Top 5 Crypto To Buy For Massive Gains In April: Popular Analyst

Highlights

- Top 5 cryptocurrencies to invest in April as per a popular analyst Rekt Capital.

- Bitcoin and Bitcoin Cash halving events to drive massive rally.

- Bull market to provide opportunity to grab profit in other altcoins.

The crypto market swings to upside momentum in this bull market as market participants await Bitcoin halving after the approval of spot Bitcoin exchange-traded funds (ETF) by the U.S. SEC. According to a well-known analyst, these are the best cryptocurrencies to buy in April, as a price rise looms around the corner and closes at a high point in March.

The latest crypto market selloff has provided an opportunity to buy the dip in these top 5 crypto — Solana, Dogecoin, Bitcoin Cash, Bitcoin, and Litecoin. The recovery in the crypto market will bring traders back to these crypto.

Top Crypto Confirms Bullish Breakout

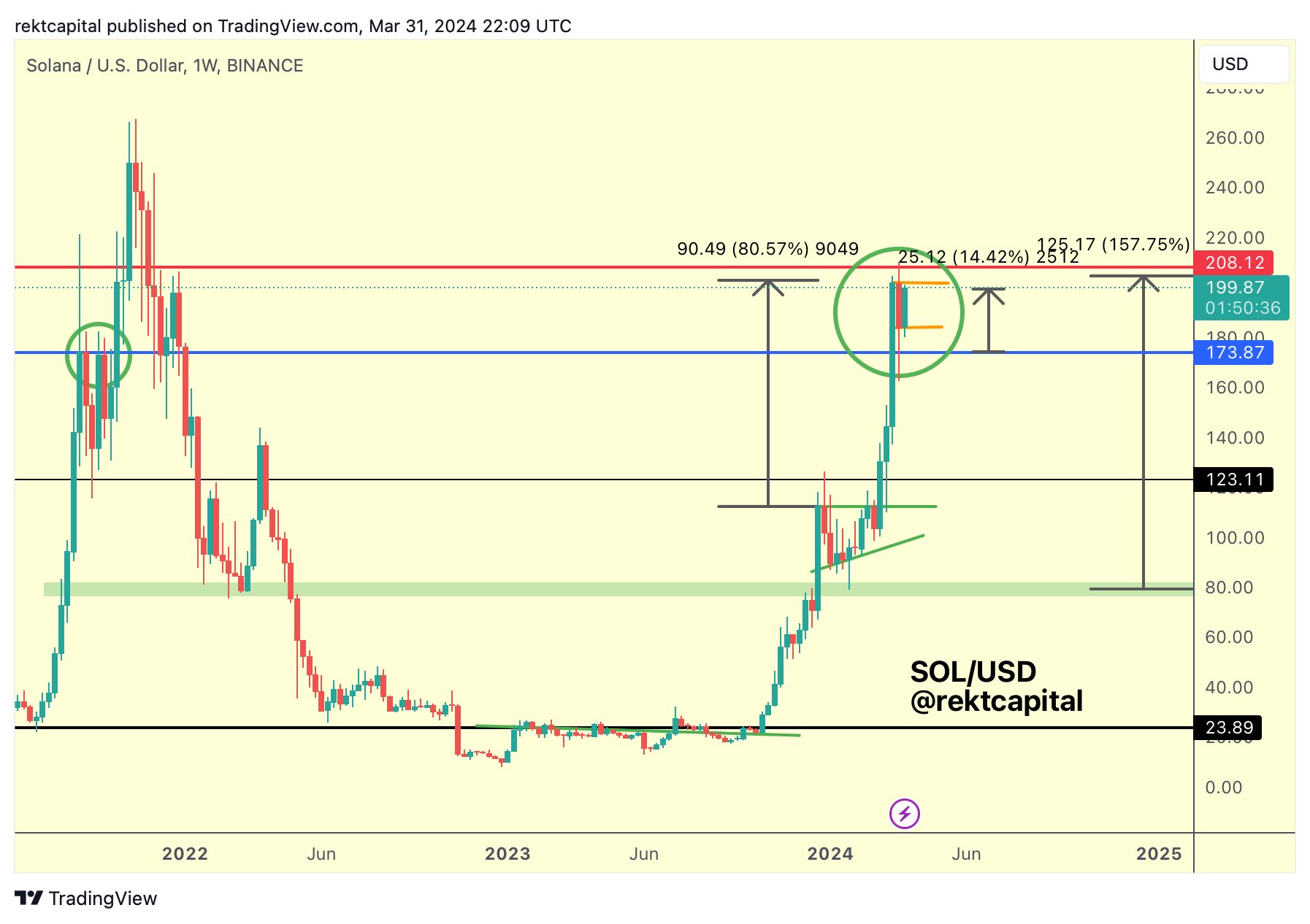

1. Solana (SOL)

Analyst Rekt Capital pointed out that Solana is showing initial signs of formation of a ‘Bull Flag’ pattern in the weekly timeframe. After this bull pattern formation, SOL price can hit a new all-time high and the odds of it happening this month are extremely high.

SOL price successfully retested the range low of $173-$175 and rebounded to trade higher above the $200 level. The $173 level is now a key support for Solana.

SOL price jumped 7% in a week and over 45% in a month. The price is currently trading at $190, with a 24-hour low and high of $176 and $191.69, respectively. Furthermore, the trading volume remains high amid meme coins frenzy and rise in interest among traders.

2. Dogecoin (DOGE)

Analysts were closing watching Dogecoin price rally for a bullish monthly candle close in March. Dogecoin managed to close above the $0.20 level as new support confirmed further upside toward the $0.30 psychological level.

Rekt Capital also noted a bullish monthly candle close by Dogecoin in the monthly timeframe. DOGE price has seen massive rallies in February and March, he expects April to end bullish for the largest meme coin too.

DOGE price has fallen below $0.20 after a massive rally, with a significant increase in trading volume. Dogecoin price rallied over 20% in a week and 70% in a month, with the price currently trading at $0.18.

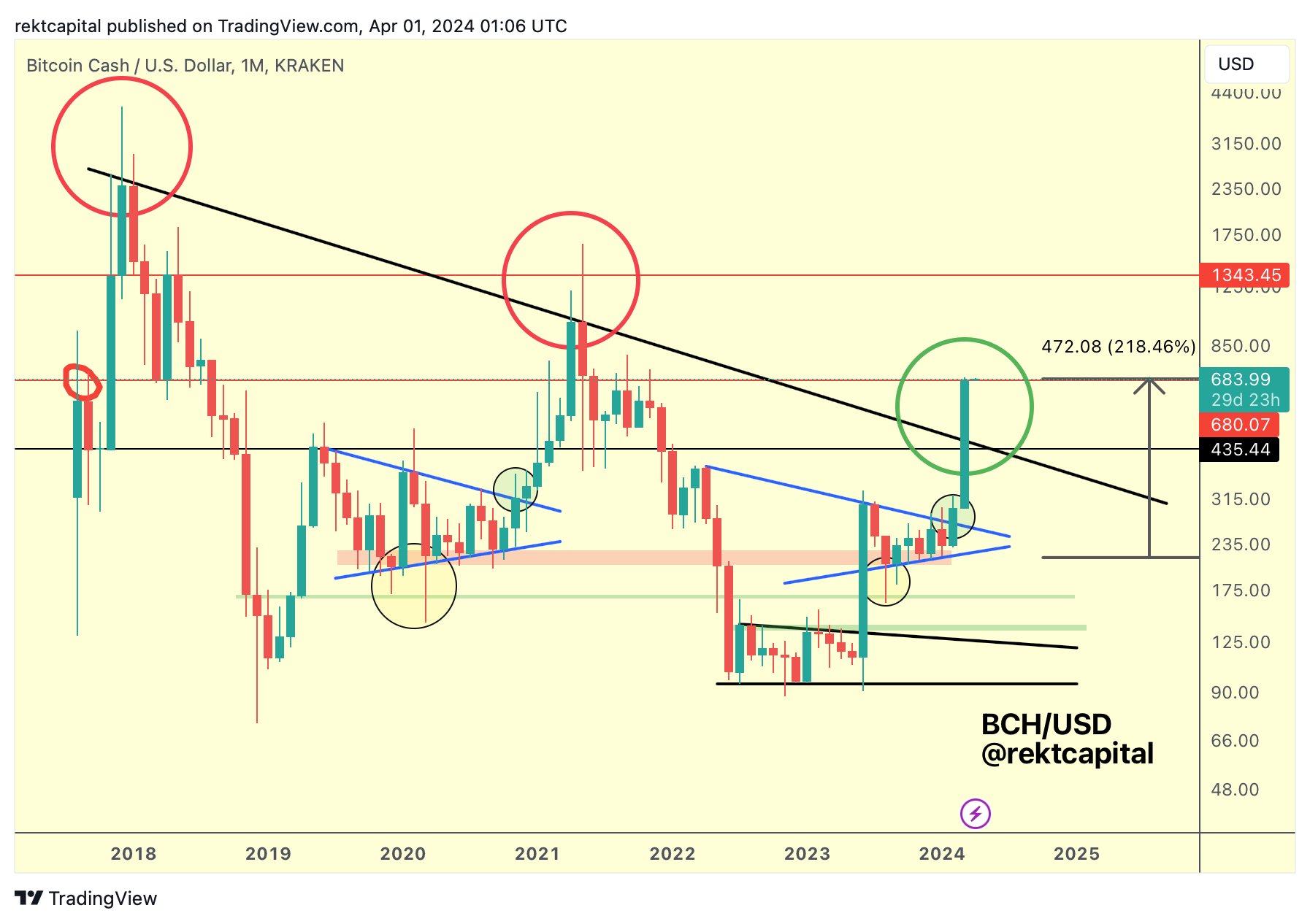

3. Bitcoin Cash (BCH)

Rekt Capital said “Bitcoin Cash has made history.” The statement came after BCH price closed the month above a multi-year downtrend for the first time since late 2017. He confirmed the end of macro downtrend for Bitcoin Cash.

The excitement surrounding Bitcoin halving has shadowed Bitcoin Cash halving event. BCH halving will happen at block height 840,000 on April 3 at approx 1:00 UTC. The current block reward is 6.25 BCH, the next block reward will be 3.125 BCH.

BCH price rose 21% in a week, with the price currently trading at $601.70. The 24-hour low and high are $596.63 and $648.39, respectively. Moreover, the trading volume has increased by more than 280% in the last 24 hours. Bitcoin Cash has rallied over 40% in a week.

Meanwhile, the Bitcoin Cash crypto has also gained investors’ attention following Binance’s recent announcement to list a new pair of the token. In a recent announcement, Binance said that it will list BCH/USDC pair on its platform.

4. Bitcoin

Experts have given a target price of at least $80K after Bitcoin halving and $120K until the end of the year. Bitcoin block halving event to happen at block height 840,000 on April 20 at approx 07:30 UTC. The block reward will reduce from 6.25 BTC to 3.125 BTC, giving a push to BTC price due to supply-demand dynamics.

Bitcoin also had first monthly candle close above old all-time highs of $69,000, which is historic. Furthermore, Bitcoin has confirmed a breakout above the weekly range, with continued inflows into spot Bitcoin ETFs.

Rekt Capital predicted that BTC price needs to dip under the range of $69,032 to successfully retest it as new support before continuing higher towards new ATH.

BTC price jumped 1% in the last 24 hours and over 12% in a month, with the price currently trading at $65,935. The dip has provided buy the opportunity, with whales already buying BTC worth billions.

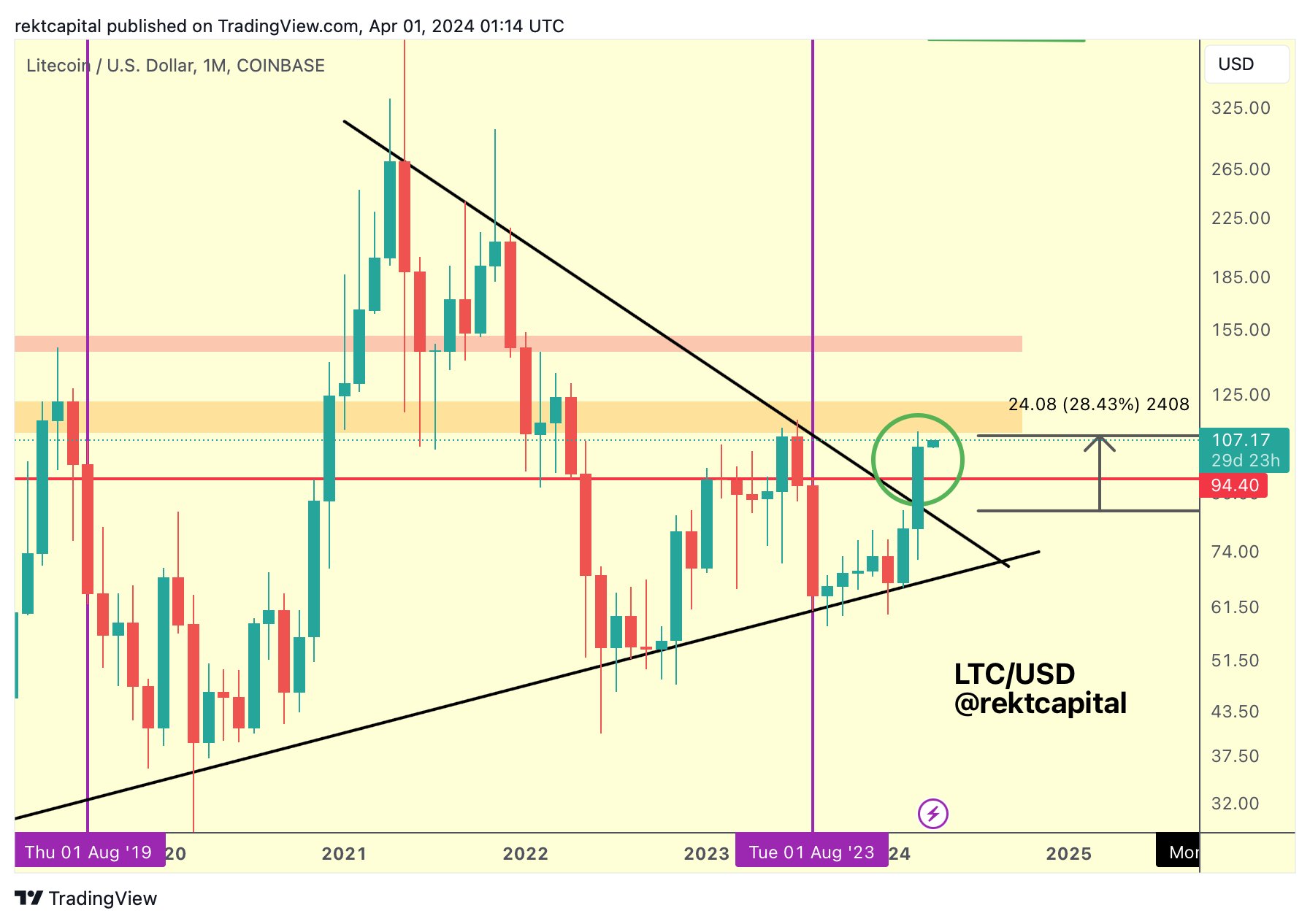

5. Litecoin (LTC)

Litecoin also had a monthly close above the long-running downtrend. The ‘macro downtrend’ has been broken for the first time since April 2021, revealed Rekt Capital.

With the macro downtrend now officially over, we will be looking at LTC price above $150 in April. LTC price rallied over 22% since successfully retesting its multi-year Macro Downtrend as new support.

LTC price jumped 10% in a week and over 20% in a month, with the price currently trading at $100.82. The 24-hour low and high are $99.51 and $109.54, respectively. Furthermore, the trading volume has increased in the last 24 hours.

The Litecoin buzz was enhanced with Binance’s latest listing announcement. Along with Bitcoin Cash and other cryptos, the leading crypto exchange also announced adding an LTC/USDC pair on its platform, boosting the traders’ confidence.

Also Read:

- Missed BOME & MEW? Whales Are Now Buying This Solana Meme Coin

- Top Bitcoin Analyst Says This Data to Trump Bitcoin Halving Impact

- Binance Expands Support for BOME, WIF, And 36 Other Crypto For Market Recovery

- Breaking: Michael Saylor’s Strategy Makes 100th Bitcoin Purchase, Buys 592 BTC as Market Struggles

- Satoshi-Era Whale Dumps $750M BTC as Hedge Funds Pull Out Billions in Bitcoin

- XRP Sees Largest Realized Loss Since 2022, History Points to Bullish Price Run: Report

- US Strike on Iran Possible Within Hours: Crypto Market on High Alert

- MetaSpace Will Take Its Top Web3 Gamers to Free Dubai Trip

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?