326 per token, alongside 192 Bitcoin (BTC), according to a press release. That is a big jump in cash terms compared to the previous week (when it held $4.9 billion worth of ETH). It indicates the speed at which the company has increased its ETH holdings.

Tom Lee, the chairman of BitMine and a co-founder of Fundstrat argued that Ethereum is one of the greatest trades in the coming decade. He emphasized the institutional demand, the migration of Wall Street and AI onto blockchain all combine to make Ethereum a stronger investment in the long-run.

The comments made by Lee indicate that the role Ethereum plays in the revolution of the finance industry would only increase as blockchain combined with traditional markets. Accumulation is not the only strategy by BitMine. It also aims to be dominant in terms of trading liquidity and institutional credibility.

BitMine has embarked on a strong growth plan, which has made it attractive to top institutional investors such as Cathie Woods ARK Invest, Founders Fund, Pantera Capital as well as Kraken. Its objective is to grow its ETH holdings and ultimately purchase 5% of the total ETH in circulation, and this has ignited greater investor interest.

According to Fundstrat, BitMine’s stock has also surged in trading activity, averaging $6.4 billion in daily volume. This makes it the 10th most liquid U.S. stock, ahead of giants like JPMorgan and Alphabet.

BitMine Overtakes MARA as Second-Largest Corporate Crypto Treasury Amid 775% Stock Surge

This purchase has placed the company as the second-largest corporate crypto treasury, overtaking Marathon Digital (MARA). Data from BitcoinTreasuries confirms that BitMine’s Ethereum-focused strategy now places it ahead of MARA in total crypto reserves.

BitMine’s ETH treasury coincides with a period institutions are rebalancing their portfolios to include crypto treasuries. In U.S. dollar terms, MicroStrategy remains the largest crypto treasury with its assets valued at $74 billion after its latest BTC purchase while BitMine comes next with $6.6 billion worth of holdings.

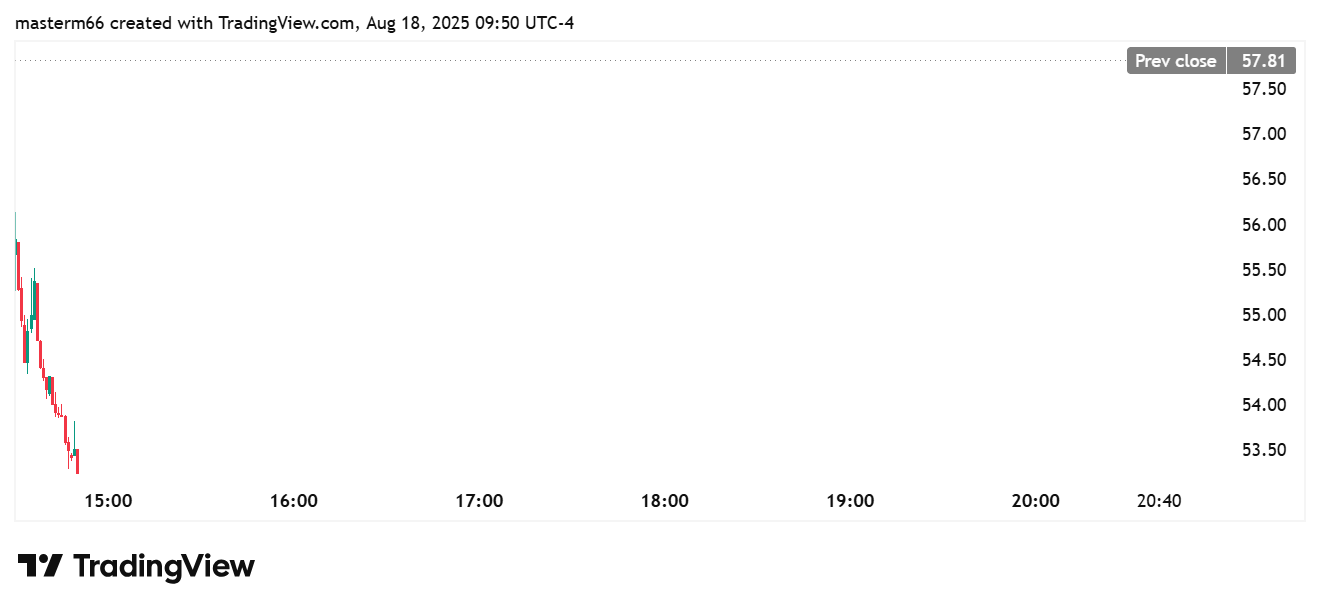

According to TradingView chart, BitMine’s (BMNR) share price has experienced a one-day loss of 4.37%. However, it has delivered staggering long-term gains. BMNR has performed better than in the past six months with 775% increase in price and over 600% on a year-to-date basis. These returns rank it as one of the best performing equities in the U.S. markets in the current year.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs