TON Strategy Company Unveils $250M Stock Buyback Plan to Boost Holdings

Highlights

- TON Strategy Company (formerly Verb Technology) approves a $250 million stock buyback program.

- The firm recently rebranded to TON Strategy (Ticker: TONX), focusing on Toncoin as its core treasury asset.

- Buybacks will depend on market conditions, liquidity, and share price, with flexibility to issue stock for more Toncoin if trading at a premium.

TON Strategy Company has approved a plan to buy back $250 million of its stock. This plan aims to improve the balance sheet of Toncoin holdings.

TON Strategy Targets Shareholder Value with $250M Buyback

In a recent press release, TON Strategy Company (formerly Verb Technology) announced that its board of directors has approved a $250 million stock buyback plan. This would be done either through open-market transactions or alternative methods permitted under securities law.

The company is not obligated to acquire a set number of shares. However, factors such as market conditions, liquidity, and share price will influence the decision.

Executive Chairman Manuel Stotz explained that the strategy is designed to give the firm flexibility in capital allocation. If shares trade at a discount to net asset value (NAV), the company could pursue buybacks. On the other hand, if the stock trades at a premium, the TON Strategy may issue stock to acquire additional Toncoin.

“Subject to market conditions, among other factors, if the stock trades at a premium to NAV, the company may consider issuing stock to buy TON. Conversely, the company may consider repurchasing its own stock if it trades at a discount to NAV. The repurchase program provides us with a tool to enable us to do so,” Stotz said.

The launch of the buyback program follows the company’s recent rebranding and ticker transition to TONX on the Nasdaq Capital Market. Formerly operating as Verb Technology, the firm has fully embraced a digital asset treasury strategy focused on Toncoin.

As CoinGape previously reported, TON Strategy disclosed holdings worth $780 million. It comprised $713 million in Toncoin and $67 million in cash. This portfolio positions itself as one of the most prominent institutional supporters of its ecosystem.

TONX Stock and Toncoin Performance

According to Yahoo Finance data, the TONX price has cooled to around $12 after peaking near $15. Earlier in August, the TON Strategy stock surged as much as 100% following its Toncoin accumulation announcement.

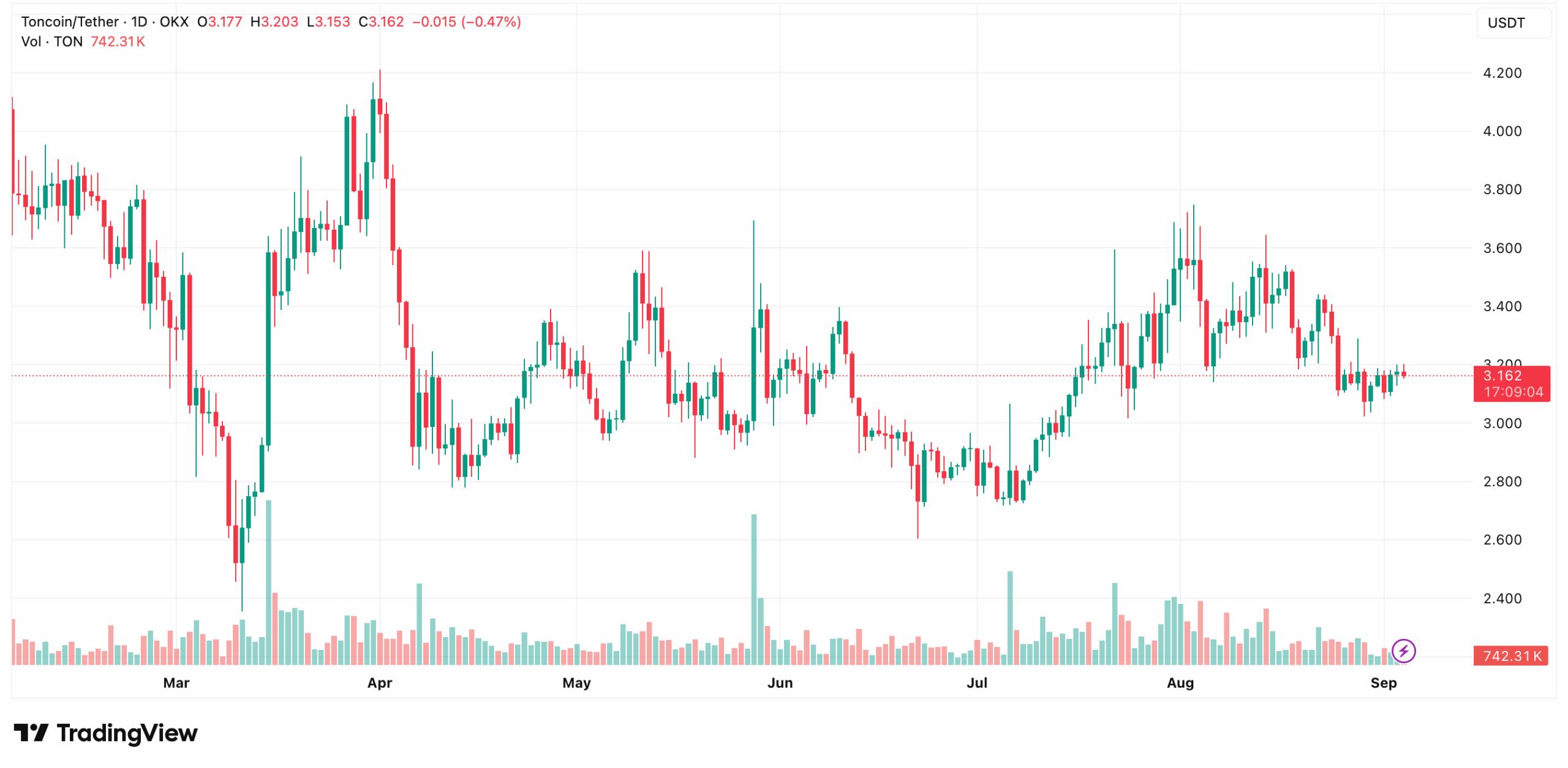

The Toncoin price has also maintained its movement. Over the past 24 hours, the token rose 0.54% to $3.18. This steady situation makes a stronger case for organizations to buy and hold onto assets.

Meanwhile, another Nasdaq-listed company, AlphaTON Capital Corp, launched its Toncoin treasury worth $100 million. The firm raised $38.2 million through a private share placement and secured a $35 million loan facility with BitGo Prime to expand its Toncoin exposure.

TON Strategy launched the $250 million buyback plan to address its current profit challenges and the recent instability of its stock. The company is currently operating with a -235.87% profit margin as it navigates through the downturn.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise