Tom Lee’s BitMine Keeps Buying ETH, Adds $150M Despite DAT Purchases Crashing 81%

Highlights

- BitMine purchased another $150 million in Ethereum.

- The firm now owns more than 3% of Ethereum’s circulating supply, moving closer to its goal of 5%.

- The Ethereum DAT market collapsed 81% in November.

Tom Lee’s Bitmine has continued buying Ethereum despite the broader treasury companies lagging in the trend. The firm bought ETH worth $150 million that increased its ownership of the token supply to 3%.

BitMine Extends Aggressive ETH Accumulation

The Ethereum treasury firm founded by Fundstrat’s Tom Lee has continued to buy ETH, adding another $150 million on Wednesday. On-chain data from Arkham shows the firm accumulated 18,345 ETH through BitGo and another 30,278 ETH via Kraken.

The buy comes amid a trend of major purchases over the past few days. Late last week, BitMine acquired 14,618 ETH valued at about $44 million to add more depth to its already large holdings.

The buying spree did not stop there, as on Monday, the company executed yet another purchase for 96,798 ETH. This means that its Ethereum treasury now exceeds 3% of the token’s circulating supply.

It has consistently expressed its goal of building up to 5% of the total supply of Ethereum. This is in a bid to tap into ETH’s rising role in settlement systems, tokenization, and wider financial services.

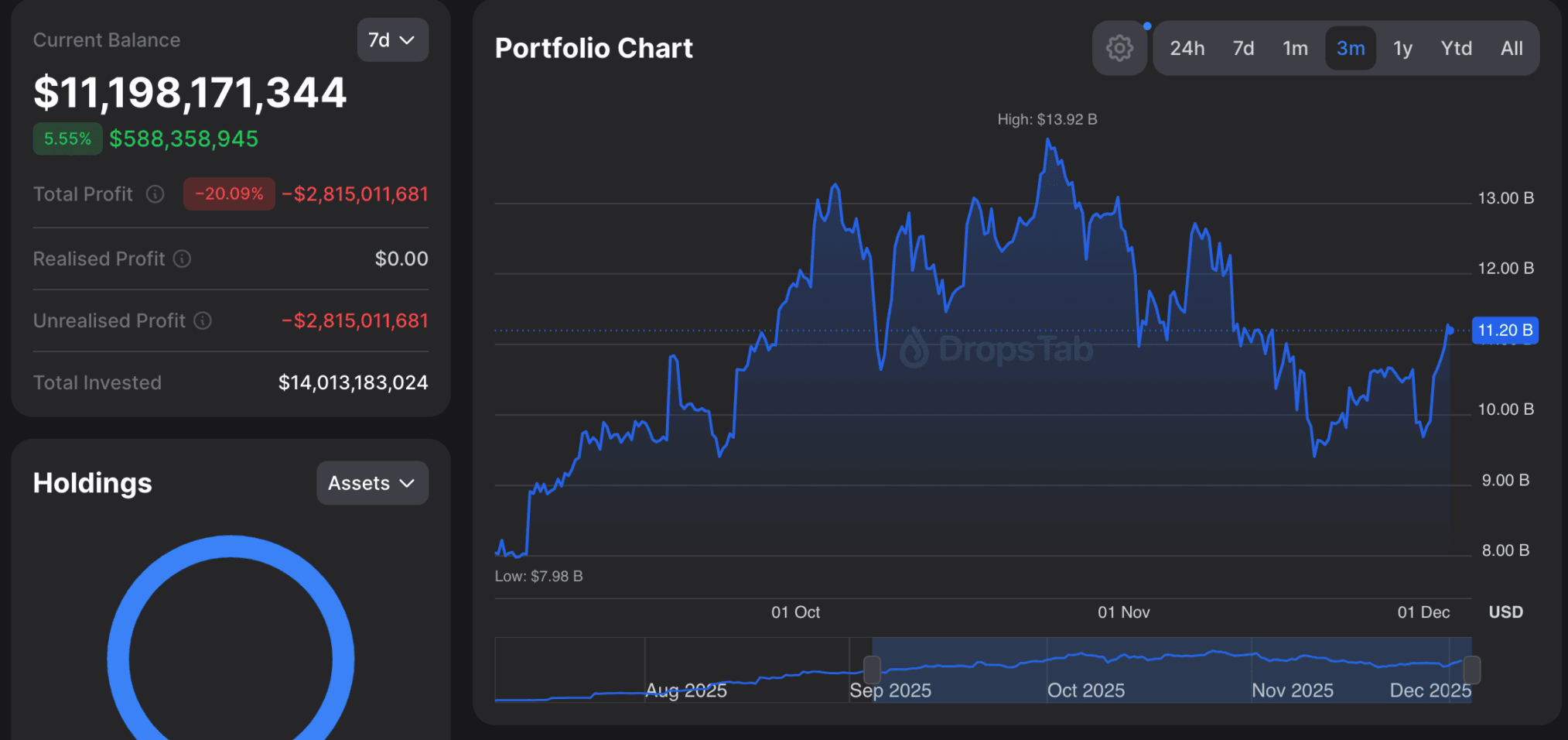

However, the firm’s stock, BMNR, had fallen over 81% from its peak. This means investor confidence has dropped in its offerings. The value of its treasury is now around $12 billion. The company sits on unrealized losses of an estimated $2.8 billion.

DAT Market Sees 81% Drop in Monthly Purchases

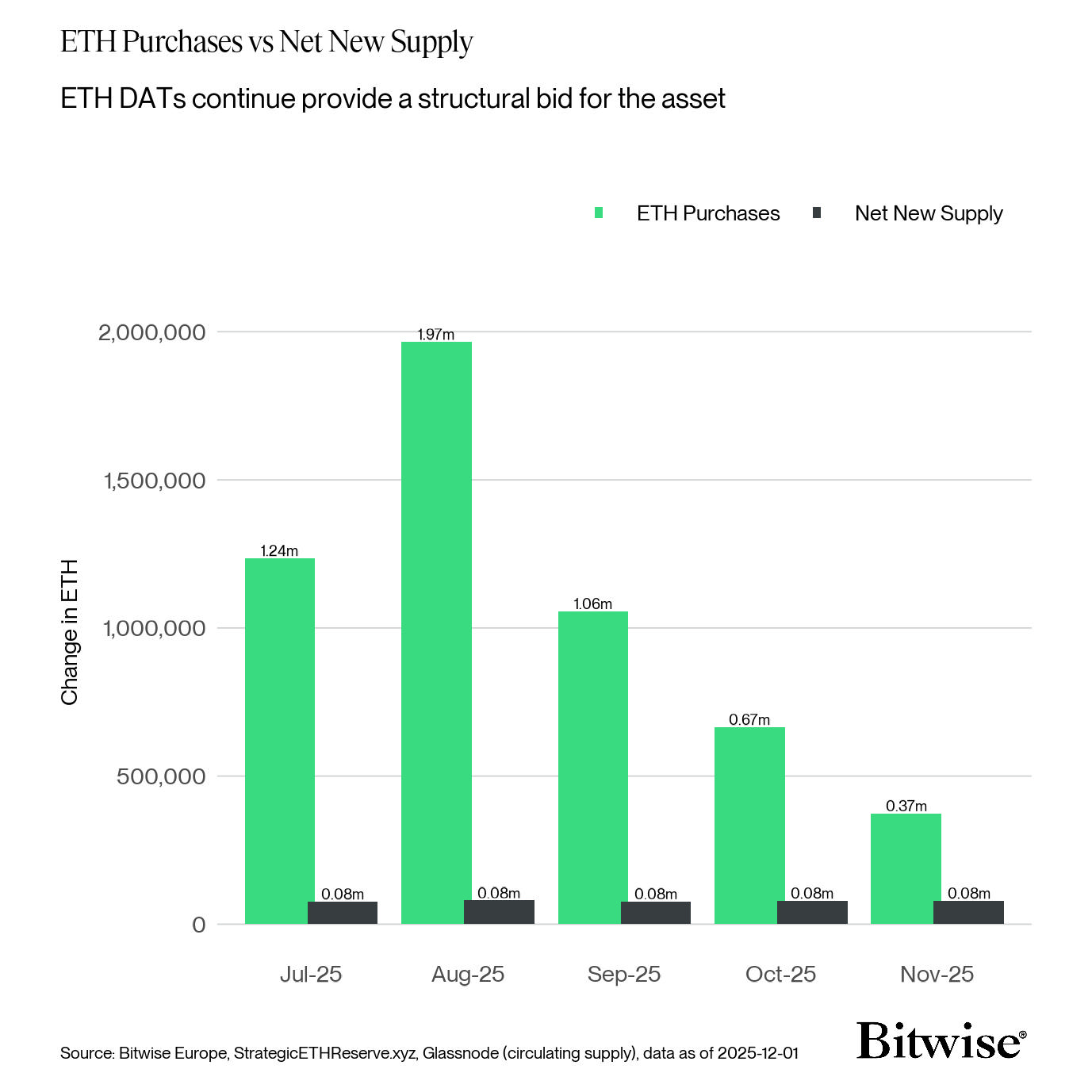

BitMine’s continued buying stands is in contrast to the broader Ethereum DAT market. According to Bitwise, treasury purchases have collapsed 81%. It fell to just 370,000 ETH in November down deeply from the August peak of 1.97 million ETH.

The DAT structure is currently experiencing a serious challenge. Many small treasuries is close to bankruptcy as mNAV multiples and premiums are dropping.

Max Shannon, senior research associate at Bitwise, explained the decline. “Treasuries were this cycle’s version of an altseason. The same pattern is now repeating, too many players, not enough capital to sustain demand.”

Shannon noted that mNAVs are falling, premiums are compressing, and purchasing power is evaporating.

“Purchases still exceed monthly supply for now, but the gap is closing quickly. “The unwind is underway,” he said.

This is a reversal from the trend of purchases as seen earlier in the year. For instance, SharpLink Gaming was consistent in making purchases of token. In August, the firm acquired more than $100 million in ETH.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Why Is Crypto Market Crashing Today (Feb 28)

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs